Due Diligence 101 (Part 2) – The #1 Reason Why Startups Fail and How to Screen Deals

In Due Diligence 101 – Part 1, we looked at why due diligence is important, some advantages that crowdfunding investors have over angel investors, and whether it is better to use your gut or use checklists.

In Part 2, we will cover:

- The number one reason why startups fail

- The 5T framework for screening crowdfunding deals

- One big question that must be answered in each of the 5T areas

- How to get your free due diligence checklist for early-stage investors

Playing to Win vs. Playing Not to Lose

Before getting into the top reasons why startups fail, investors should remember the golden rule of early-stage startup investing.

Due to the power law nature of startup investments, it is crucial for financial investors to only invest in businesses that have the potential for massive returns (i.e. “playing to win”).

This strategy is vastly different from trying to invest in startups that have a lower risk of failure (i.e. “playing not to lose”).

Think about poker. If you decide to fold every hand and only play when you are dealt pocket rockets (i.e. two aces – the best starting hand in Texas Hold ‘Em), unless you get incredibly lucky, the blinds will slowly whittle away your stack until you go broke.

Risk is a necessary part of early-stage investing.

It can be counter-intuitive, but investors can’t (and shouldn’t) try to mitigate every risk. If you only invest in low-potential startups, your odds of hitting that home run that returns more than all your investments combined will be drastically reduced.

With that in mind, let’s look at what the data says about why startups fail.

Top reasons why startups fail

According to CBInsights, some of the top reasons that startups fail are:

- No market need (42%)

- Ran out of cash (29%)

- Not the right team (23%)

- Get outcompeted (19%)

- Pricing / cost issues (18%)

- User un-friendly product (17%)

- Product without a business model (17%)

- Poor marketing (14%)

- Ignore customers (14%)

- Product mistimed (13%)

The percentages sum up to over 100% since the data was taken from a survey of 101 startup post-mortems and many cited multiple reasons for their startup’s ultimate demise.

According to the data, the top reason that startups fail is that there is no market need.

However, I don’t believe that is the real reason why startups fail.

The REAL Reason Why Startups Fail – the Founder Gives Up

Coming from an engineering background, I was trained to find the “root cause” of an issue. This prevents coming up with band-aid solutions or only addressing symptoms. It is when you get down to the crux of what really is going on.

One of the tools when investigating the root cause of an issue is using the Five Whys approach, where you continually ask “Why?” five times until you arrive at the real issue.

Example: the phone won’t power on. Why? The electronic circuit board is bad. Why? One of the capacitors is damaged. Why? It was damaged while soldering onto the board by hand. Why? The solder assembly instructions weren’t clear.

Thus, the root cause was that the assembly instructions (i.e. process) weren’t clear. It required updating the process by adding a picture and a better description. That fix – called a “corrective action” – would prevent that same particular issue from happening again in the future.

For startup failures, I would apply this same approach of asking “Why” until arriving at the real issue.

Example 1: No market need. Why? The product wasn’t solving a real problem. Why? Customer feedback wasn’t solicited early enough. Why? Too little cash/time/resources. Why? The founder didn’t hire the appropriate team. Why? The founder/CEO didn’t have the cash/time/resources.

Example 2: Ran out of cash. Why? Burn rate was too high. Why? Too many software developers required to meet demanding VC schedule. Why? Expectations with investors weren’t managed by the founder/CEO.

Maybe you’re starting to see a theme. My personal opinion is that all these reasons listed by CBInsights can be traced back to the founder as the real reason for failure.

Don’t just take it from me, though. According to Jason Calacanis in his book Angel,

“The number one reason a startup fails is that the founder gives up.” -Jason Calacanis, Angel

Founder(s) / CEO Must Have a Hunger to Win; A Desire to Succeed Against all Odds

Have you met someone who was so determined that you knew they were going to succeed, no matter what?

On the flip-side, have you met someone who when the first signs of trouble showed up, were already thinking of ways to jump ship and avoid dealing with the issue?

A founder who wants to win against all odds will find a way around any issue – whether it’s a people issue, product issue, capital issue, or any other type of issue.

It won’t always be an easy solution. It may require laying off team members to reduce the burn rate, pivoting from an initial idea that isn’t gaining adoption, having hard discussions with investors about raising more capital, or a host of other actions. But a founder who wants to succeed no matter what will find a way.

That’s why I believe that the founder(s) and team are not just one of the most important aspects of screening an early-stage deal – they are the most important aspect.

5T Framework for Early-Stage Crowdfunding Deal Screening

In the angel and venture capital industry, there are many frameworks for screening deals and performing due diligence.

Many of the popular methods involve some combination of four to seven (or even more) “T” areas. These are areas that investors believe are important for venture investors to assess before making an investment.

Instead of re-inventing the wheel, we believe that key questions can be summed up best using 5 Ts for early-stage crowdfunding investments.

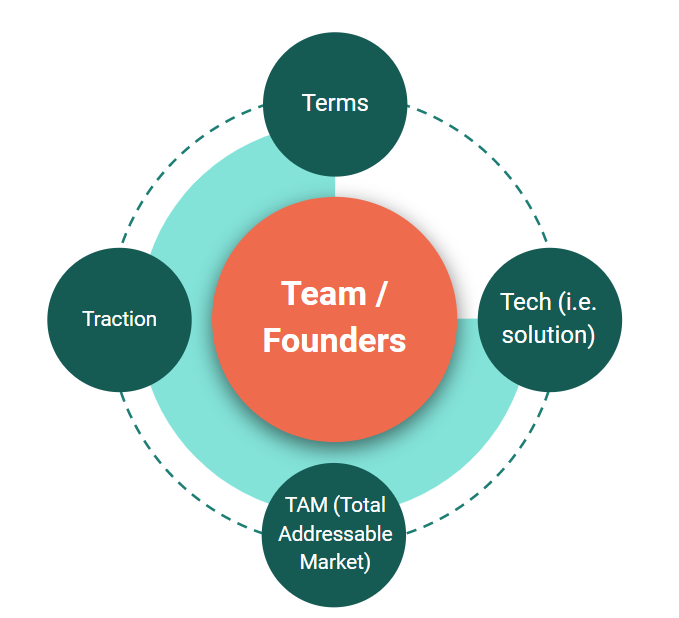

The Crowdwise 5T framework for screening early-stage crowdfunding deals is:

- Team (most crucial)

- Tech (i.e. solution)

- TAM (Total Addressable Market)

- Traction

- Terms

As we’ll discuss, the reason that the Team (i.e. founders) circle is the largest is that the founders are the only non-negotiable area of the 5T early-stage deal screening process.

If the founders are weak, you should stop right there. A weak founder – even with the greatest idea in the world – will likely not lead to success. On the other hand, an exceptional founder can (and often does) make up for weaknesses in the other four areas.

Various studies have shown that founders who have built and sold successful businesses in the past are statistically more likely to succeed in new endeavors.

To assess a potential investment in each of these 5T areas, I find it best to try and summarize each of the 5Ts with a single, powerful question.

One Key Question for Each Area of the 5T Framework

In our free screening checklist, we have a collection of numerous questions to help investors assess a potential investment in each of the 5T areas.

Summarizing all the checklist questions into a single, powerful question, here is what I am looking for in a potential investment in each of the 5T areas:

- Team – is the founder amazing and do they want to win against all odds?

- Tech – is the product solving a real problem and 10X better than what’s available?

- TAM – is the market huge and attainable?

- Traction – is there a proven need and are customers willing to pay?

- Terms – are the deal terms suitable for you and do they align founder/investor goals?

Getting the answer to each of the above questions may require looking at numerous aspects of the business, as outlined in the checklist below.

Free Due Diligence Checklist Download

While each investor will have variations of what they look for when evaluating potential investments, you shouldn’t have to start from scratch.

To provide more insight into how to answer each of the big questions for the 5T areas, I have created a checklist of the types of questions that I ask before making my own investments.

The checklist is completely free.

To get your free due diligence checklist, create a free account and then log in to the Members-Only Resources page of CrowdWise Academy.

The document also provides links to white papers, VC checklists, and other resources to help you in customizing and creating your own deal screening checklist.

Next Topic – Valuation, does it matter for angel investors?

In out next topic, we introduce one key part of due diligence that we glossed over. That is early-stage startup valuation.

What is valuation, why is it important, and does it even matter for early-stage investors such as angels and crowdfunding investors? We cover all of these topics and more in our Valuation (Part 1) article.

[…] Part 2, we will talk about the CrowdWise 5 T’s framework for conducting due diligence (Team, Tech, […]

[…] the 5T Framework of Due Diligence is a good method to use in doing […]