Intrastate Crowdfunding and Blue Sky Laws

At the federal level, the SEC governs the offers and sales of financial securities. Federal exemptions, such as Reg CF and Reg A+, allow crowdfunding companies to offer and sell securities nationwide. However, there is another option for founders to raise capital and for investors (including non-accredited investors) to gain access to more early-stage deals. This method for raising capital is called intrastate crowdfunding.

Most of what we have discussed on Crowdwise has dealt with Reg CF, Reg A+, and Reg D federal exemptions. With a few exceptions, anything that is exempt at the federal level will be accessible to investors across all 50 states, and even internationally in many cases.

It is possible, however, to raise primarily local capital, within a single state. The potential investor base may be smaller in this instance. But the potential benefits – such as having less stringent filing requirements, higher limits for both issuers and investors, and other benefits – may be enticing enough to lure entrepreneurs and founders to consider intrastate crowdfunding.

In today’s article, we will shed some light on what intrastate crowdfunding is, what are some pros and cons for both investors and founders, what Blue Sky Laws are, and where investors can go to learn more.

What is intrastate crowdfunding?

As the root “intra” suggests, intrastate crowdfunding laws are states’ local securities exemptions that allow businesses to raise capital from both accredited and non-accredited investors within a single state or territory.

Intrastate crowdfunding laws allow small businesses and startups to issue securities to local investors within their state and not be subjected to burdensome securities regulations that are intended for more mature companies. The SEC, which typically regulates securities offerings at the federal level, defers to state securities regulators for intrastate sales.

Not every business can qualify in a given state, though.

Under Rule 147 and Rule 147a of 3(a)(11) of the 1933 Securities Act, certain requirements must be met, such as the business having their principal place of business in-state, sales only being to in-state residents, and more. The updates to Rule 147a in 2016 also allow businesses to be organized or incorporated out of state, as long as their principal place of business is still in-state.

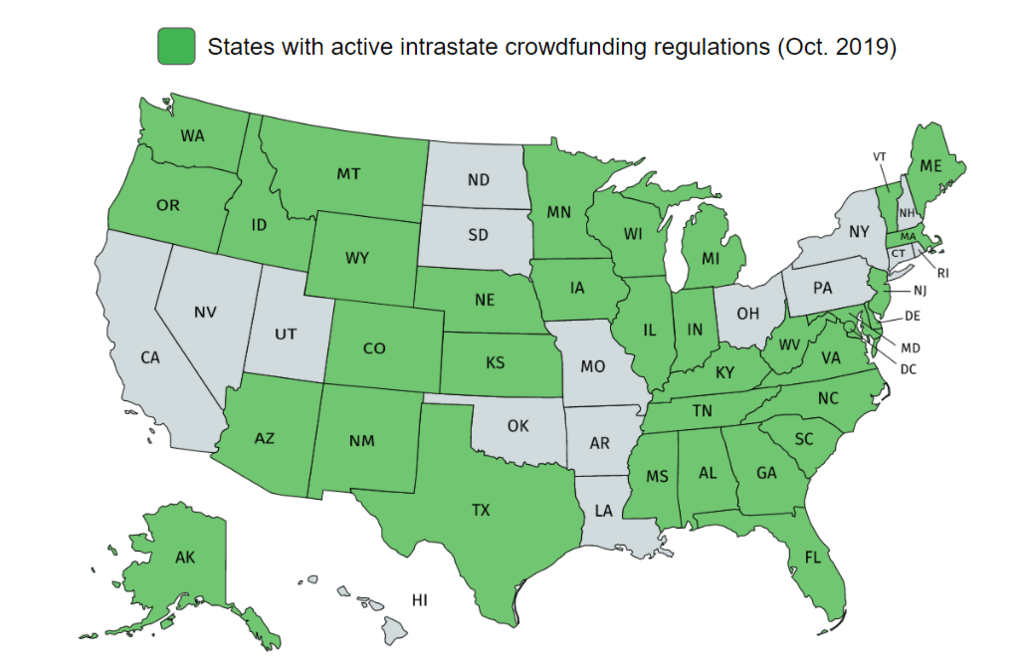

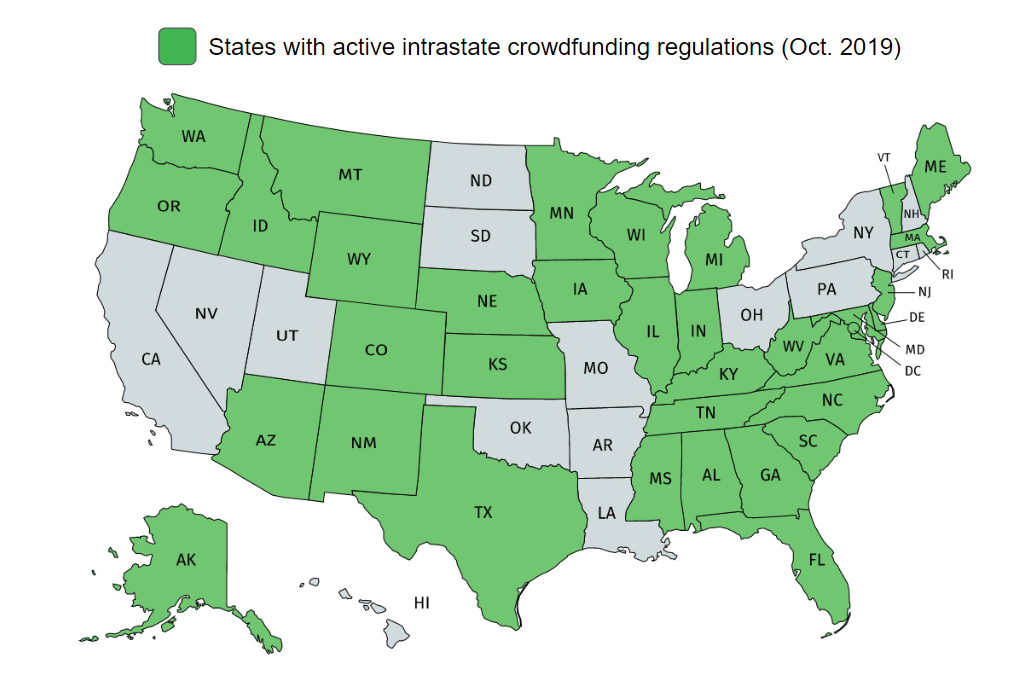

There are currently 34 states and the District of Columbia that have enacted intrastate regulations for crowdfunding capital formation. A list of these states and links to their laws are given on the NASAA website.

Pros of intrastate crowdfunding

Given that Reg CF (JOBS Act Title III) exists at the federal level, why would issuers (i.e. startups and small businesses) consider using intrastate crowdfunding?

First, some of the issuer campaign limits – such as Reg CF, which has a $1.07M cap – are higher at the intrastate level. In addition, there may be less-stringent auditing requirements, meaning lower legal and administrative costs for the startup.

For example, in Minnesota, MNVest allows small businesses with self-certified financials to raise up to a $1 million limit, while CPA-reviewed financials can raise up to a $2 million limit.

Intrastate crowdfunding also differs from Reg CF for investors. While Reg CF imposes strict investor limits (even for accredited investors), each state may have its own set of investor limits. Often, these investor limits allow non-accredited investors to invest more than permitted under Reg CF, while non-accredited investors may have no limits imposed on them.

Cons of intrastate crowdfunding

While the limits may be higher and the cost of capital may be lower for issuers that use intrastate crowdfunding, one of the downsides is that businesses can only sell securities to investors that are residents of the state that they are raising capital in.

This greatly limits the potential investor base compared with using a federal exemption, such as Regulation Crowdfunding.

For businesses primarily looking for local supporters, this can be a great way to connect with the local community. But for businesses and high-growth startups trying to raise awareness and capital on a broader scale, this could be a potential downside.

From an investor’s perspective, you will only see deals posted from in-state businesses that meet all intrastate qualifications and choose this method to raise capital.

This means there will be fewer deals and options on intrastate crowdfunding portals. And with weaker deal flow, this makes it much harder to diversify and find quality deals.

What are Blue Sky Laws?

Blue Sky Laws are anti-fraud securities regulations at the state level.

Whereas only 34 states (and D.C.) have intrastate crowdfunding laws, all 50 states have their own securities laws and rules, commonly known as Blue Sky Laws. These laws are broader than crowdfunding regulations.

To understand how Blue Sky Laws interact with some of the federal regulations, such as Reg CF and Reg A+, it is important to define an important legal term called preemption.

Preemption means “the invalidation or superseding of a U.S. state level law when there is a conflicting federal law”.

Essentially, when laws at the federal level and at the state level conflict, preemption of state-level laws means that the federal law takes precedence.

Regulation CF Preemption

If a startup raises capital using the federal Reg CF exemption, Reg CF preempts (that is, overrules) the state level Blue Sky Laws – in most cases.

Some states will still have notice filing requirements. For the most part, though, this means that the startup will not have to worry about complying with Blue Sky Laws from all 50 states, even though they can legally accept investments from all 50 states.

Regulation A+ Preemption

Reg A+ has two tiers – Tier 1 and Tier 2.

For Reg A+ Tier 2 offerings, Regulation A (federal level) provides preemption of state-level laws on registration and qualification of securities being sold.

However, for Reg A+ Tier 1 offerings, there is NO preemption of state-level laws. Having to register and qualify a securities offering in numerous states (all with different laws) can be burdensome and costly for small businesses, which makes this exemption less useful for raising capital across borders.

What about Direct Public Offerings (DPOs)?

While a Direct Public Offering (DPO) isn’t an official term in the eyes of the SEC, it essentially means any business that raises capital directly from the public without an intermediary (i.e. third party such as a funding portal, broker-dealer, or investment baking firm).

In early-stage investing, DPO typically refers to pre-JOBS Act methods for crowdfunding capital from both accredited and non-accredited investors. DPO in this context refers to businesses raising capital under Rule 147 of the 1933 Securities Act, which is the intrastate exemption.

However, DPO can also refer to businesses using lesser-known exemptions, such as Reg D Rule 504. And with Title IV of the JOBS Act (aka Reg A+), there are now more avenues in which small businesses can raise capital directly from the crowd, without having to go through a third-party Reg CF funding portal. Fundrise, a FinTech REIT company, has demonstrated great success raising tens of millions of dollars directly from its own website through numerous Reg A+ “internet” public offerings (iPO).

Adding to the potential confusion, DPOs are also common terminology for public businesses that list on national exchanges via direct listings, such as Spotify (2018) and Slack (2019).

Thus, it’s important to dig a little deeper when you hear about a “DPO”, since the term encompasses many different types of securities sales to the public.

The State of Intrastate Crowdfunding Regulations

While many states enacted their own crowdfunding legislation to address shortcomings in the first version of Reg CF, the good news is that each of these states is now a mini-experiment of sorts.

Each state has been allowed to innovate and regulate as they see fit, so regulators at the SEC now have a diverse set of inputs and data to use when they go back to the drawing board for Reg CF version 2.

Whether it is updates to the accredited investor definition, increasing the limits on Reg CF campaigns, revising the limits on investors, allowing the use of Single Purpose Vehicles (SPVs), or other revisions to the current laws, there is still a lot of room for improvement in Reg CF. Intrastate crowdfunding laws provide some insight into what some of those future improvements may look like.

Because laws are constantly evolving, both investors and issuers should always use the NASAA website and their local state’s securities regulators website for the latest information.

[…] Rule 147 and 147a (Intrastate Crowdfunding) […]

[…] level with crowdfunding policy, there is a need to reform many of the outdated and ineffective crowdfunding policies in many states. Such reforms would increase the potential for state-based crowdfunding successes as well. By […]