LLC to C Corporation Conversions – Tax Consequences for Investors

Since we’re a month from the April 15 tax deadline (pending any Coronavirus extensions), I spent the past weekend trudging through a small pile of Schedule K-1 forms to get my Limited Liability Company (LLC) investment taxes in order. I prepare my own taxes using TurboTax (Self-Employed online version – get 20% off) and the number of Schedule K-1s has slowly grown over the years as my investments have grown. Most of them are relatively straightforward to put in, with perhaps a few dollars in Box 1, Box 2 or a few other places.

This year, I had my first experience dealing with an LLC investment that converted to a C Corporation on the last day of 2019. Since it took me a little extra research to ensure I was entering the information correctly, I wanted to share some of my personal lessons for the benefit of others.

If you have invested in an LLC (taxed as a partnership) that hasn’t converted to a C Corporation yet, or are planning on investing in one, check out our post on how investing in an LLC versus a C Corporation can impact your taxes.

TLDR: at a bare minimum you’ll need something like TurboTax Self-Employed or Home & Business (the desktop version) to help you with your taxes. However, most investors that can afford it would be best-served by hiring a professional. As you’ll see, there is a lot of tax and legal jargon that you’ll be required to navigate if you wish to handle the conversion by yourself.

Disclaimer: This article is for informational purposes only. Each investment and investor is unique and will result in different tax situations. Nothing should be construed as legal, tax, or investment advice. Always consult with your professional tax, legal, or investment advisor.

Why would an LLC convert to a C Corporation?

First, a company must have a good reason for incorporating, as the process of converting from an LLC to a C Corporation is neither cheap nor fast.

While an LLC may give founders more flexibility in some aspects when starting out, most LLCs end up converting to C Corporations as they mature. Some of the reasons that LLCs incorporate are to:

- Accept Venture Capital (VC) investment

- Plan for a potential future re-org

- Grant stock options

- Save on the administrative and tax costs of issuing Schedule K-1 forms

- Carry out certain professional activities

There are many other differences between LLC and C Corporations, ranging from taxation to governance and more. Even C Corporations can vary from state to state. In 2018, 82% of Initial Public Offerings (IPO) were Delaware Corporations because of the business-friendly benefits of being incorporated in Delaware (regardless of where they are physically located).

How are LLC investors notified of a conversion to a C Corporation?

Once a company makes the decision to convert from an LLC to a C Corporation, the CEO will likely send an email notifying you of the change. That is how I first found out about my investment’s plan to convert.

Realize that there are many different ways for an LLC partnership to incorporate (at least six according to this). Each of these methods has potential tax implications for the partners and may result in the LLC being treated differently after the fact (e.g. dissolution versus being a wholly-owned subsidiary of the new corporation).

In my case, the incorporation was done through option six: contribution of ownership interests into the new corporation in exchange for shares in the new corporation.

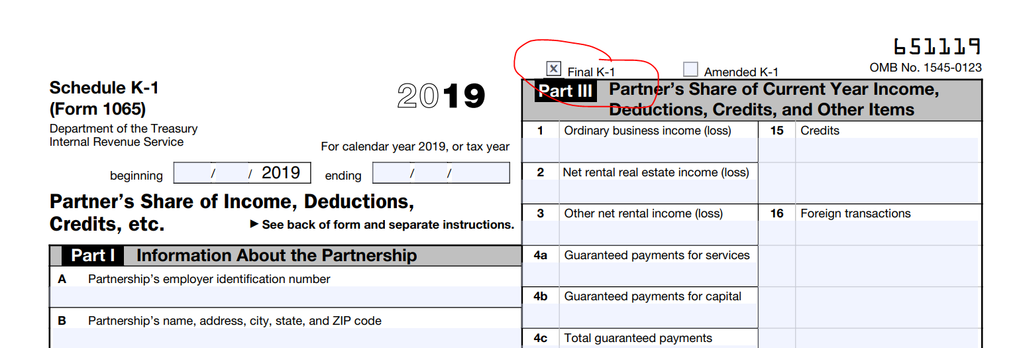

As a result of this transaction, the former LLC became a wholly-owned subsidiary (and disregarded entity) of the new corporation, and so my Schedule K-1 was marked as a “Final K-1”. C Corporations do not issue Schedule K-1 forms because they are not pass-through entities; C Corporations pay taxes at the corporate level.

I also had a “Partner Footnotes” section attached to the Schedule K-1 that described the conversion from the LLC to the C Corporation, including the conversion details.

If the company had used a different method of incorporation that resulted in the dissolution of the partnership, then the “Final K-1” box would still likely be indicated on the Schedule K-1. If the Final K-1 box is checked, be sure to understand why so it can be appropriately handled in your taxes.

Handling the LLC to C Corporation conversion on your taxes

Once you realize that an investment has decided to convert to a C Corporation, how do you handle this on your tax return?

The short answer is: you should have a professional help you. There are so many nuances and gotchas, and the cost of making a mistake and/or the pain of an audit may be more than whatever you think you would save by doing it yourself (never mind the value of your time – trust me on this one).

However, if you’re stubborn like I am, or the cost of paying for a professional to handle it would cost more than the amount of the investment, you may decide to try and handle the Schedule K-1 and conversion yourself. Remember that the situation will differ for each investment and investor, so be sure to do your own research for your specific situation.

With all that being said, there are a few general questions you will likely need to answer to get started. Here are some of the ones that I had to explore.

How was the conversion from the LLC to C Corporation handled?

After I found out which of the six methods the LLC used to incorporate, I had to then decide which of the three IRS tax analyses to use.

The IRS’ three tax analyses (Revenue Ruling 84-111) are:

- Assets-over method – transfer of partnership’s assets to the new corporation, followed by the partnership’s distribution of the corporation’s new shares and the partnership’s liquidation.

- Assets-up method – the partnership liquidates, distributing all assets to partners, and then the partners contribute the assets to the new corporation in exchange for shares.

- Interests-over method – partners transfer their partnership interests to the new corporation in exchange for new shares.

My LLC used the third method (which I found out from the “Partner Notes” section of the Schedule K-1). That resulted in the former LLC not dissolving but becoming a wholly-owned subsidiary of the new corporation and a disregarded entity.

Note that in the first two methods, the partnership is ultimately dissolved, which would also need to be handled on your tax return.

Did you receive any cash or assets in the transaction?

In my instance, I received no cash or assets in the transaction and all my LLC membership interests were converted to stock in the new C Corporation. Obviously, if you receive any cash or other assets during the transaction, you may have other tax liabilities.

Since I had zero gains or losses for the transaction and all my membership interests were exchanged for new shares in the corporation, I had to handle the disposition of my LLC membership interests.

To handle the LLC conversion in TurboTax:

- Navigate to Personal Income –> Business Investment and Estate/Trust Income –> Schedule K-1

- Select Partnerships/LLC (Form 1065)

- Add details for Schedule K-1

- On “Describe the Partnership,” check the box that says, “This partnership ended in 2019”

- On “Describe Partnership Disposal”, select the appropriate option for your situation (likely either “Complete disposition” if sold or dissolved, or “Disposition was not via a sale” if you want TurboTax to suspend all gains/losses)

- If you select “Complete Disposition”, you will have to enter the Sales Price and Cost Basis so TurboTax can calculate your Short-term or Long-term gains (losses). If you select “Disposition was not via a sale”, you will simply enter the “Date Disposed” and “Date Acquired” for the partnership interest. No taxable gains or losses will be calculated.

Under “Complete disposition”, there are also disposition options for abandonment, liquidation, and if the owner died and interest was transferred.

What is your “inside” tax basis capital account and “outside” basis for the LLC investment?

With LLC investments, your “inside” tax basis, calculated as the Partner’s Capital Account on Schedule K-1, may change each year, even if you never receive any distributions from the partnership. For example, if you invested $100 in an LLC, a few years later your inside tax basis (i.e. capital account) could be greater or less than $100, even though your “outside” tax basis (i.e. the adjusted cost basis your investment) has not changed.

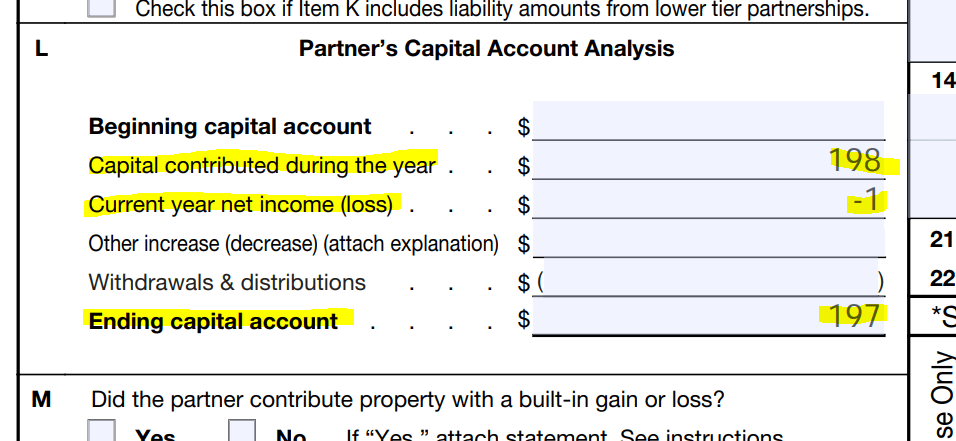

To see how your inside tax basis has changed each year, refer to Line L of Form 1065 (Schedule K-1), Partner’s Capital Account Analysis.

For my investment, I invested $198 the first year. On my Schedule K-1, a loss of -$1 was listed as a “Syndication Cost”, so my inside tax basis (i.e. partner’s capital account) at the end of the first year was $197. Remember that my outside tax basis (the cost basis of my interests in the partnership) was still $198, plus investment fees.

Here is what that looked like.

Thus, the ending capital account value of $197 will be the tax basis used for calculating my new equity ownership in the C Corporation. However, as an individual investor, I must still keep track of my original cost basis (the “outside” basis), since that will be the relevant basis to use for calculating taxable gains or losses in the future.

I warned you that this wouldn’t be easy. Yet here you are, still reading. So how do I track all of these different cost basis amounts, you ask?

I use my startup portfolio management tool, VentureWallet, to keep track of all my outside tax basis amounts for my startups, including conversion dates and other important information that I will need for future tax records.

What date did the conversion take place?

Owners of LLC membership interests are not eligible for the Section 1202 Qualified Small Business Stock (QSBS) tax benefits (up to 100% tax-free gains) that C Corporation investments can take advantage of.

After the conversion to a C Corporation, however, the 5-year holding period may start for Section 1202 QSBS, assuming that the other QSBS requirements are met. As such, ensure you record the date of the conversion and other key criteria required for documenting whether or not the investment qualifies as QSBS.

You’ll thank yourself in several years for taking the time to do this now (and VentureWallet is a great tool to track all these dates)!

What if you didn’t receive a Schedule K-1 for an LLC investment?

I have several LLC investments that have never issued a Schedule K-1. There are several reasons why you may not receive a Schedule K-1 after the March 15 deadline passes.

- First, the LLC may elect to be taxed as a corporation instead of being taxed as a partnership. Only LLCs taxed as partnerships (or taxed as an S Corp) have to issue Schedule K-1 forms to partners.

- Second, do you own actual equity in the LLC, such as Common or Preferred Shares? Convertible Notes and SAFEs are not equity ownership in the partnership and thus would not require a Schedule K-1 to be issued.

- Third, your LLC may have filed for an extension. If they filed for an extension, they would have an extra six months, until September 15, to file.

- Fourth, your LLC may not use the typical calendar-year filing deadline. If they use a different fiscal year, the deadline is the fifteenth day of the third month of the company’s fiscal year.

Having no taxable income is not an excuse, though; regardless of taxable income, LLC businesses must issue Schedule K-1 forms to partners regardless of taxable income.

In the end, the Founders and CEO should maintain good communication with their investor base, so be on the lookout for emails or updates on the funding portal to keep investors abreast of this important information.

Responses