Part 4 – Deal Types in Equity Crowdfunding

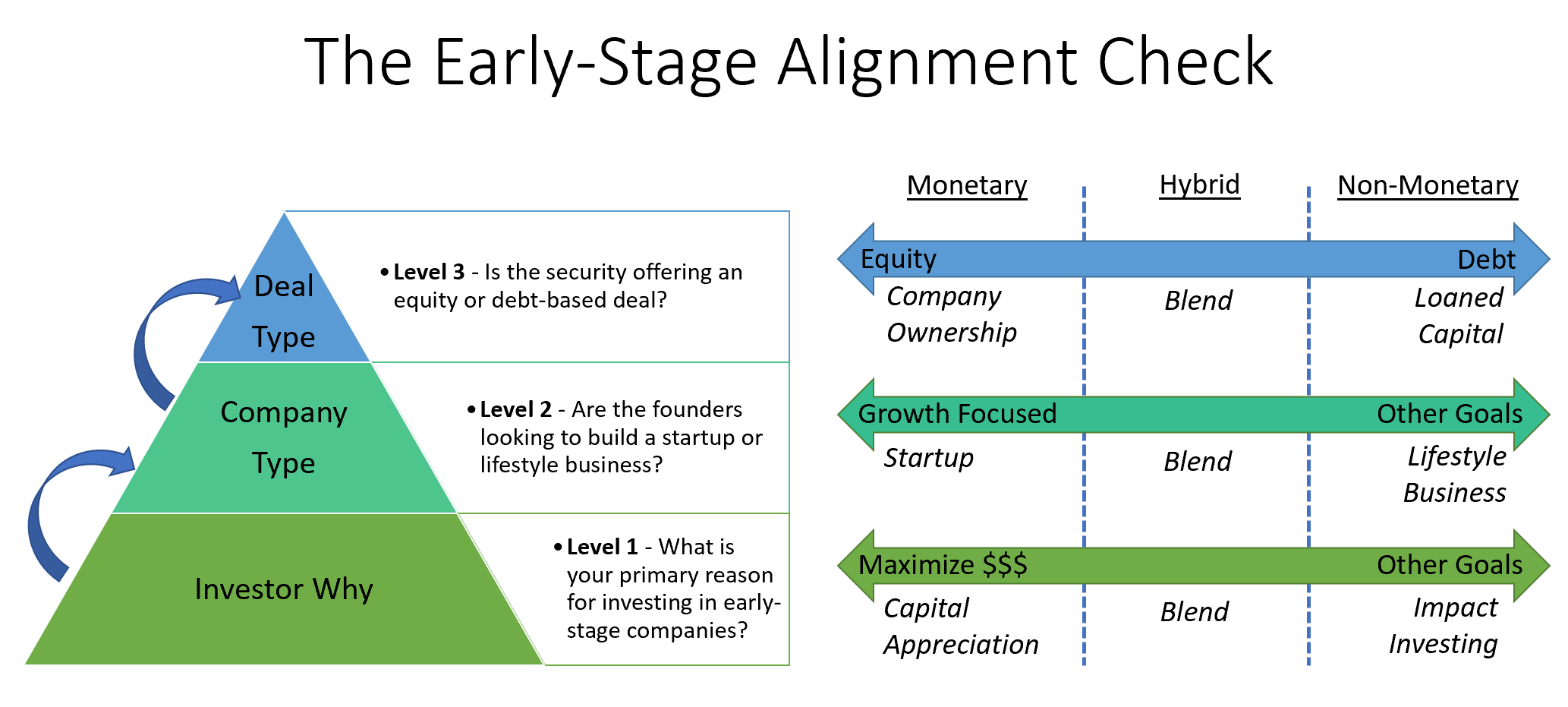

At this point in the equity crowdfunding investing 101 series, you have gained an understanding of what equity crowdfunding is, learned how to assess your personal investment goals, and discovered the different types of businesses that you can invest in. This brings us to the final step in the early-stage investment alignment check – the types of deals and offerings that you can invest in.

Assuming that you find a business that aligns with your investment goals, there is still one more critical aspect that you need to understand before you decide whether to invest.

That is the type of security (equity vs. debt) and deal terms being offered – which we will refer to as either the “deal” or the “offering”.

If the perfect company for your portfolio offers the wrong type of security, it could completely sabotage your investment. In certain instances, a company may even continue operating successfully for decades, but the wrong type of offering could prevent investors from ever seeing a single penny returned (these types of businesses – alive but not offering returns to investors – are referred to as zombies).

To ensure you understand the different types of offerings and which type is right for which company and investor, let’s dive in to the types of equity crowdfunding deals you will see.

Different Equity Crowdfunding Deal Types and Offerings

In the world of equity crowdfunding, not all deals are created equal.

In addition to the type of business, the next thing to consider for each investment is the type of deal or offering.

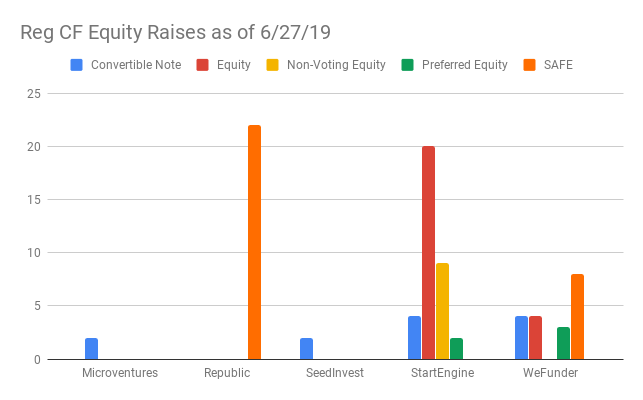

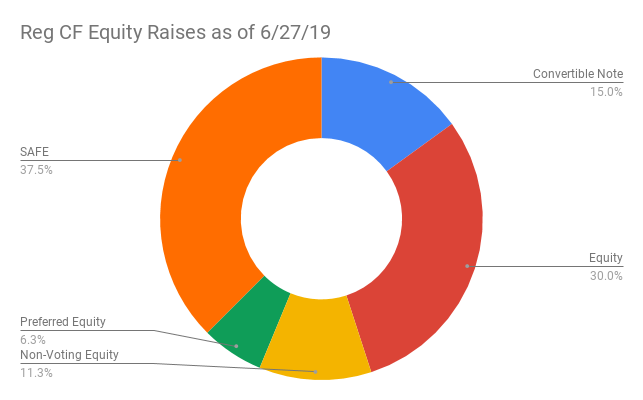

As of June 2019, here is the latest breakdown of deal types being offered across five of the top funding portals, obtained from EDGAR Form C filings and CrowdLustro. Note that some funding portals focus on a single type of offering – such as Crowd SAFEs on Republic – while others have more diverse offerings, such as those on StartEngine.

Different Deal Types for Different Investors

Not every type of equity crowdfunding offering will be suitable for every investor.

Investors who are not interested in capital appreciation could potentially invest based on the company’s credentials alone, disregarding the type of offering and deal.

That is because this type of investor treats the crowdfunding offering more like rewards-based crowdfunding, such as Kickstarter, where they are more interested in supporting the founder or company for altruistic reasons rather than getting a return on their money.

However, the type of deal and terms are critical for those of us who are looking to generate maximum returns on our money. And here at CrowdWise, we are interested in ensuring that each of you is making wise investments so that your money can grow.

For the investor who invests for altruistic reasons, wouldn’t it still be better to have your investments grow, so that you are able to support more companies you believe in and have an even greater impact?

Great Company but Wrong Deal Type

Let’s say you have found the perfect business by your investment standards. You believe in the product they are developing. They have an excellent team, proven traction, and seem like a great investment. You are ready to write them a check.

From a business perspective (level 2 of the alignment pyramid), you are ready to invest.

When you go to look at the type of security they are offering (level 3 of the pyramid), you find out they are offering a revenue-sharing note. This is essentially a debt-based vehicle that allows you to receive interest payments as the company generates revenue.

For someone who wants to generate a steady stream of income, this type of investment could be perfect. However, for an investor looking for high-growth potential – i.e. to get 10X or more on their investment and find the next unicorn – this deal would likely be a no-go simply due to the type of offering.

First, for income investors looking to add a steady stream of income to their portfolio, it is likely that you will find more reliable (and less risky) investments in assets other than early-stage companies.

Why would you settle for only 5%, even 10% interest on an early-stage company that has a 70% (or higher) failure rate? For the much higher risk that you are taking as an early-stage investor, you need to demand much higher premiums in order for the math to make financial sense.

Second, for an equity investor looking to maximize long-term gains, the limited upside of any debt-based note, such as a revenue-sharing note, means that your upside potential is capped.

And as we will see when diving into the math, the primary returns from early-stage companies are not from the “base-hits” in the sense of stock-market like returns, but from “home-runs” that offer 10X, 50X, and even higher returns, for those few companies that do exceptionally well.

This is why investors looking to maximize gains and invest in early-stage companies must seek out equity-based deals – and avoid debt-based deals – on equity crowdfunding platforms.

Investors will continue to invest in debt-based deals when they believe in supporting the company, the founder, the mission, or have other, non-monetary objectives. Just keep in mind that their reason for investing is non-monetary – or else they haven’t run the numbers.

On CrowdWise, we are going to make informed, data-driven decisions to help us make the best investment decisions we can for growing our portfolio.

Types of Deals in Equity Crowdfunding

While the most popular types of deals in equity crowdfunding are outlined below, it is important to note that every deal is unique. Always review the terms, since even the same type of investment – like a “preferred share” – can have many nuances to it.

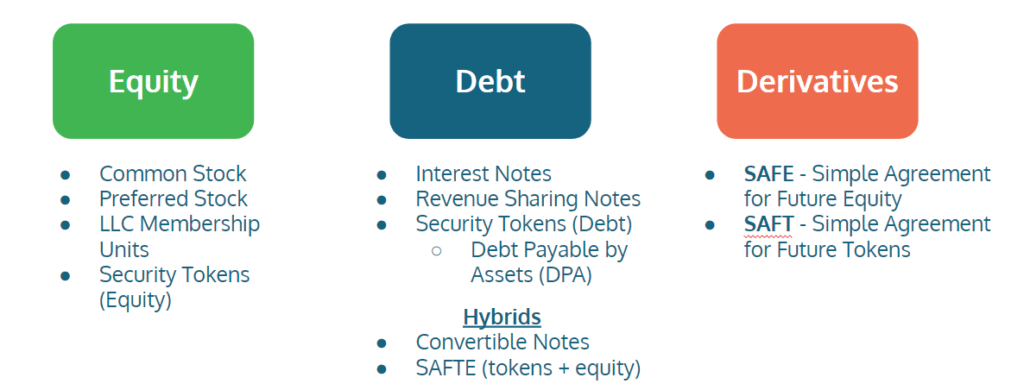

The primary types of equity crowdfunding securities are:

- Equity

- Common or Preferred Shares

- SAFEs (Simple Agreement for Future Equity)

- Debt

- Interest Notes

- Revenue Sharing Notes

- Hybrid

- Convertible Notes

- Tokens (Blockchain offerings)

- Coins or Tokens

- SAFT (Simple Agreement for Future Tokens), or SAFTEs (Simple Agreement for Future Tokens or Equity)

- Token DPA (Debt Payable by Assets)

Common or Preferred Shares are like owning stock in a company. These are a basic form of equity that give you a percentage of ownership in a company, like what the company founders hold. Preferred shares may offer additional benefits to investors. For example, preferred shares typically have a liquidation preference, meaning they are paid out in full prior to common shares if the company were to declare bankruptcy.

Example: 100 Shares of Preferred Stock at $1/share

SAFEs (Simple Agreement for Future Equity) are a newer security invented by the incubator Y-Combinator and intended to be a better alignment of values for both investors and startups. They typically will have a valuation cap and a discount rate, and will not have any interest or maturity date. Thus, they can be thought of as being like a convertible note with no interest rate or expiration date. An in-depth explanation and examples of SAFEs can be found on Y-Combinator’s website.

As of 2019, WeFunder also offers SAFEs that do not have a valuation cap or discount rate, but instead come with a Most Favored Investor clause. This is similar to a Most Favored Nation (MFN) clause in traditional angel contracts, and means that as they negotiate deal terms with other investors after the current round, you will get the best deal terms from those negotiations.

Example: $100 SAFE with a $5M valuation cap and 20% discount

Debt-based securities are simply an offering at a given interest rate and with a maturity date.

Example: $100 Note with 10% interest rate and 24-month term.

Revenue-Sharing Notes are essentially a debt-based vehicle that will pay you back an interest rate or multiple of your investment, but the payments will align better with company revenues. This means you could be paid back sooner or later than a typical debt-based note, depending on the company’s cash-flows.

Example: $100 Revenue-Sharing Note at 5% of revenues quarterly, with a 2.0X payback multiple (100% of principal plus 100% on top).

Convertible Notes are a type of hybrid debt/equity security that converts to either common or preferred shares during a liquidity event, and may include an interest rate and expiration date.

Example: $100 Convertible Note with a $5M valuation cap at conversion, 20% conversion discount, 6% interest rate, and 24-month term.

Tokens (or “coins”) are to blockchain companies what shares of stock are to equity companies. While Token sales (and their associated offerings, such as SAFTs, SAFTEs, and Token DPAs) will not be part of the initial scope of CrowdWise, it is important to recognize those offerings when you are screening deals.

Deal Type is Crucial for Both Investors and Founders

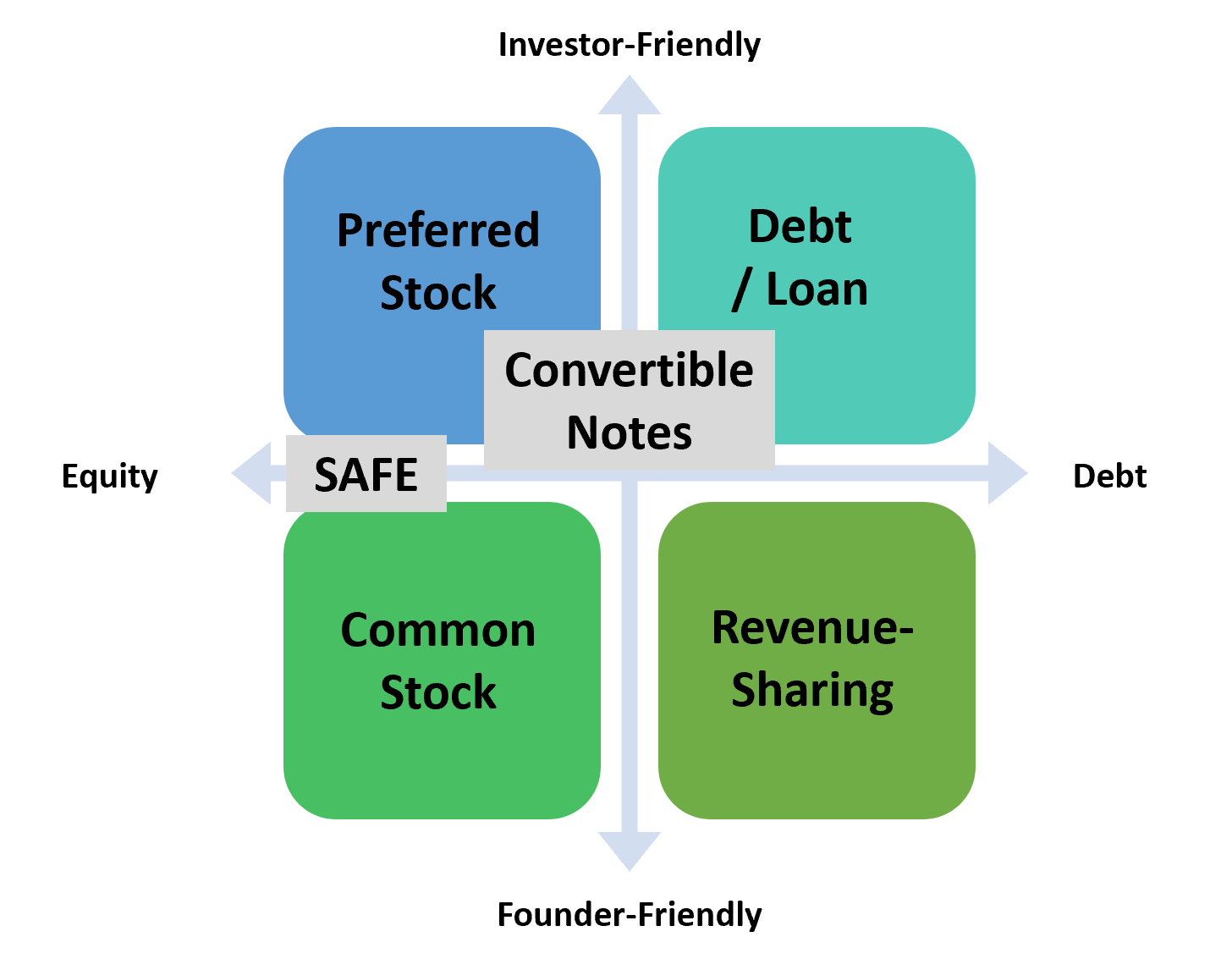

Just as you wouldn’t use a hammer to install a screw, you wouldn’t invest in a debt-based note if your goal was capital appreciation. The type of security being offered can be seen as a tool that will help you achieve your (and the founder’s) goals, so you need to be sure you are using the right tool for the job.

It is important to understand that each type of deal has different pros and cons for both the investors and the founders.

SAFEs were created by Y-Combinator in 2013 to be a better option for startup founders by lowering the legal fees and paperwork, and thus the cost of offering equity to investors. To achieve this, they removed the interest rate and maturity date, since in the startup world, investors are primarily looking for “home-runs” (10-100X and more), and don’t typically care for smaller returns of 5-10% on interest. Startup investors either want a massive return or nothing at all.

A SAFE offering is not a priced round, so valuation of the company does not occur at the time of the offering. In most of the current Reg CF offerings, you will invest in capped SAFEs (e.g. $5M cap, $15M cap, etc.). This ensures you are granted a reward in later priced rounds for taking a risk by investing earlier. That being said, two of the three top performing Reg D offerings on WeFunder have been uncapped SAFEs; thus, when a deal is “hot,” it doesn’t matter whether you pay $5M or $50M to get in on the next Uber. The key is to get access at all.

It was observed that interest-bearing vehicles, such as convertible notes, are sometimes the straw that breaks the camel’s back for startups that aren’t doing well. When convertible notes and other debt become due, if a company has not yet found product-market fit or reached profitability, all these liabilities can force them into bankruptcy. Even if success and product-market fit were right around the corner, that 5% interest rate for investors can cause them to fail. Thus, the SAFE – by eliminating interest payments – gives the startup the maximum chance of maximum success.

Revenue-sharing notes, since they allow the company to make payments that better align with their cash-flows, make it less risky for the business to pay back investors. However, that means investors may either get paid back earlier than expected, or could also be paid back much later than expected if the company is slower to start bringing in revenues to pay off debt.

The figure below is a matrix view of different equity crowdfunding offering types, ranging on the spectrum from investor- to founder-friendly, and from equity- to debt-based.

On CrowdWise, our primary focus will be on equity offerings. Debt-based offerings like standard debt notes and revenue-sharing notes will not be discussed in future articles.

Deal Term Terminology

In a future blog post, we will dive deeper into the various terms and nuances that you will see when analyzing a certain offering.

For equity-based deals, the most common terms you will see are:

- SAFEs

- Valuation Cap (or Most Favored Investor clause on WeFunder)

- Discount Rate

- Common or Preferred Stock

- Share Price

- Convertible Notes

- Conversion Discount Rate

- Interest Rate

- Maturity Date / Term

| Common Stock | Preferred Stock | Convertible Note | SAFE | |

| Ownership? | Yes | Yes | No | No |

| Voting Rights? | Yes* | No | No | No |

| Liquidation Preference | No | Yes | No | No |

| Interest / Dividends? | No | Maybe | Yes | No |

| Key Terms | Per share price, voting rights, transfer rights | Per share price, voting rights, transfer rights | Interest rate, conversion cap and discount rate, maturity date | Valuation cap and discount rate |

| Other Terms | Liquidation preferences, conversion terms | Repurchase rights, conversion terms | Repurchase rights, conversion terms |

*Although Common Stock may include voting rights, crowdfund investors are typically “minority holders” and thus delegate their voting rights to a proxy, such as the CEO

For reference, there is also another entire class of offerings available related to blockchain and cryptocurrency. Due to the complexity and differences between equity and token-based offerings, we will be limiting our discussions to equity (not tokens) to start.

Regulation Crowdfunding vs. Regulation A+ Offerings

In addition to the type of security being offered, it is important to note whether each offering you are looking at is a Regulation Crowdfunding (Reg CF) or Regulation A+ (Reg A+) deal.

Essentially, Reg CF allows a maximum raise up to $1.07M, while Reg A+ allows a maximum raise up to $50M. Thus, Reg A+ raises could be much larger rounds, such as Series A or Series B, whereas Reg CF would typically be considered something more like a pre-seed or seed round in traditional angel investing.

Understanding what type of deal you are investing in will be important for two reasons.

First, the SEC has two different limits for non-accredited investors in terms of how much you can invest in a Reg CF deal vs. a Reg A+ deal. Use our calculator here to see your Reg CF deal limit based on income and net worth.

Second, the potential risk and return may vary depending on the size of the deal. Typically, the earlier the investment (pre-seed and seed stage under Reg CF), the higher the risk but the higher the potential return.

We will be investigating historical data in more detail in future posts, but you can think of Reg CF and Reg A+ in the same way you might think of a Small-Cap and Large-Cap stock, respectively. Just remember that with early-stage investments, both Reg CF and Reg A+ are actually still much earlier and riskier than even Micro-Cap stocks.

Note: Some funding portals may refer to each type of offering using different names, but it is still the same thing. For example, StartEngine calls them OPOs (Online Public Offerings), where a Large OPO is Reg A+ and Small OPO is Reg CF.

Which Type of Investment is Right for You?

Depending on your investment strategy, you may decide you want to add an income component to your current portfolio, and so revenue sharing notes or debt may be your best option for investments (although we would suggest that similar interest rates could likely be found with a much lower risk in other investments).

For others who are looking to take advantage of the extremely high risk and extremely high rewards of early-stage investing, you are likely more interested in equity options, such as common or preferred shares, SAFEs, or convertible notes.

If you are investing for altruistic reasons in the company, product, or founder, then the deal type is not as important, since you are not concerned with financial returns on your investment.

Using Deal Types as a Preliminary Filter to Save Time

One great method to reduce the number of potential investments on your screening list is to use deal types (equity or debt) as a filter.

If I’m only interested in high-growth startups, then I should immediately remove any debt-only or revenue-sharing offerings from my list and not waste any time doing any research on those. Just be careful that I may still wish to look at hybrid offerings such as Convertible Notes, so check that the website and filter you are using are returning the desired results.

This is a great way to save your time and only look at the deals that truly meet your investment system.

Summary of Deal Types in Equity Crowdfunding

We covered the different deal types and securities that are offered in equity crowdfunding. You now have an understanding of what deal types align with your investment goals, and which types of deals are more desirable for either founders or investors.

Remember it is imperative to always read through the specific deals and terms for each investment, since even the same type of investment can have different terms added in or removed.

Similar to the business types discussed last week, no single security is superior to another. Each offers the investor something different, so you have to ensure the deals you are investing in align with your investment goals.

Since I am personally looking to maximize the financial returns of my portfolio, I only consider equity-based (or hybrid) deals when investing in equity crowdfunding.

Ready to get started?

In the final part of this series, we will discover where and how investors actually buy early-stage companies in equity crowdfunding. We will discuss what funding portals are, what the top funding portals are, and other important things to know before getting started.

We will also provide links to resources and helpful websites to help you get started investing.

Assuming you find a business and a deal that aligns with your investment goals, are you wondering what the steps are to actually screen a potential investment? Or how to determine how much you should invest in each deal? Or perhaps how to use each funding portal to find and invest in startups?

We will cover all of these questions and more in future blog posts.

For those of you who prefer a more organized method to their learning – rather than scraping through all the blog posts – we also offer free investor mini courses through our CrowdWise Academy.

Click here to learn more about CrowdWise Academy for investors

Lastly, be sure to follow our blog to get the latest and greatest blog posts on equity crowdfund investing delivered right to your email inbox. You can follow the blog using the subscribe link on our homepage or at the top of any blog post in the sidebar.

——————–

This is Part 4 of a five-part series to provide a brief introduction to equity crowdfunding.

[…] K-1’s are only issued to partners who own equity (i.e. shares). If you invested via a SAFE, Convertible Note, or any other instrument that hasn’t yet been converted to equity, then you won’t be receiving a K-1 for that […]

[…] Not at all! Of course they want to be profitable (who doesn’t!?). They can successfully return money to investors via revenue-sharing, debt, or some other types of deals. […]