Home › Forums › Startup Investors › General – Investors › Republic Announces the Note Profit-Sharing Token!

Republic Announces the Note Profit-Sharing Token!

Posted by Brian on June 25, 2020 at 12:41 pmLaunching July 16th, investors can purchase the Republic Note Profit-Sharing token:

They are limiting sales to $8 million at $0.12 per note.

What do people think?

Any thoughts on how to value the potential of this and whether the $.12 per Note is worth it?

Brian replied 4 years, 11 months ago 5 Members · 22 Replies- 22 Replies

It’s difficult to know if it’s worth it, given that it is impossible to value Republic’s current portfolio accurately. It is nice that the token is tradable, so at least investors can recuperate some of their money in case it is overvalued at $0.12

The Note white paper is here – I suggest everyone reads it. That being said, it’s 48 pages so I know not everyone will, so maybe I’ll do a brief summary in a blog post.

Regarding Note token valuation: I plan to do a deep dive blog post and a video about estimating the current value of the Note token based on the current portfolio of Republic.

Based on some quick back of the envelope calculations, the $0.12/Note is a little on the high side of valuation in my opinion based on the current number of companies on the platform; however, it all depends on your assumptions and growth projections in terms of what it could become.

Let’s do a quick and dirty calculation to see if the $0.12/Note is fairly valued

To begin, assume we just consider the 100% profit share from Republic’s public crowdfunding business. Republic Core (the company that issues the Notes) plans to pay out dividends to Note holders in $2 million increments, and will issue a max of 800,000,000 Notes. That means each dividend payout is effectively $0.0025 per Note at maximum issuance (not at launch, since there will be ~1/2 as many Notes in circulation). So you’d need 48 dividend payouts to break even for your $0.12/Note if we’re being conservative and assuming all 800,000,000 Notes are in play.

The question then becomes – how fast do you assume dividends will pay out?

Next, let’s calculate the break-even number of companies that Republic would need on their platform in order to have the Note pay back the $0.12 cost.

Since Republic gets 2% of securities sold on the public side, assuming an average campaign raise of $300k (the actual average based on their 124 public companies has been $267k each), that would mean Republic gets a $6,000 stake in each company. To get to each $2M dividend threshold, that’s a 333X total return. Assuming an 80% startup failure rate, 15% target IRR, and 5 year time frame, that’s an average 10.1X return required for each non-failed company. That means ~33 companies need to succeed for each $2M payout, and from before, we know we need 48 payouts to break even. At a failure rate of 80%, that means Republic needs 7,913 companies on their platform in order to break even at $0.12/Note.

So, the question remains. Is that good value? At first glance, ~7,900+ companies is a long way away from the 124 public companies they currently have.

However, we were very conservative in our assumptions and neglected a lot of factors.

First off, we’re completely ignoring the profit-sharing from the private side. For simplicity, let’s just assume those returns will be 1/4 the public side, since 25% of carry is shared with Republic Core (and those deals may be later stage, but also have lower failure rates).

Also, at initial issuance, Republic plans to have a maximum of 370 million Notes in circulation. That cuts the number of required companies above in half.

You also need to consider the growth rate of the number of companies on Republic. While Republic has had 124 startups successfully raise on their public platform since they started, they could easily double (or more) than that number in the next year alone. The industry continues to grow, and Republic mentions in their white paper that they may choose to include new lines of business in Note profit distributions (e.g. their recent real estate acquisition Compound) – “…part of the proceeds from one or more of any such new businesses

may be attributed to and become Core Proceeds in exchange for services

rendered by Republic Core.”Furthermore, all the growth assumptions are likely conservative for the industry (80% failure rate, 15% IRR, 5 year investment time, which results in a 10X return multiple on non-failed companies). Many studies show average angel investor and VC returns may be more in the range of 20-25% IRR. And perhaps the due diligence and deal curation on Republic means that the failure rate will be lower than 80%.

So perhaps ~500-1,000 companies is a more realistic “break-even” number for the current value of the Note.

Am I missing any other factors?

What do people think of my assumptions and math?

I’ll do a deeper dive on this in the next week or two.

Other assumptions I’ll plan to include:

- Fees of Profit Distributions

- Estimate the present value of future cash flows rather than only looking at the break-even point

- Worst / Typical / Best-case scenario modeling

Republic categorizes this as crypto. Is there a mining component to it? If not, I’d call it a digital investment but not really a digital currency.

Did I miss something?

Still, I like that republic is offering something a little different.

I look forward to you deeper analysis.

I believe the Algorand blockchain, which the Note token will be hosted on, is a Proof-of-Stake (POS) instead of Proof-of-Work (POW) blockchain like Bitcoin. There weren’t many (any) details about this in the white paper, but that would mean there aren’t “miners” in the traditional sense of Proof-of-Work blockchains like Bitcoin and others.

Either way, it is a “crypto”. I need to read more to understand how the dividend payments will work, since it sounds like you’ll be paid in a USD(?) stablecoin rather than being paid dividends in more Note tokens.

FYI – there is an AMA tomorrow with Republic’s co-founder and CEO all about the Note token: http://crowdwise.org/events-equity-crowdfunding/republic-note-ama-with-ceo-kendrick-nguyen/

I see. I have to say that it’s an interesting twist to the crowdfunding/angel investing realm. I look forward to learning more about it.

Yeah, and I find it a fascinating way to actually allow non-accredited investors to potentially (at least partially) profit from accredited-investor only deals through their private platform.

Any thoughts on how this would all be handled tax-wise? For the NOTE token as well as the earnings and their cost-basis vs the NOTE itself?

Great question. I asked during yesterday’s AMA if Republic would be providing tax advice, and Kendrick Nguyen (CEO of Republic) said: “Note holders will be responsible for their own taxes but will provide some guidance and hopefully product support down the road.”

If I had to guess, based on what I currently do for other tokens that I hold, it might look something like this (obviously everyone’s situation is unique, this is NOT tax advice):

- When you initially purchase Note tokens, that will be treated as the cost basis for your investment (the same as if you purchased stock)

- If you receive Note tokens for free – i.e. from converting your Reward Notes to Republic Notes at a 1:1 basis, you may have to claim that as ordinary income. However, if you consider it as a gift, the IRS gift limit in 2019 was that you don’t have to claim it if it’s up to $15,000

- For distributions, I’m guessing those would be treated as ordinary, non-qualified dividends, taxed at your ordinary income rate. There is a chance that they may structure it such that they would be considered qualified dividends.

- If you later sell your Republic Notes for a loss or gain, you’d be responsible for long-term and/or short terms gains or losses, the same as stock.

Again, those are just my assumptions as of now. We’ll have to see how they actually set it up.

For those who missed the Republic AMA with CEO Kendrick Nguyen, I posted some of the most helpful AMA questions from the other day (many of which weren’t covered in the Note whitepaper or FAQ page) here:

http://crowdwise.org/funding-portals/republic-profit-sharing-note-ama-summary-july-2-2020/

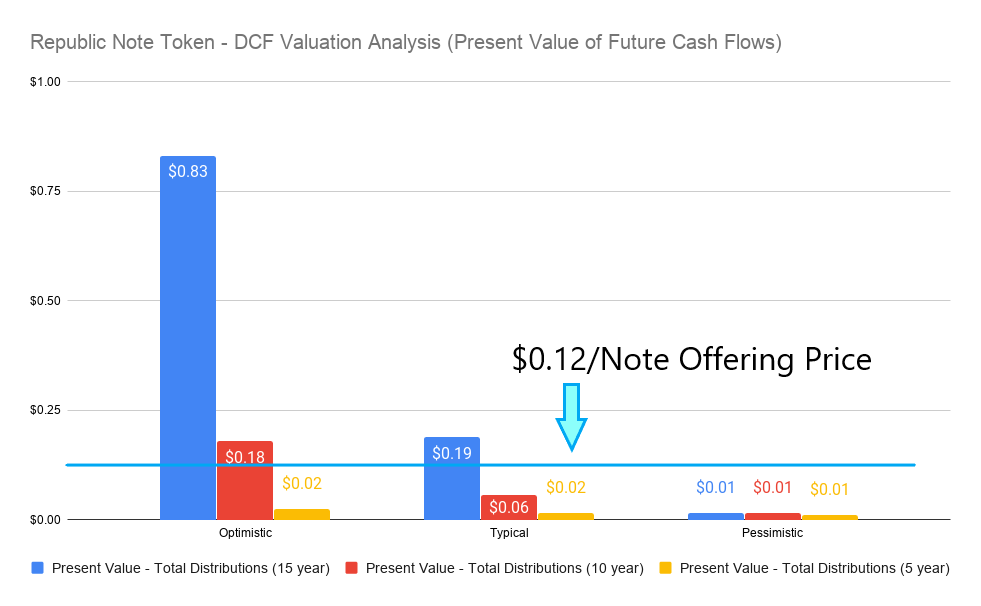

I finished my initial analysis and posted results here.

http://crowdwise.org/data-analysis/republic-note-token-is-it-a-good-investment/

Here’s a sneak-peek at the chart of results for the upper, middle, and lower-bound estimates based on my 15-year projections:

I went ahead and reserved 2000 tokens.

Awesome! I, too, reserved some Notes.

For anyone who is wondering, you can increase your reservation at any time (assuming they aren’t sold out), but you can’t decrease it.

IMPORTANT UPDATE:

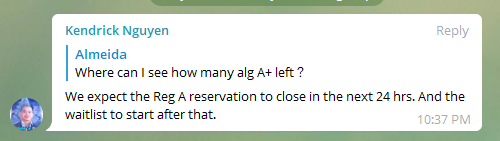

For any investors who might be interested in the Note, you might want to get in your Reg A+ reservations ASAP today.

Last Thursday, 7/16 at 10:37PM, Ken Nguyen, the CEO of Republic, said on Republic’s Telegram channel that they expected the “…Reg A reservation to close in the next 24 hrs. And the waitlist to start after that.”

While the 24 hours has passed and Note reservations still seem to be active, it must mean they are getting close.

While I wasn’t sure what the demand would be, it seems that the demand for Notes at the $.12/Note was much larger than even Republic anticipated.

Brian, thanks for the video and spreadsheet that attempts to estimate the value of a Republic Note. I was conducting a “back-of-the-envelope” calculation for myself, and stumbled upon your post.

I’m astonished that it seems that they may sell out of the Note. My base case assumptions are somewhere between your “Typical” and “Pessimistic” scenarios, and I’m dubious that the Note will prove to be a good investment. I decided to take a flyer and purchase some, but that was more for about putting some value on the perks they’re promising to give than any belief that the Note will be worth it.

I suspect that after this initial hype that the price will plunge after a year or two when people figure out no dividends will be paid out for a long while. In the Republic Note documents, they state that in 2019 they had less than $2,000 worth of proceeds eligible for distribution. Yet, the accumulated proceeds have to be $2M before they even decide to pay out. So basically, they’re going to have to more than 1000X what they got last year before anyone might get a distribution, and even if that happens, assuming 800M Notes are issued, that basically means you’ll get $2.50 per 1,000 tokens. Since 1,000 tokens is being sold for $120 in this offering, it means that every once (a year? two years? never? maybe, hopefully every month?) in a while you’ll get $2.50 toward your $120 investment.

I’m going to have to put a reminder in my tickler for 3 years from now to see the going rate for a Republic Note will be then.

Hi Jerry – thanks for your thoughtful post and for joining Crowdwise!

I was talking to Kendrick (CEO of Republic) yesterday and he mentioned that they’ve been seeing 2x to 8x growth year over year. Now, obviously that can’t continue forever, but if they do in fact add 200+ companies next year to the public platform (and see similar growth rates on their private platform), that could impact the potential 5-year returns in a much more positive way than I’d been assuming (which was a 35% YoY growth rate).

Honestly, and this is purely speculative – while the current future value of the Note may seem somewhat underwhelming, I think that both Kendrick and the entire Republic team are so dedicated to making this succeed that they’ll do whatever it takes to make the Note succeed (i.e. adding future business lines to contribute to the profits of Republic Core, continuing to grow and expand offerings, etc.).

So if anything, I reserved some Notes because I believe that the team is truly committed to making it succeed; having it end up a flop would obviously be bad for Republic and the industry. Also, yes – the apparent demand was much higher than even they anticipated, so who knows, the value may initially spike if/when they are tradable, but I expect there could be a lull as well in 1-2 years when it’s after the hype dies down but before profits start being distributed.

Anyway, I’m in it for the super-long run (10+ years), and I’m overall excited to see how this experiment turns out!

FYI – these assumptions (minor changes to my spreadsheet) would result in a much more optimistic 5-10 year picture.

- Assume Notes in circulation is 400M instead of 800M (which will be more accurate for the first few years)

- Assume 200 new public companies per year (zero growth) and 50 new private companies each year (zero growth)

As you can see, these few changes in assumptions would give a much more optimistic outlook for the 10 year and 15 year payouts for the typical and optimistic cases.

I’m inclined to think just buying ALGO is a much better investment.

Still, I bought a small chunk. If anything, just to support the concept.FYI – here is a question I got that I want to clarify (the page was temporarily down, but has been fixed):

Question:

(1) I’m confused as to how assuming zero new company growth rate would result in favorable deltas in the payout calculations. Fewer new companies mean fewer chances for a profitable outcome. Concretely, it seems to me you’re saying that setting “Republic New Company Annual Growth Rate” to zero leads to higher payouts, which it (sensibly) doesn’t.

(2) The optimistic growth rate seems high to me. Having to evaluate 200 companies a year is already a time sink. Growing the number of new companies by 35% seems high. People will start facing the “paradox of choice”– having too many items to choose from will lead to analysis paralysis.

My Clarification:

1) Sorry for the confusion. What I meant was that – by assuming 200 new companies in Year 1 (next year) instead of the initial assumption (35% YoY continual growth on the ~124 companies) and then keeping the growth rate flat at 200 companies/year for simplicity’s sake (not realistic), then that would be a conservative assumption that, if the 200 companies/year are realized next year, would under-predict the real-world results that would likely see years 2-15 at higher number of companies than 200/year. Even if the growth rate on adding 200 companies per year is lower at say 5-10% per year, it would be a much more optimistic picture than the original analysis. So a 0% growth rate on the 200 companies/year in the model is likely under-predicting the true value (assuming they can hit that next year).

2) Agreed – which is why, for being conservative and simplistic, I just assumed that they can hit 200 companies/year next year and then maintain that level in the coming years.

What the model should really do if I had the time is start with a much higher growth rate in say years 1-3 (maybe 100%, 200%, etc., which is what they’ve been experiencing), but then move down to something much more conservative, which could be as low as 5-10% in the later years.

According to an email that was sent out this week by Republic, investment demand has already exceeded $10 million between accredited and non-accredited reservations. So they have increased the max offering cap up to the allowed $16 million.

After $16 million are sold and reserved, according to the limits mentioned in their whitepaper, it will then go to a waitlist for any interested investors.

Also, one comment on increasing the “cap” from $8M to $16M, since many investors seem to be complaining to Republic that they are essentially diluting the original investment value.

According to the whitepaper, the maximum number of Notes that can ever be issued is 800M. However, they already planned to release these additional $8M in Note tokens at a later date. Thus, all they are doing is allowing more investors to pay $.12/Note on those tokens now, rather than wait a year or two until the offering is qualified and then issuing those tokens at a potentially higher price.

It doesn’t change any of the tokenomics for the earlier investors in the first $8M.

It is not diluting your tokens, since those were already part of the total 800M total Notes.

It is simply allowing more investors to invest at the cheaper price now due to demand.

Log in to reply.