Top 10 Equity Crowdfunding Sites – 2020

2023 UPDATE: the top platforms of 2022 and equity crowdfunding stats are in! Read more here.

What are the top equity crowdfunding sites of 2020 for both investors and entrepreneurs? We have broken down the best crowdfunding platforms in terms of the number of investors, capital raised, fees, and other key areas.

UPDATED with the latest platform data as of January 2021: numbers below include the latest stats through the end of December 2020. The video reviews the data as of September 2020.

Earlier in 2020, we looked at the Top 8 Regulation Crowdfunding (Reg CF) intermediaries ranked by total capital raised and deal flow. We also shared our free funding portal comparison matrix for investors. Today, we will break down the top 10 equity crowdfunding platforms from the perspective of both a startup founder and a startup investor.

In today’s post, we’ll look at:

- The top equity crowdfunding sites for investors

- The top equity crowdfunding sites for founders

- List of the top ten equity crowdfunding sites by capital raised in 2020

Startup founders and investors can download our free 2020 equity crowdfunding site comparison matrix below to compare the top eight portals based on fees, investors, due diligence, and more.

Get your free Reg CF platform comparison matrix

What should investors look for in an equity crowdfunding site?

All else being equal, startup investors should be investing on platforms that best align with the types of deals and investment opportunities that they are looking for. Areas that every investor should consider to determine what is the best funding portal includes:

- Types of companies and deals

- Quality of deals

- Quantity of deals

- Early-stage (Reg CF) vs. Later-stage (Reg A+) startups

- Investor fees

- Due diligence and deal curation done by the platform

- Types of securities offered (e.g. Common Stock vs. SAFEs)

- Secondary Market options (for increased liquidity)

- Payment forms accepted (credit card vs. ACH vs. wire)

In general, the top three platforms (Wefunder, StartEngine, and Republic) alone account for over 80% of 2020 total Reg CF deal flow in terms of the amount of capital raised. Thus, investors looking to source the highest-quality deals should be looking at least across these portals, as the majority of successful deals come across these three funding portals.

Depending on the types of companies you like to invest in, there may be smaller, niche portals that are also worth considering – check out the complete list of FINRA-approved funding portals. If you want highly-vetted deals, Seedinvest and Equifund CFP are two other great options.

Furthermore, the three portals above only take the majority of Regulation Crowdfunding deal flow; certain sites, such as Seedinvest, have focused more on highly-vetted Reg A+ deals that may be later stage but are still raising in the tens of millions of dollars, so investors who are looking for later-stage deals may need to look across more of these portals.

Data Sources: 2020 Reg CF data obtained from NextPitch.tv and KingsCrowd.com.

Major Fee Changes since 2019

In terms of major changes since 2019, investors should be aware that Wefunder has introduced a lead investor structure. This helps Wefunder companies by allowing all crowdfunding investors to show up as a single line-item on the corporate cap table. However, investors compensate the lead investor by agreeing to pay 10% of future profits (if any).

In addition, StartEngine did not have investor fees for much of 2019, but has shifted back to charging investors 3.5% per investment.

Republic is the only of the top three funding portals that still has no fees for investors.

Which equity crowdfunding sites have secondary trading platforms / markets?

Right now, there are two Reg CF secondary platform that allows investors to buy and sell Reg CF shares:

- Netcapital Secondary (operating for several years)

- StartEngine Secondary (launched Nov. 2020) – registered Alternative Trading System (ATS) with FINRA

In my view, a secondary market is more of a nice-to-have rather than a necessity. I believe that taking the temptation completely off the table in terms of being able to sell your shares early (and miss out on potentially massive later-stage gains) is important and helps investors from being susceptible to human biases and psychology. That being said, it is nice to be able to pick up shares of a company that you perhaps missed previously, or even acquire more shares of a company that you believe in.

What should founders look for in an equity crowdfunding site?

Startup founders should be concerned with many of the same factors that startup investors are looking for in a top portal, with a few additional areas of interest:

- Number of active investors

- Types of investors (average check size, type of deals)

- Total amount of capital raised

- Average amount raised per campaign

- Number of campaigns

- Types of companies (niche or local offerings vs. more broadly-appealing businesses)

- Platform fees

- Discounts on fees

- Due Diligence process

- Securities offered (e.g. SAFE, Equity, etc.)

- Valuation ranges

- Cap table structure (i.e. single cap table line-item vs. many)

- Experience of the platform’s team

- Funding history (of the platform itself)

- Overall fit

Investors on the platform

All else being equal, the more potential investors are on a platform, the higher the amount of capital you may be able to raise.

Keep in mind that many portals tend to see a 50/50 split between on-platform investors vs. new investors brought in by a campaign, whether that is by your existing customers or paid acquisitions. Crowdfund Capital Advisors found in their 2020 Reg CF study that as much as 80% of campaign commitments may come from first- or second-degree associations with either the company or entrepreneur, suggesting that businesses who already have a large existing audience or customer base may be able to have better success in equity crowdfunding.

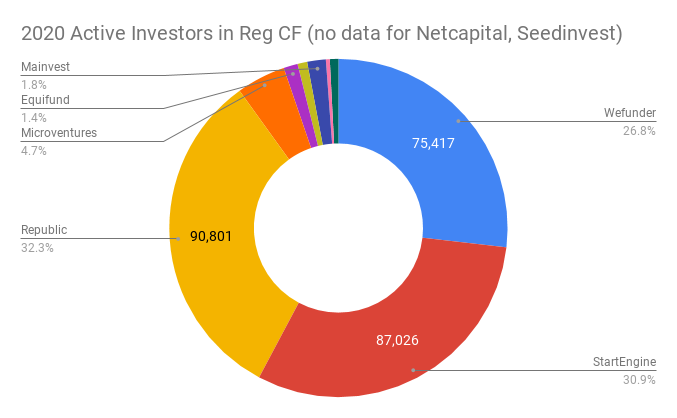

Also, keep in mind that each crowdfunding platform may list the total number of investors to be in the hundreds of thousands based on the total number of accounts (e.g. Wefunder claims 600,000+), but you really want to focus on how many active investors are on the platform.

While there is no data for the number of investors on Netcapital and Seedinvest (they don’t make this info public), below is a breakdown of the number of active investors on each of the top 10 Reg CF sites.

Note that while Republic.co is the third-largest in terms of capital raised, it has a much higher number of unique investments. This suggests that there are either more overall active investors, or that investors tend to invest in more deals on average than on Wefunder and StartEngine.

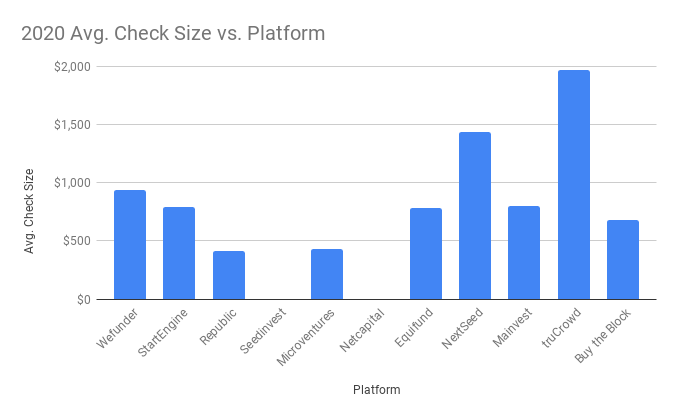

Average Investor Check Size

The Crowdfund Capital Advisors 2020 Reg CF study also found that typically 80% of the investors are accredited and 20% are non-accredited; however, 80% of the capital comes from accredited investors, while only 20% of the capital comes from the larger number of non-accredited investors.

Issuers (e.g. the startup founders and entrepreneurs) should consider the type of investor that you are looking to attract to your campaign. Investors on Republic tended to invest smaller amounts on average compared to Wefunder and StartEngine, but there was a larger number of investors on average in each Republic campaign (again, no data for Seedinvest or Netcapital).

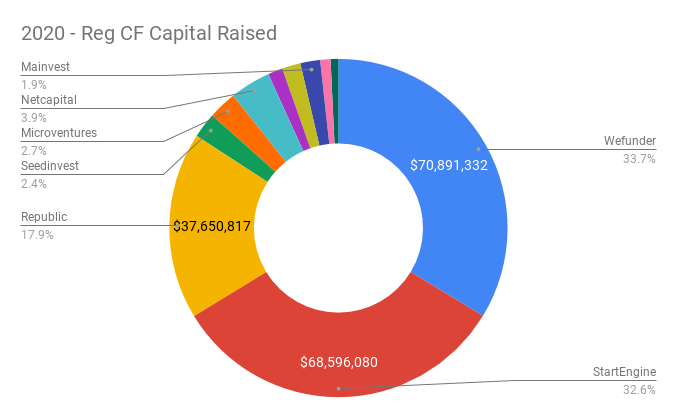

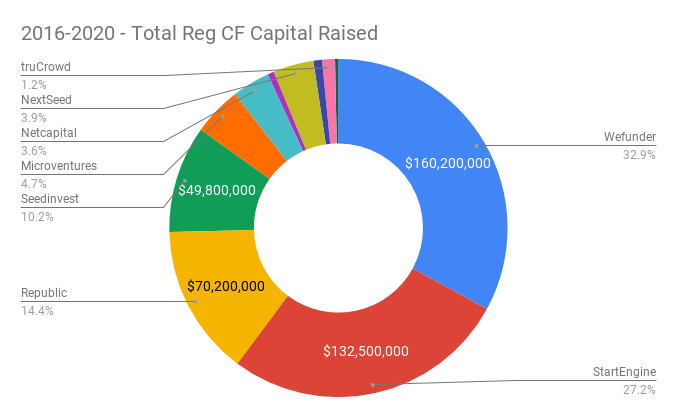

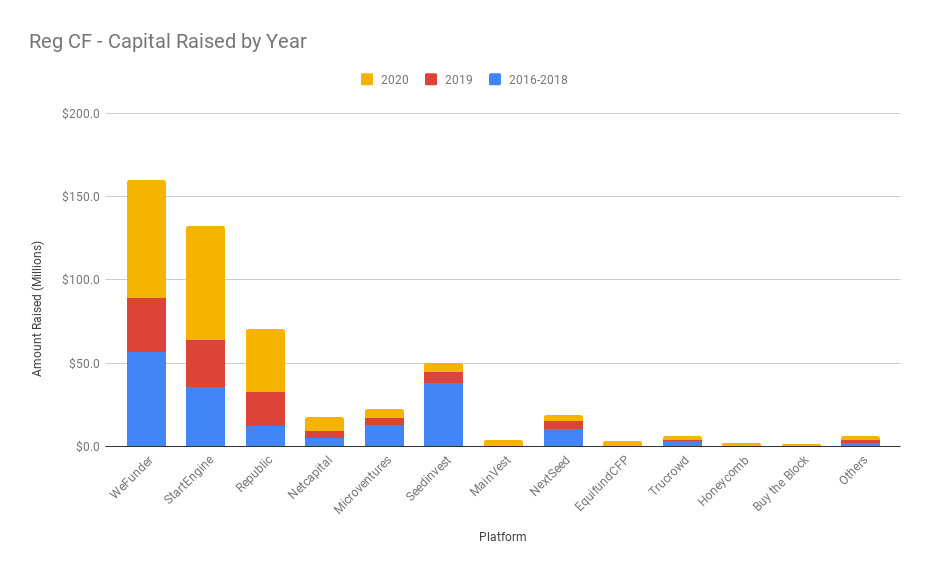

Total Capital Raised

Perhaps the most important factor for issuers that demonstrates how successful a funding portal has been for issuers is the amount of capital raised. You’ll notice that three of the equity crowdfunding sites (Wefunder, StartEngine, and Republic) have dominated 2020 Reg CF capital raised, while the numbers are also quite similar when looking at total Reg CF capital raised since 2016. Republic has had a strong showing in 2020 and overtaken Seedinvest for the third spot in the total Reg CF raised since 2016. Netcapital and Microventures have both overtaken Seedinvest in terms of 2020 capital raised.

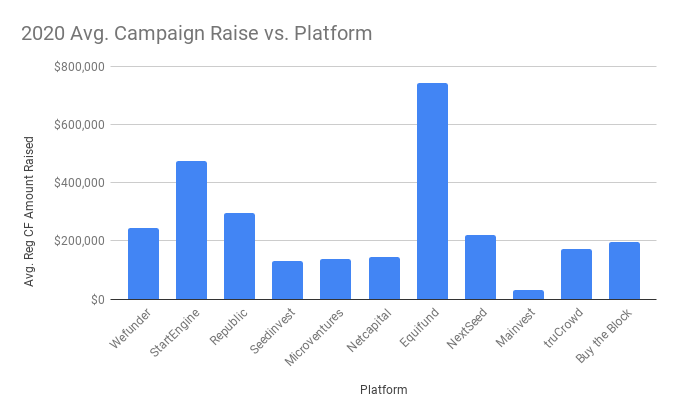

Average Capital Raised per Campaign

Since the current Reg CF limit is capped at $1.07M, we can look at the average amount raised per campaign across each funding portal to get an idea how successful each issuer has been on average (without having to worry about very high outliers).

Keep in mind the sample size in the above chart. i.e. Equifund, while it appears to have raised a very high average amount, only had four deals in 2020.

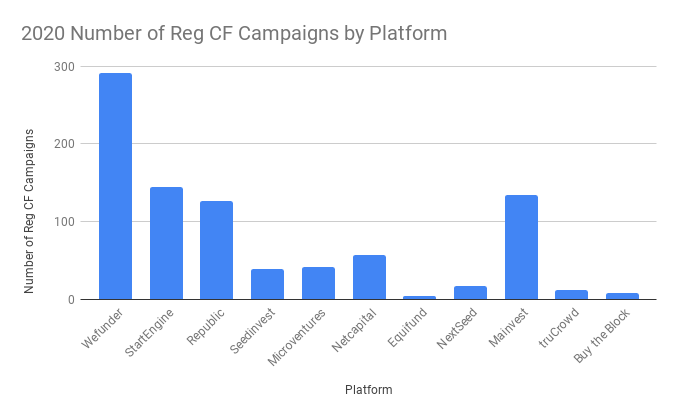

Number of Reg CF Campaigns

In terms of raw number of offerings by platform, the top three funding portals have had the most deals by far, with the exception of Mainvest. (Note: chart updated on 1/3/2021)

Platform fees

Fees vary widely from platform to platform. Some portals, such as SeedInvest, include most of their fees in their overall percentage that they take upon successful completion of the campaign. Others, such as StartEngine, have many smaller fees that depend on the type(s) of payments you accept, whether you have international investors, and more.

While a few percentage points of difference might sound small, think of how the fees will impact your campaign in terms of your maximum target. For example, if you raise $1 million, every 1% of fees is $10,000. Remember to balance this with what the platform offers in terms of investors, though. A portal with zero fees but very few investors won’t help you raise any capital!

Discounts on fees

Several platforms offer referral bonuses for startups and those who refer them to the platform. These bonuses typically result in $1,000-8,000+ in savings for issuers (i.e. startups). However, these fees are typically for new applications only, so be sure to reach out to us in advance if you are looking to apply to a Reg CF funding portal that offers a referral discount.

- Save up to $10k on Wefunder’s fees using our link here and no up-front fees

- Save up to $1,000 on StartEngine (contact us)

- Save $1,000 on Republic fees and get white glove treatment – contact us (warm introduction required for discounts)

Due diligence and deal curation process

Intermediaries that have extra due diligence or deal curation (above and beyond the required Reg CF checks) are:

- Republic

- SeedInvest

- Equifund CFP

- Netcapital (“100-point check”)

- MicroVentures

- NextSeed

The intermediaries in the Top 10 that do not perform additional due diligence or deal curation are:

- WeFunder

- StartEngine

- Mainvest

- Buy the Block

Issuers should reflect on whether their business will pass additional due diligence in advance. If you believe your startup may be viewed as a non-traditional type of startup (e.g. a film, food and beverage chain, main street business, etc.), you may be better off going with the portals that don’t require due diligence.

Startups should look at the types of deals currently live on each platform to get a feel for whether investors on that platform will be comfortable investing in your business.

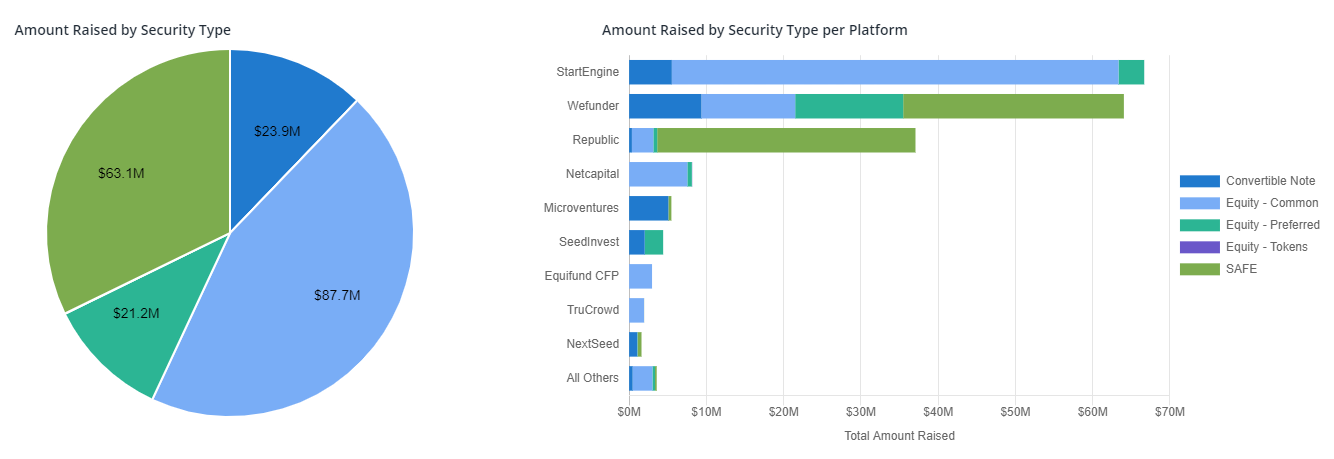

Securities offered

While several intermediaries have a diverse set of securities that are offered (e.g. StartEngine), others may choose to focus on a certain type of security, such as Republic and their single Crowd SAFE offering. Even Republic has even been including more types, such as Stock Purchase Agreements for Common Stock, as of Q2/Q3 2020.

Wefunder tends to prefer SAFE offerings, but do have some Common and Preferred Stock offerings, too.

StartEngine specifically avoids offerings SAFEs, but does allow for some convertible notes. Most of StartEngine’s offerings are Common Stock.

Thus, if you have a certain type of security in mind that you would like to offer, check the live offerings on the platform to ensure that your desired security type aligns with others that the platform offers to investors.

This is important because the platform will be better able to advise you on favorable terms for that security type, and investors will be more familiar with assessing deal terms for that type of security.

Here is the 2020 data for the types of Reg CF security offered (Reg CF equity types only – e.g., no debt, rev share, etc. in the below numbers):

Valuation range

As discussed in our 2019 valuation summary article, the bulk of Reg CF offerings range from $2M-$11M pre-money. However, there are still a decent number of offerings up to $20M in pre-money valuations, and even some that go as high as $60M that are currently live. Note that most companies with valuations over ~$40 million tend to be Reg A+ offerings, since they are likely around Series A (a bit later-stage) and will be looking to raise more than the current Reg CF cap of $1.07M allows.

Choose a Reg CF portal that is most in line with your anticipated valuation, as this will both maximize your odds of being accepted by the portal, as well as being a good fit for the investors on that platform.

Cap table structure (i.e. single cap table line-item vs. many)

Another important aspect of an equity crowdfunding site is whether they have a way to avoid the “messy cap table” issue – e.g. whether all crowdfunding investors will appear as a single line item on your cap table or as individual lines (one per investor).

Messy cap tables are an issue for several reasons. First, Section 12(g) of the Exchange Act mandates that any company with more than 2,000 holders or record or 500 non-accredited investors becomes a public reporting company under the Exchange Act. While Reg CF provides some relief (this doesn’t apply if an issuer has total assets as of the end of its last fiscal year not in excess of $25 million), this essentially means that any company with more than 500 non-accredited investors and over $25 million in total assets is no longer exempt, and registration can be costly and burdensome on an early-stage startup.

Second, VCs and later-stage investors generally have negative feelings towards messy cap tables. Thus, a messy cap table can influence a startup’s ability to raise future capital on favorable terms from top-tier firms.

Wefunder has recently instituted their Lead Investor structure as a way to fix the 12(g) cap table issue. There is an annual fee that must be paid to XX Investments LLC (the custodian for Wefunder investors) after year three, and investors agree to pay 10% “carried interest” (e.g. 10% of profits) to be split 50/50 among XX Investments and the lead investor. This lead investor also gets voting power on behalf of investors and has a fiduciary duty to crowdfunding investors.

Netcapital also has a way to ensure that investors are only a single line-item on the cap table, as does Republic with the Crowd SAFE.

As of Q3 2020, StartEngine still does not have a solution for the messy cap table issue, and so investors show up as individual line items on the cap table.

Experience of the platform’s team

All else being equal, who would you rather go with – a funding portal that has a few deals a year, or a platform that helps launch dozens of deals a month?

There are pros and cons to each. Obviously, you may get more hand-holding and guidance with some of the smaller portals, which may be suitable for your situation. However, the larger portals have more resources, revenues, and experience, which tends to benefit the companies raising on those platforms.

Funding history (of the platform itself)

Another factor that shouldn’t be overlooked is the amount of funding and the backers that the funding portal itself has. For example, in 2020, Wefunder closed out a $50M round, StartEngine raised over $10M for themselves via their Reg A+ campaign, and Republic sold out its $16M Republic Note offering.

This is not only a vote of confidence in those platforms, but shows that they know how to raise capital themselves and thus can “walk the walk” when it comes to helping companies raise funds (especially those that raised using crowdfunding).

Platforms that are well-funded will have the resources to help issuers succeed and are often-backed by notable investors and advisors, ranging from Mr. Wonderful on StartEngine, to AngelList and others on Republic.

Ensuring the platform itself is healthy in terms of its financial situation will ensure that you don’t have to worry about whether or not they’ll be around in a year or two in case you decide to do another crowdfunding round. You will also know that you’ll still have easy access and tools to stay in touch with your investor base with a well-developed platform.

Overall fit

Founders have many options (more than 55 – complete list here) for selecting an equity crowdfunding site. In the end, you must weigh all these factors, but spend some time talking to the teams and you will quickly get an idea of whether or not each platform might be a good fit for your campaign.

Many of the smaller funding portals are much more focused on certain niches, such as cannabis, green energy, local and main street businesses, and more. So if you’re looking to connect with a specific crowd, these focused funding portals may offer you a smaller but more relevant base of investors.

Top Equity Crowdfunding Site Ranking and Comparison 2020 (Reg CF)

Here is a brief overview of the top ten equity crowdfunding sites and how they compare on the various characteristics.

The top equity crowdfunding sites ranked by capital raised through January 1, 2021 are:

- WeFunder – $70.9M

- StartEngine – $68.6M

- Republic – $37.7M

- Netcapital – $8.2M

- MicroVentures – $5.7M

- SeedInvest – $5.1M

- Mainvest – $4.0M

- Nextseed (merged with Republic in 2020) – $3.7M

- Equifund CFP – $3.0M

- Trucrowd – $2.1M

The ranking order for platforms outside of the top three has changed quite a bit over the last year since we covered the 2019 crowdfunding site rankings.

Note: this is for Reg CF capital raised on each platform. Regulation D (Reg D) and Regulation A+ (Reg A+) offerings are also done by many of the platforms and would greatly increase the amount of capital raised. The above numbers may have some small amounts of Reg D included in the totals as some of the platforms don’t easily differentiate the amounts raised in side-by-side raises.

WeFunder (review and overview)

- Startup capital raised (2020): $70.9M

- Platform Fees: 7.5% of amount raised (best price match offer) – get up to $10k off Wefunder’s fees when you apply using our link here

- Other Fees: none (credit card fees of 3.5% paid by investors)

- Referral Discounts on Fees: Yes – up to $10k off fees and $0 up front –apply using our link here

- Extra Due Diligence / Deal Curation: No

- Primary Securities: SAFE, Equity, Revenue Share

- Registered Broker-Dealer: No

StartEngine (review and overview)

- Startup capital raised (2020): $68.6M

- Platform Fees: 7-12% of amount raised; $10k service fee

- Other Fees: 0.5% escrow fee

- Referral Discounts on Fees: Yes – up to $1,000

- Extra Due Diligence / Deal Curation: No

- Primary Securities: Equity (Common), Convertible Notes

- Registered Broker-Dealer: Yes

- Secondary Platform: launching in Q4 2020

Republic (review and overview)

- Startup capital raised (2020): $37.7M

- Platform Fees: 6% of amount raised, 2% of securities sold

- Other Fees: $1,500 for Form C, ~$1,500 for escrow, 3.5% for credit card transactions

- Referral Discounts on Fees: Yes – $1,000 discount and white glove treatment – (email intro via Venture Partners program required – contact us here)

- Extra Due Diligence / Deal Curation: Yes

- Primary Securities: Crowd SAFE

- Registered Broker-Dealer: No

Netcapital

- Startup capital raised (2020): $8.2M

- Platform Fees: 4.9% of amount raised + engagement fee

- Other Fees: escrow included in Netcapital performance fee

- Referral Discounts on Fees: None

- Extra Due Diligence / Deal Curation: Limited (100 point inspection)

- Primary Securities: Equity (Common)

- Registered Broker-Dealer: No

MicroVentures

- Startup capital raised (2020): $5.7M

- Platform Fees: No fees in 2019; now charge 5% commission + 2% securities as of August 2020

- Other Fees: $1,000 min. or .35% escrow fee; $1,500 Form C software; $1,000 Form C legal review

- Referral Discounts on Fees: None

- Extra Due Diligence / Deal Curation: Yes

- Primary Securities: Convertible Note

- Registered Broker-Dealer: Yes

SeedInvest

- Startup capital raised (2020): $5.1M

- Platform Fees: 7.5% of amount raised, 5% of securities sold

- Other Fees: SI covers escrow, legal, due diligence, and filing fees up-front, reimbursed as flat $10k upon successful campaign closing

- Referral Discounts on Fees: None

- Extra Due Diligence / Deal Curation: Yes

- Primary Securities: Convertible Note, Equity (Preferred)

- Registered Broker-Dealer: Yes

Mainvest

- Startup capital raised (2020): $4.0M

- Platform Fees: 6% of amount raised

- Other Fees: None

- Referral Discounts on Fees: No

- Extra Due Diligence / Deal Curation: No

- Primary Securities: Revenue Share

- Registered Broker-Dealer: Yes

NextSeed

- Startup capital raised (2020): $3.7M

- Platform Fees: 7-10% of amount raised (only 5% for investors brought in through unique referral link)

- Other Fees: escrow fee of $500; investors charged 1% on each payment

- Referral Discounts on Fees: Yes – $500

- Extra Due Diligence / Deal Curation: Yes

- Primary Securities: Debt, Equity, Revenue Share

- Registered Broker-Dealer: Yes

Equifund CFP

- Startup capital raised (2020): $3.0M

- Platform Fees: 7% of amount raised and 7% of securities offered

- Other Fees: None

- Referral Discounts on Fees: No

- Extra Due Diligence / Deal Curation: Yes

- Primary Securities: Equity (Common)

- Registered Broker-Dealer: No

TruCrowd

- Startup capital raised (2020): $2.1M

- Platform Fees: $3,500 listing fee, up to 12% of amount raised

- Other Fees: escrow fee $5,000

- Referral Discounts on Fees: No

- Extra Due Diligence / Deal Curation: No

- Primary Securities: Various

- Registered Broker-Dealer: No

Buy the Block

- Startup capital raised (2020): $1.6M

- Platform Fees: 4.5% of amount raised plus 2% equity

- Other Fees: See fee schedule

- Referral Discounts on Fees: No

- Extra Due Diligence / Deal Curation: No

- Primary Securities: Equity

- Registered Broker-Dealer: Yes

Download our Free Reg CF Intermediary Comparison Matrix (for Startup Founders)

To get all this information in spreadsheet format, along with more details not given above, download our 2019 Reg CF intermediary comparison matrix for founders.

[…] http://crowdwise.org/funding-portals/top-10-equity-crowdfunding-sites-2020/ […]

[…] http://crowdwise.org/funding-portals/top-10-equity-crowdfunding-sites-2020/ […]

[…] http://crowdwise.org/funding-portals/top-10-equity-crowdfunding-sites-2020/ […]

[…] was on the CrowdWise website and came across the top 10 Investment Crowdfunding portals by amount raised in 2020 and […]

[…] Buy The Block, the Black-owned Regulation Crowdfunding real estate platform was named a top 10 platform rated on capital raised in […]

Hi Brian, thank you so much for the phenomenal value you are adding to the Equity Crowd Funding community. My question is, apart from these top 10, how many purely equity-based crowdfunding sites are there, in total? Thank you!

Hey Torben – you can get a list of all the current FINRA-registered funding portals here – looks like there are 60 as of today:

https://www.finra.org/about/firms-we-regulate/funding-portals-we-regulate

Note that there may be a few that are registered broker-dealers instead of solely being a funding portal. Most of these (for example, StartEngine) have both a funding portal and a BD to be able to handle different offerings and situations; however, there could be a few BDs who aren’t on the funding portal list.

Hope this helps!

Awesome thank you so much! I’ll potentially take some time to see if an exact number can be reached. In terms of the total market size for equity crowdfunding, potentially mind-boggling, would there be a source, for a 2025 or 2030 figure? Thanks again.

Probably one of the best data sources for all the active equity crowdfunding campaigns right now would be Kingscrowd.com and their Ratings platform here (https://www.kingscrowd.com/ratings), which is the database of over 2000+ campaigns from past and present. They will also be releasing an Analytics platform in the coming months that will have more industry-wide numbers.

Another good current data source for the industry is Crowdfund Capital Advisors.

For a 2025-2030 figure, perhaps the best estimate would be from Statista for “Crowdinvesting” trends, and then extrapolating to 2025-2030. Just keep in mind that with the potential SEC changes to increase the cap to $5 million for Reg CF, we could see an even larger growth rate in the coming years because of an influx of new companies and investors. Hope this helps!

Here’s the Statista link – https://www.statista.com/outlook/377/100/crowdinvesting/worldwide#market-revenue

[…] in 2021, accredited investors will don’t contain any investment limits underneath Reg CF. A most modern look found that on the entire 80% of the investors are accredited and 20% are non-accredited, so right here is […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] highest 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] highest 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] سیستم عامل برتر 209 میلیون دلار در سال 2020 جمع آوری کرد و بیش از 177 میلیون دلار از این سه شرکت جمع آوری کرده […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] highest 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] Find investors through other sharing economy platforms like crowdfunding. […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] high 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

[…] top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three […]

Hi Brian, Thank you for the great article, it’s super helpful. Is there a way to get some background color around the chart “Average Capital Raised per Campaign”? Do most campaign actually attempted to raise the old maximum $1M and if so it would mean that most campaign raised actually 20% or less than their target amount? Or are most campaigns attemptinf for a much lower target amount? I’m trying to get a sense for how successful is the average campaign, actual vs goal, how many are raise less and ow raise more than their target amount?

Thank you very much,

Philippe

Sorry for typos 🙂

No worries 🙂

The best resource I know of today is from Kingscrowd:

kingscrowd.com/analytics and kingscrowd.com/ratings

The second URL is a paid-only service, but you can do a detailed search for all 2,700+ raises in the Kingscrowd database (since 2018).

I just did a quick filter for all RegCF companies that raised over $1M and looks like there have currently only been 105 out of 2807 companies that have broken the $1 million barrier.

You can use that Kingscrowd table to sort by industry, valuation, and other metrics that might make the information much more applicable to your specific situation.

Hope this helps!

FYI – I wouldn’t pay much attention to the “target” amount (i.e. minimum) on past campaigns vs. how much they raised, since most companies now just set that to be $25k or $50k, with the expectation being that they’ll raise much more than that.

Also, even the maximum amount can be a bit misleading, since companies often update that when (if) they hit a lower maximum of say $250k or $500k. This would be captured by filing an amendment to the Form C (Form C/A), but you’d have to do a lot of manual digging right now if you wanted to find all this information.