Risks of Equity Crowdfund Investing – Part 1

In Part 1 of understanding the risks of the equity crowdfunding asset class, we will investigate what risk-reward tradeoffs are, and dive into some human psychology that impacts our investment decisions.

Part 2 investigates the top seven asset-class risks specific to equity crowdfunding, and what you can do to mitigate those risks as an investor in these startups.

——————-

Whether it’s in financial investing, your career, relationships, or anything else in life, you typically have to take larger risks if your aim is larger and more desirable outcomes. Investing in equity crowdfunding is no different.

It’s no secret that the private markets have brought enormous wealth to the earliest investors in some of today’s largest companies. The classic example is Peter Thiel, Facebook’s first investor, who turned his $500k investment into more than $1B after its 2012 IPO – a 2000X return (IRR=95%).

But these returns don’t come without a price. What is the price investors pay for higher potential returns?

The price you pay for higher potential returns is that you accept a much higher risk of failure compared to traditional investments, such as stocks, bonds, and real estate.

The reality is, more than half of your investments will likely fail; that is, they will return less than 1X of your invested capital.

To be successful as an investor in equity crowdfunding, it is crucial to comprehend the additional risks that you are taking, and what (if anything) can be done to help mitigate some of those risks.

To set a solid foundation for understanding risk, we will discuss the risk-reward tradeoff, and then investigate how the human brain deals with risk, and how it can impact your investment decisions.

Risk vs. Reward – the Classic Tradeoff

Facebook, Uber, Airbnb. These are only a few examples of recent, massive private market investor successes. Comparing these early-stage returns with the public markets, there is no public stock that can rival the magnitude of those returns over the same timeframe.

The reason, as previously mentioned, is that investors in private, early-stage companies are accepting a much higher risk of failure in return for much higher potential returns.

This is commonly referred to as the risk-reward tradeoff.

The most classic example of this tradeoff is stocks (high risk, high reward) versus bonds (low risk, low reward). However, stocks and bonds are just two examples of the many types of asset classes. Other asset class examples range from real estate and cash equivalents, to some of the newer options such as equity crowdfunding startups and cryptocurrencies.

Each asset class has a corresponding risk-reward profile, and building a robust investment portfolio requires diversification among these various asset classes.

In the case of equity crowdfund investing, you need to ask yourself if you are willing to accept the much higher risk and increased volatility in exchange for the potential of achieving higher returns.

Risk-Reward Curve Visualization

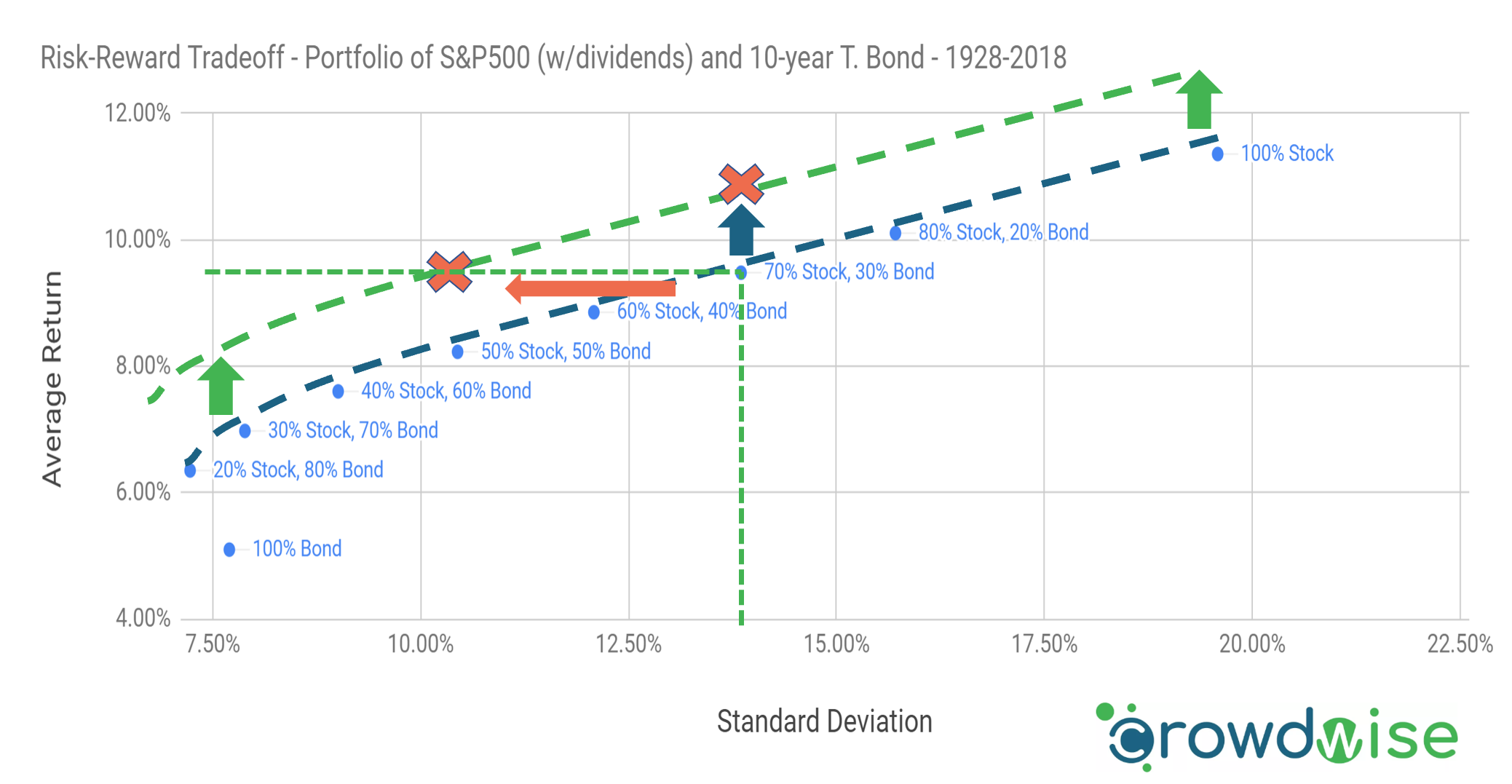

To get a better understanding of risk-reward tradeoffs, let’s take a look at a standard investor’s portfolio that consists solely of stocks and bonds.

Plotting volatility (using standard deviation of annual returns) on the X-axis, and average annual returns on the Y-axis, here is an example of what risk vs. return looks like for several portfolio allocations of stocks and bonds.

As you can see, whether you are 100% stocks, 100% bonds, or any combination in between, your portfolio’s maximum expected returns fall along a curve based on the risk-return profiles of the two asset-classes that you hold.

Did you also notice that a portfolio with 100% bonds is not the lowest-risk option? Although somewhat counter-intuitive, by adding a small amount of more risky stocks to a pure bond portfolio, you can actually boost your portfolio’s potential returns, while simultaneously lowering the overall portfolio risk.

Risk-Reward Lesson 1 – the “safest” individual investments (in this example, bonds), by themselves, are not the lowest risk portfolio option. A lower-risk portfolio can be achieved by diversifying and adding small amounts of higher-risk, non-correlated assets (in this example, stocks).

Equity Crowdfunding Investments and the Risk-Reward Curve

Let’s continue to build on this example and see how equity crowdfunding, a new asset class, could potentially impact your portfolio’s risk-reward curve.

Assume you take a small portion of your portfolio and invest it in alternative investments, like equity crowdfunding startups.

The impact of adding non-correlated, alternative investments is that your portfolio’s risk-reward curve should shift up. Due to the higher risk-reward nature of the startup asset class, this boosts your portfolio’s potential returns at each level of volatility.

To illustrate what impact this would have on your risk-reward curve (not based on actual data), the blue arrow below shows how a 70% stock / 30% bond portfolio would be impacted by adding non-correlated assets with higher risk-reward profiles.

Note: shifted green curve is for illustrative purposes only. Not based on actual data.

Notice something else that occurred which was impossible before: if you draw a horizontal line from the previous 70/30 data point (shown by red arrow), there is actually now a possible alternative allocation – with the same expected return value – but at a lower risk level (i.e. standard deviation).

This is a similar effect to what we previously saw, where adding stocks to a pure bond portfolio can actually boost returns while reducing risk.

Risk-Reward Lesson 2 – diversifying your portfolio’s investments to non-correlated assets, like startups from equity crowdfunding, can potentially boost returns while reducing risk.

A few quick disclaimers:

- The shifted green line is only a theoretical example of the potential impact of adding startups. The actual performance (returns and volatility) of equity crowdfunding is still to be seen.

- The data for expected returns are the averages of annual returns for the S&P 500 index (inclusive of dividends) and 10-year T. bonds from 1928-2018. Here, average is not the same as something like an Internal Rate of Return (IRR) – i.e. a 100% gain and -50% loss in two consecutive years is an average of 25%, but IRR would be 0% (100–>200–>100).

- Standard Deviation is a common measure of stock and bond market volatility, but is not 100% accurate. This assumes non-skewed, normal distribution returns, and in reality is only an approximation of actual market volatility. Startups are also non-normal and assumed to follow power-law returns.

Now, you hopefully have a better logical understanding of risk-reward tradeoffs and how adding non-correlated assets (like startups) can boost returns while reducing risk.

While rational planning and logic are part of the equation to deal with risk, there is another factor that also has a massive impact on your investment decisions. That factor is the human brain.

A Thought Experiment – Risk vs. Reward

Imagine that someone gives you $5,000 that you must invest, and you are presented with two different options for investing.

For the first option, you would have 100% chance of making 10% on your investment. For the second option, you would lose the entire $5,000 investment 70% of the time, and return 4X your investment 30% of the time.

So your options for the $5,000 are:

Option 1:

- 100% chance of ending up with $5,500

Option 2:

- 70% chance of ending up with $0

- 30% chance of ending up $20,000

Which would you choose?

If you are risk-averse like many investors, you likely would take the sure deal of $5,500 in option 1.

Why?

It mostly comes down to the way that humans weigh different risky options – in general, humans associate more pain with losses than the pleasure they get from gains.

If you calculate the expected value of outcomes for the two scenarios, option 2 would actually be more profitable in the long-run. It offers a 10% better return on investment (ROI) in expected outcomes, but with a higher volatility of returns:

Expected Value of Option 1 = (100%*$5,500-$5,000)/$5,000 = 10% ROI

Expected Value of Option 2 = (30%*$20,000-$5,000)/$5,000 = 20% ROI

This is the classic risk vs. reward tradeoff in investing. If you are here and reading this blog, chances are you are already more tolerant of risk and seeking out higher returns than the average investor, so perhaps you did select option 2.

Now, there is a caveat to this question that we overlooked. If you could only invest in one, single investment that followed the returns of option 2, you would end up broke 70% of the time. That probably doesn’t sound appealing to most people.

And a 70% failure rate isn’t too far off from the actual startup investing failure rates that many Angel investors experience.

So why would anyone invest in an asset like that? And how do you take advantage of the higher expected value, as shown from the math, without a 70% chance of going broke?

The Key to Succeeding when the Odds of Failure are High

The answer – you need to place many, small bets on those types of risky assets. In a similar fashion to how casinos want to see many smaller bets to take advantage of their house edge, you want to spread your investments over many startups when the failure rates are high.

Over the long-term, your investments will (hopefully) then start to reflect the mathematical advantage due to the risk-reward tradeoff.

Understanding the higher risk and volatility is a crucial part of investing in equity crowdfunding. Especially since the asset is so different from traditional investments such as bonds, stocks, and real estate.

Let’s explore this concept of investor loss-aversion a little more and see how we can use this in our investment strategies.

Loss Aversion and Prospect Theory

While the previous example of investing $5,000 was fictitious, this illustrates how your brain reacts when comparing a lower risk-reward investment (e.g. bonds) with a higher risk-reward investment (e.g. private startups).

According to various studies, humans are prone to suffer from a behavioral bias called loss aversion. However, most people are not even aware of what it is or how it impacts their investment decisions.

Loss aversion describes how investors tend to experience much more pain from losses than they experience in pleasure from equivalent gains. In other words, losing $5,000 hurts a lot more (psychologically) than gaining $5,000 feels good.

This can lead to sub-optimal investment decisions, as shown in our previous thought experiment.

Loss aversion is a key concept associated with Prospect Theory, the result of the work of Nobel laureate Daniel Kahneman in 1979.

Prospect theory describes how humans weigh different options that involve risks (i.e. prospects), and how they perceive the expected outcomes of those options. When estimating perceived outcomes (often poorly), it was observed that we tend to value the potential losses and gains, rather than valuing the final outcome.

How does this play out in investing?

You probably haven’t heard of the disposition effect before, but I bet you (or someone you know) has fallen victim to it. I know that I have.

The disposition effect describes how investors tend to hang on to their losing stocks too long, while selling their winning stocks too soon.

In the context of Prospect Theory, this is when investors are over-eager to take guaranteed gains off the table as soon as possible (reducing perceived volatility), instead of taking a risk to let their winners run and get higher potential gains. And for losing stocks, they hang on with the hopes that stocks will rebound in price (thus reducing their painful losses), instead of cutting the cord and taking a sure loss.

Fortunately, when it comes to timing your sell decisions, equity crowdfund investors have some barriers inherent to the nature of startup investments that can unintentionally protect you from your psychological self. The illiquidity of startups means you can’t sell your equity shares whenever it pleases you, even if you need the money.

We will be getting into the specific risks, including illiquidity, in part 2 of equity crowdfunding risks next week.

What this all means for equity crowdfund investors

Risk-reward tradeoffs, loss aversion, prospect theory – what does all this mean for investors in equity crowdfunding?

Takeaway 1 – understand where the equity crowdfunding asset class fits in terms of your overall portfolio strategy.

As we saw with the risk-reward curves and asset-allocation, startups should be a part of an overall investment strategy.

As we saw with the risk-reward curves and asset-allocation, startups should be a part of an overall investment strategy.

In addition to practicing diversification among startups (spreading many smaller bets among many startups), the total allocation of startups and other high-risk investments should be a very small portion of your overall investment portfolio.

The current Regulation CF legislation imposes limits on non-accredited investors, and most Angels don’t recommend allocating more than 10% of your total investable assets to startups, especially when starting out.

Takeaway 2 – succeeding in investing is as much a psychological battle as it is a logical battle

I have always believed that psychology plays a crucial role in any investor’s success. After all, the markets and prices are based on supply and demand, and both of those are driven by humans and their beliefs.

Don’t just take it from me, though – here’s what one of the world’s greatest investors believes:

“The most important quality for an investor is temperament, not intellect.” -Warren Buffett

Thus, I encourage you to understand as much as possible about how your own mind works – including loss aversion – so that you can make better investment decisions. You won’t be perfect and won’t completely rule out emotions, but simply being aware can give you enough reason to pause and ensure that your lizard brain isn’t hijacking your life’s savings.

Next Post – Part 2, Specific Crowdfund Investing Risks

With a solid foundation of risk-reward tradeoffs and some investor psychology under your belt, we will next dive into the specific risks that are present in equity crowdfund investing.

Until next time, stay wise, and be sure to check out our free courses at CrowdWise Academy to learn more about investing in equity crowdfunding.

[…] we discussed in recent posts regarding risk versus reward, Jason says that if you don’t risk anything in your investments or in life, then you can’t […]