LLC vs C Corporation Investments – Tax Implications of Business Type

With so many new things to learn when investing in the private markets, it is easy to overlook one important topic that may only come up once a year – taxes. While the ability for non-accredited retail investors to invest in private markets may be new, the tax laws around private market investing are not.

Today we will discuss some of the key tax differences of investing in a Limited Liability Company (LLC) versus a C Corporation.

It may be easy for an investor in equity crowdfunding to invest $10 across dozens of startups with no immediate tax consequences. But when April 15 comes around, that investor could be in for a rude awakening if they didn’t consider the tax implications of those investment decisions.

Even investing as little as $10 in a Reg CF startup could trigger you to receive unexpected tax forms, like a Schedule K-1. Thus, it’s crucial to understand how the type of business – whether an LLC (taxed as a partnership) or C Corporation – can impact your taxes before you invest.

This article is not tax or investment advice. It presents some of the considerations and trade-offs so that investors can understand the potential tax consequences before making their first investment. The intent is also to inform investors about some of the relevant sections of the tax code that are potentially applicable to equity crowdfunding, so that they can ask more educated questions of their tax advisor or CPA when it comes time to file personal taxes.

Furthermore, tax codes are constantly changing, especially around the development of Reg CF, Reg A+, and equity crowdfunding, so always refer to the IRS website and your professional tax advisor for the latest rules and regulations, as well as your local state’s regulations.

Summary of Tax Differences – Investing in LLCs vs. C Corporations

The tax consequences of investing in an LLC (taxed as partnership) or C Corporation will not be presented as pros or cons; what may be a “pro” for one investor can easily be a “con” for another investor in the exact same business due to differences in personal tax situations.

At a high level, here are some key differences in how investing in the two different business entities can impact your personal taxes.

Limited Liability Company (LLC) – taxed as a partnership (i.e. pass-through)

- Tax Forms to Expect: Schedule K-1

- March 15 deadline. Issued only if you own equity, i.e. shares, not if you invested through a pre-money SAFE, Convertible Note, etc.

- Tax Considerations:

- Pass-through taxation may trigger unexpected taxes for investors during the year

- Pass-through taxation may require you to file state income tax returns in multiple states, or require non-US citizens to owe US taxes

- Will not qualify for any preferential tax treatment under Qualified Small Business Stock (QSBS) or Small Business Corporation (SBC) exemptions: Section 1202 (QSBS tax-exempt gains), Section 1045 (QSBS deferred gains), or Section 1244 (SBC losses)

- Schedule K-1 forms must be distributed by each LLC business by March 15 to all partners, and must be entered into individuals’ tax returns before filing personal tax returns

- May be beneficial for investors looking to: avoid double taxation, write off operational losses from the business during the year, obtain better outcomes if the business is sold when held for fewer than 5 years or if acquired for assets.

- May cause issues for: tax-exempt and foreign partners, investors trying to simplify their annual taxes (one Schedule K-1 per company, may trigger taxable income in multiple states), investors hoping to file personal taxes prior to March 15, investors looking to minimize their self-employment tax, investors looking to gain preferential tax treatment from QSBS or SBC stock, investors looking for different classes of stock (e.g. Preferred Shares).

Not all LLCs are taxed the same

Important note: while the default for LLCs with two or more members is to be taxed as a partnership (i.e. pass-through entity), LLCs that file Form 8832 with the IRS can elect to be taxed as C Corporations (or S Corporations). Thus, merely seeing that a business has “LLC” in its name is not sufficient to determine the tax consequences of that investment.

C Corporation

- Tax Forms to Expect: none

- 1099, only if dividends were paid (uncommon for early-stage businesses)

- Tax Considerations:

- No pass-through taxes, so typically no annual tax filing requirements unless there was a loss or sale during the year

- May qualify as Qualified Small Business Stock (QSBS), allowing:

- Section 1202 – up to 100% exemption on QSBS gains (up to $10M or 10X cost basis) if held for more than 5 years

- Note: this only applies to equity (Common or Preferred Shares). That means Convertible Notes and pre-money SAFEs do not start the 5-year holding period until they convert, and may be ineligible for 1202 due to the asset requirements at the time of conversion.

- However, note that in September 2018, Y-Combinator updated their SAFE template to a post-money SAFE, and included section 5(g), which states that those SAFEs are to be treated as Common Stock under IRC Section 1202. This version is not yet used on any equity crowdfunding sites.

- Section 1045 – deferral on QSBS gains if reinvested within 60 days per Section 1045

- Section 1202 – up to 100% exemption on QSBS gains (up to $10M or 10X cost basis) if held for more than 5 years

- May qualify as a Small Business Corporation (SBC), allowing:

- Section 1244 – write off qualifying SBC losses as ordinary losses vs. capital losses

- May be beneficial for investors looking to: invest in Preferred Stock (e.g. institutional investors, Venture Capital funds), hold an investment longer than 5 years to gain preferential QSBS tax treatment, defer QSBS gains by reinvesting, write off qualifying SBC losses.

- May cause issues for: investors looking to write off operational losses from their investments each year, investors looking to exit in fewer than 5 years, investors looking to avoid double taxation.

Business Entity Selection Depends on Much More Than Taxes

While some of the tax implications for investors are described above, there are also many implications for the business itself in terms of the type of business entity they select. These range from flexibility, formation fees, corporate governance, paperwork, the ability to transfer ownership in the future, and much more. The selection of the type of business entity is much more complex than just determining the potential impact on investor taxes.

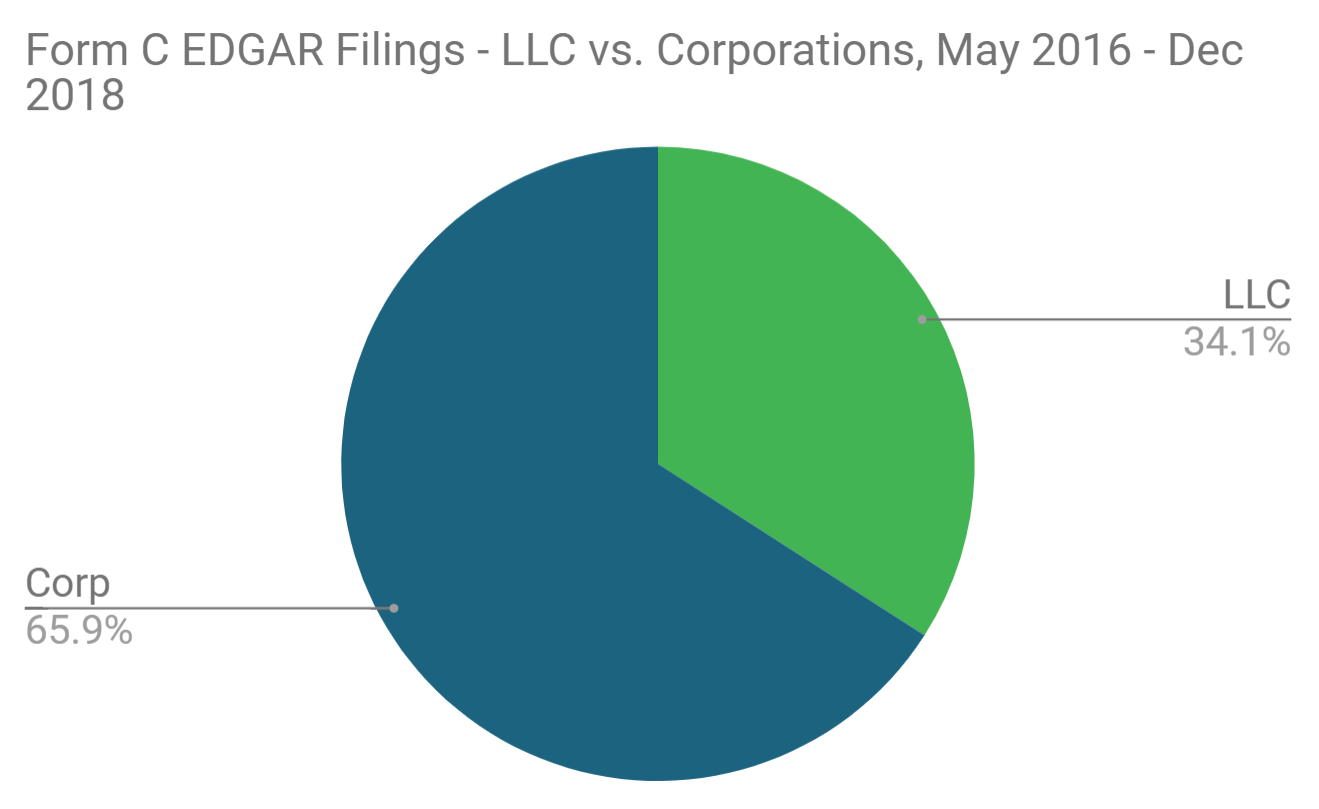

How many Reg CF companies are LLCs vs. C Corporations?

Analyzing the 1300+ unique businesses that have filed at least one Form C with the SEC from May 2016 through Dec. 2018, more than 1 out of every 3 companies that have attempted to raise funds via Regulation Crowdfunding (Reg CF) was an LLC. With those odds, we believe it is worth your time as an investor to understand the tax implications of your Reg CF investments.

Data Source: Form C Filings on SEC’s EDGAR database, May 2016-Dec 2018

What about S Corporations?

While S Corporations are treated as pass-through entities, similar to LLCs taxed as partnerships, the nature of regulations that are imposed on S Corporations greatly limits their ability to raise using equity crowdfunding.

Some of these restrictions – such as requiring 100 or fewer shareholders, only allowing US citizens or residents to invest, and only allowing natural human beings (meaning VCs can’t legally invest as an entity) – mean that you likely won’t see any S Corporations raising funds on equity crowdfunding sites.

If you do own equity in an S Corporation, expect to receive a Schedule K-1 for your taxes.

How the Business Entity Type Can Impact Future Funding Rounds

Many of the same tax implications mentioned above for individual investors can influence, deter, or sometimes even legally prevent Venture Capital (VC) firms or other investors from investing in later rounds.

Equity crowdfunding investors should consider how the type of business (LLC vs. C Corp) can influence the business’ ability to raise future funding. The fact is that many VCs will only invest in C Corporations.

For Angel investors, while there is more flexibility in terms of what they can legally invest in as individuals, some Angels still avoid LLCs taxed as partnerships due to potential tax complications. For example, if you owned equity in 50 different LLCs, there would be 50 more Schedule K-1 forms that you’d have to wait for and deal with come tax time. If just one of those 50 was late in getting their Schedule K-1 to you, it may require you to file an extension on your personal taxes.

Businesses can elect to change from an LLC to a C Corp down the road to facilitate future funding. It will, however, come at a cost of time and money.

LLC businesses can also elect to be taxed as a C Corporation or S Corporation, so investors must do their homework to understand what they are investing in.

Speaking from personal experience, this year I received six Schedule K-1’s for my personal investments and didn’t find it to be too much of a burden. While the majority of the boxes had no information and the taxable amounts (losses and gains) were negligible for my personal situation, each investor must weigh their own situation and determine if the risk is worth the potential reward and effort.

The requirements for filing nonresident state tax returns can be quite complex and varied, so consult with your tax advisor or CPA if you receive Schedule K-1 forms from other states.

One Hidden Advantage of Investing in LLCs through Equity Crowdfunding

As we have discussed in past posts, many investors believe that the way money is made in early-stage investing is by investing in successful, non-consensus businesses.

If every investor knew that Uber was going to be a unicorn from the start and everyone had been given access to invest, then everyone would have invested (which they didn’t – 150 of the 165 on AngelList didn’t even respond). Having such a high demand to invest would have driven up the valuation to a level that eventually led to a more reasonable representation of the business’ actual value, if it could have been known at the time.

Thus, the fact that VCs and other firms are typically opposed to investing in LLCs and write them off without a second thought means that some of these businesses could potentially be future massive successes that get passed over by the professionals. The hope is that some of those LLCs will go on to become wildly successful, and there will then potentially be a new investment opportunity for those same VC firms that otherwise would not have occurred had only traditional sources of funding been available.

This is one small example of the large diversity gap that equity crowdfunding is starting to address in early-stage funding. There are no strict rules, no Limited Partners (LPs) to report to, and no restrictions on background or credentials for those who can invest. Investors are free to invest in what they believe in, which is leading to radical changes in the types of companies that are getting funding.

Furthermore, there can be instances where avoiding the double-taxation of corporations can be more lucrative; but as many founders find out, VCs often push businesses to convert to corporations, even when remaining an LLC could be more lucrative.

What if I invested in an LLC but didn’t receive a Schedule K-1?

The deadline for receiving Schedule K-1 forms is March 15 each year.

One reason why many investors don’t invest in LLCs taxed as partnerships is that Schedule K-1 forms will often come in right before the deadline (or late), causing delays in filing your own personal taxes (perhaps requiring filing an extension), triggering unexpected gains or losses, self-employment tax, pass-through deductions, and other situations that some investors prefer to avoid.

What if you invested in an LLC but haven’t yet received your Schedule K-1, and the March 15 deadline has passed?

First, Schedule K-1’s are only issued to partners who own equity (i.e. shares). If you invested via a SAFE, Convertible Note, or any other instrument that hasn’t yet been converted to equity, then you won’t be receiving a K-1 for that investment for that tax year.

Second, the business could have elected to be an LLC taxed as a C Corporation. In that instance, there would be no pass-through tax on your personal 1040 form from the C Corporation return. Note that LLCs taxed as S Corporations would still issue a Schedule K-1 (Form 1120S).

Lastly, if you own equity and you’re sure the LLC is taxed as a partnership, but still haven’t received a Schedule K-1 by March 15, it is probably wise to reach out and check with that business. The business may have filed for an extension, among many other possibilities, so it is best to confirm and avoid any potential penalties on your personal tax returns from the IRS due to filing late or missing required forms.

Summary of Tax Implications for Crowdfund Investors

With some of the differences outlined above for investing in LLCs vs. C Corporations, it is important to remember that the equity crowdfunding industry is still in flux. There will almost certainly be changes in the coming years, so always consult with your personal tax or investment advisor.

Takeaway: investors shouldn’t jump blindly into the world of equity crowdfunding without understanding the potential impact that even a $10 investment could have come tax season.

What does this trade-off mean for the new equity crowdfunding investor?

While we can’t provide specific recommendations, remember that the types of companies that you hold in your portfolio are another type of diversification.

As with anything that is uncertain, one way to mitigate the risk of impact on your taxes is through diversification. Diversifying investments in both LLCs and C Corporations can allow a portfolio to mature and benefit from some of the positive outcomes while mitigating the risk of going all-in and experiencing a negative outcome.

Personally, I prefer to focus more on the quality of the business, team, and offering, building a mix of business types along the way. After all, if you invested in a company with returns like Uber’s, would you be splitting hairs over whether they were an LLC or a C Corp in their earliest days?

In the end, each investor is unique. Our aim is to also make each investor wiser and to avoid making mistakes that they may later regret.

[…] If you have invested in an LLC (taxed as a partnership) that hasn’t converted to a C Corporation yet, or are planning on investing in one, check out our post on how investing in an LLC versus a C Corporation can impact your taxes. […]

[…] startups may take advantage of federal tax credits under the IRS’s Internal Revenue Code (IRC) Sections 1045, 1202, and 1244. These tax credits are important to the US startup ecosystem because they encourage investment in […]

[…] For more insights, check out our comparison of investing in LLCs and C Corps. […]