Checking for Investor, Founder, and Deal Alignment in Equity Crowdfunding

When looking at any equity crowdfunding deal, it is crucial to ensure that the goals of the investor, the company, and the offering are aligned.

Experienced investors who have screened hundreds of early-stage deals can quickly assess whether or not a deal aligns with their specific investment objectives.

However, for investors new to the world of early-stage investing, how do you know whether a deal is a good fit for you?

Today, we will break down the step-by-step approach that I personally use to assess whether an investment is right for me, before I decide to further assess whether it is a good investment or not.

This can be a tool to help quickly eliminate misaligned deals from your screening list, leaving you with more time to research the deals that do align with your investment goals.

Why Should I Care? The Importance of Alignment

At one point or another, we have all been on a team that had a crystal clear vision. On those teams, everyone marches to the same drumbeat. Little effort is wasted on issues that don’t directly contribute to the mission. Everyone knows their role on the team. Prioritization happens naturally – since everyone understand the ultimate objective – and the team is highly efficient and productive.

At one point or another, we have all been on a team that had a crystal clear vision. On those teams, everyone marches to the same drumbeat. Little effort is wasted on issues that don’t directly contribute to the mission. Everyone knows their role on the team. Prioritization happens naturally – since everyone understand the ultimate objective – and the team is highly efficient and productive.

It’s no surprise that many articles and books tout the importance of having clear, meaningful objectives to have a successful and high-performing team.

On the flip side, we have all been on a team where there was no clear vision or objective. Significant time and energy are wasted on debating subjects that may not even contribute to the end-goal, and it can seem like every day is an uphill battle.

When you invest in an equity crowdfunding deal, you are becoming a part of the team that you invest in. While you may not be part of the physical team that designs or sells the product, you are providing capital to help them achieve their mission.

The criteria that you – the investor – have for success, and the criteria that the company has for success could be very different. Does success mean changing the world at all costs? Or does it mean maximizing growth and investor returns at all costs, even if that means abandoning the original product or idea?

Founders will have many important decisions to make along the road to success. How they weigh their options and make decisions will depend on their vision for the company, not yours.

Thus, it is crucial that your own goals are well-aligned with the founders’ goals in early-stage investing, as well as the deal structure of the offering.

Alignment Questions Every Investor Should Ask

Alignment of objectives will lead to better odds of success for both the investor and the company. Examples of some of the questions you may ask include:

Investor questions: are you, as an investor, mainly interested in supporting companies that positively impact your local community? Or are you more interested in maximizing capital appreciation and returns for your portfolio?

Company/Founder questions: is the company aiming to be the next Facebook or Google, putting growth above all else? Or are they dedicated to serving a few, small communities, and keeping their brand small and their growth more manageable?

Deal/Offering questions: is the deal structured in a way that will give investors equity in the future success (or failure) of the company? Or are they offering a debt-based deal that will be paid back over time with interest?

These are the types of questions you should ask before investing in any early-stage deal. Each company that you assess will likely lie somewhere on a spectrum for these questions, and no two companies will be alike.

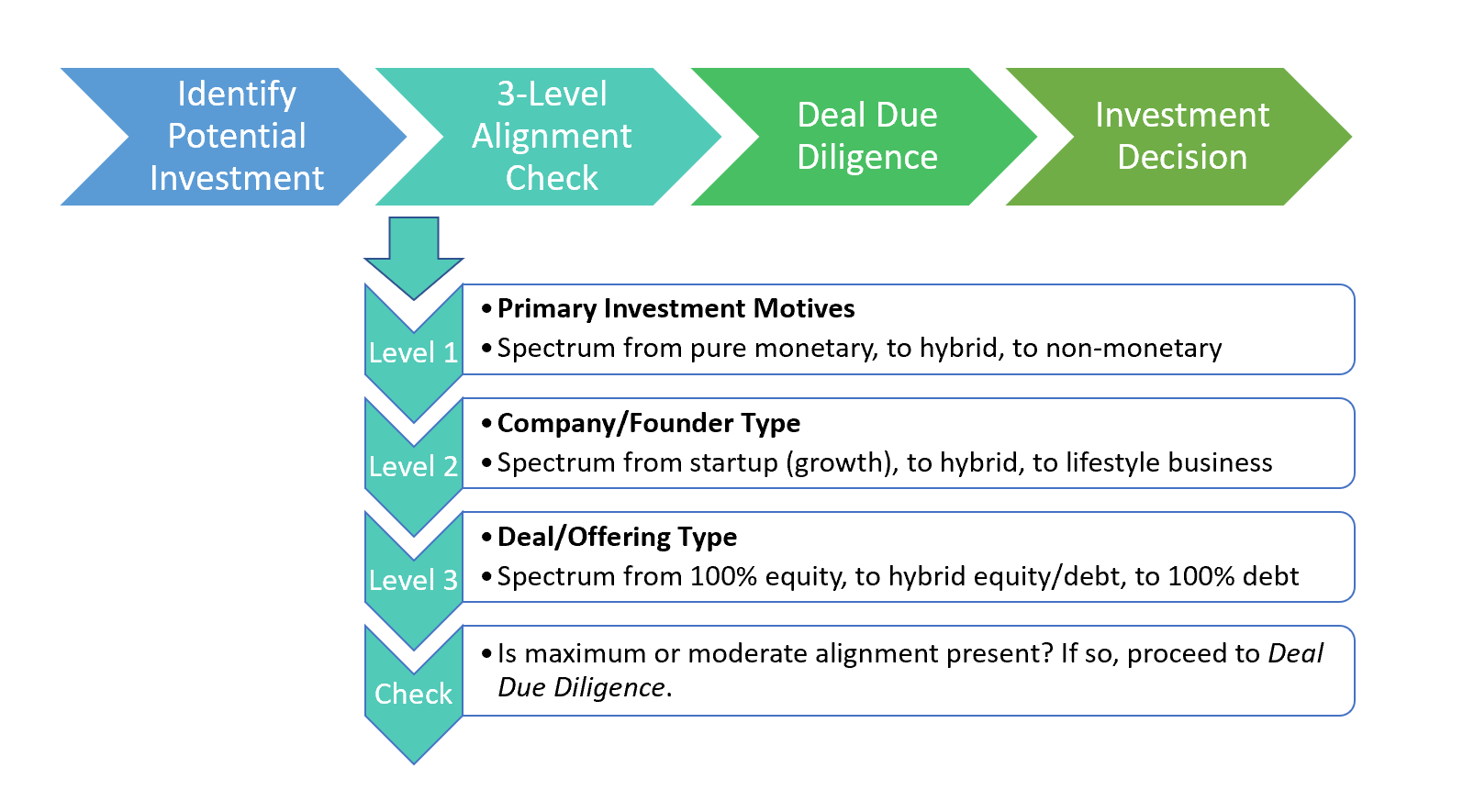

To help put a framework around these questions and provide a step-by-step approach, we organized these questions into the three-level alignment check.

The Three-Level Alignment Check for Early-Stage Investments

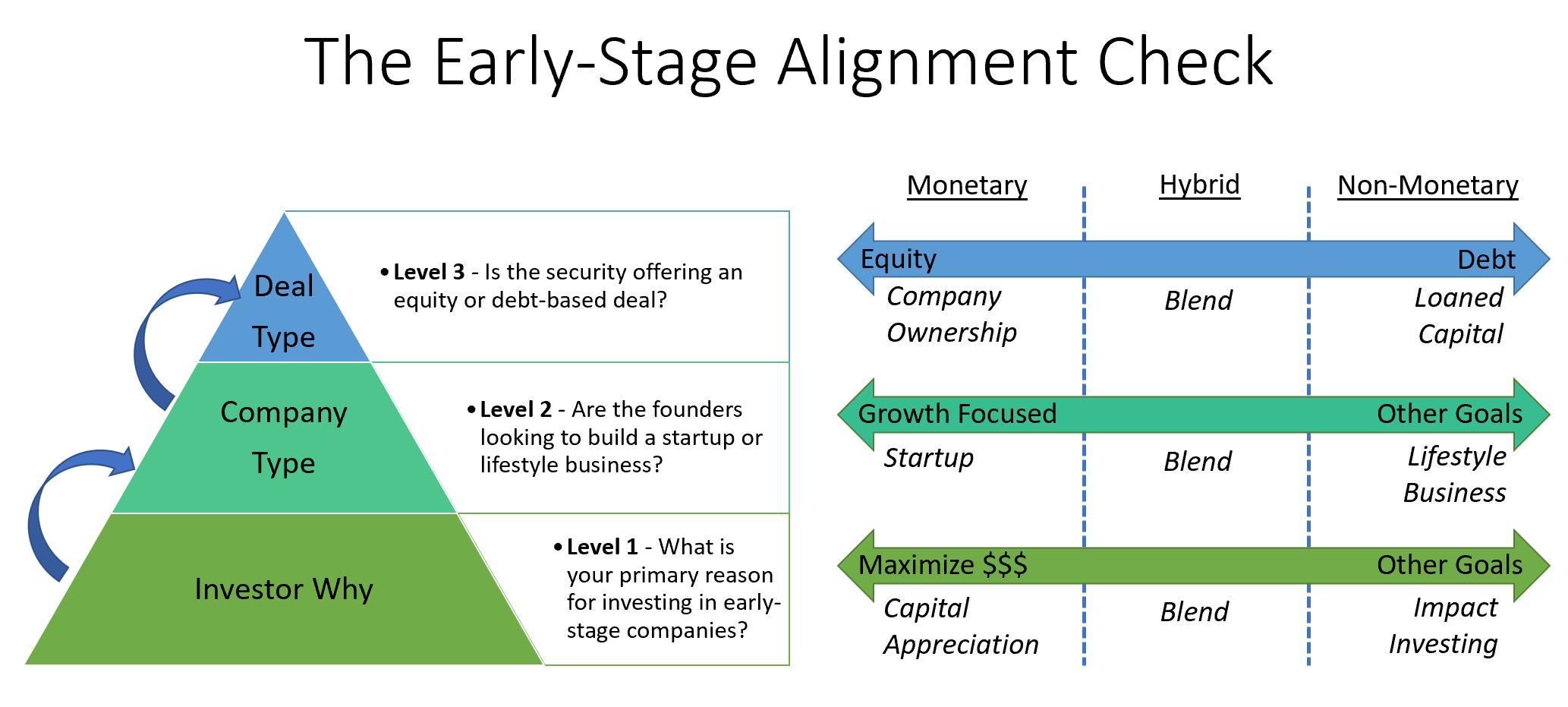

The investor, the company, and the offering make up the three levels of the alignment check pyramid.

The three levels of the early-stage alignment check are:

- Level 1: Investor’s Why – your primary reason for investing (Part 2 of the introduction series – Four Key Reasons to Invest in Early-Stage Companies)

- Level 2: Type of Company – the type of company the founders are building (Part 3 of the introduction series)

- Level 3: Deal Type / Structure – the type of deal and terms of the security offering (Part 4 of the introduction series)

For each potential investment, work your way up the pyramid and assess each element along the alignment spectrum on each level.

Using the Early-Stage Alignment Pyramid

It is important to start on level 1 of the pyramid with your personal investment motivations. If you don’t know your own goals or reasons for investing, any investments that you make will be a shot in the dark in terms of what the potential outcomes will be.

Starting on the lower level and working your way up prevents you from wasting your time. For example, starting out by looking at the type of deal being offered (on level 3) makes no sense if you have not yet looked at the type of company or your reason for investing. You may eliminate certain deals just by noticing that the company (level 2) doesn’t align with your goals, and so you won’t even care what type of security (e.g. common shares) the company is offering.

On each level, there is a corresponding spectrum that ranges from monetary gains as the primary focus, to non-monetary gains as the primary focus. Maximum growth and capital appreciation are represented on the left of each spectrum, while goals other than maximum growth and capital appreciation are represented on the right.

For each level, you should locate where along the spectrum you believe each potential investment lies before moving on to the next level.

How to Interpret the Early-Stage Alignment Check Diagram

After assessing where on each spectrum a certain deal falls, you will see three different outcomes that can indicate whether there is alignment on a particular investment opportunity.

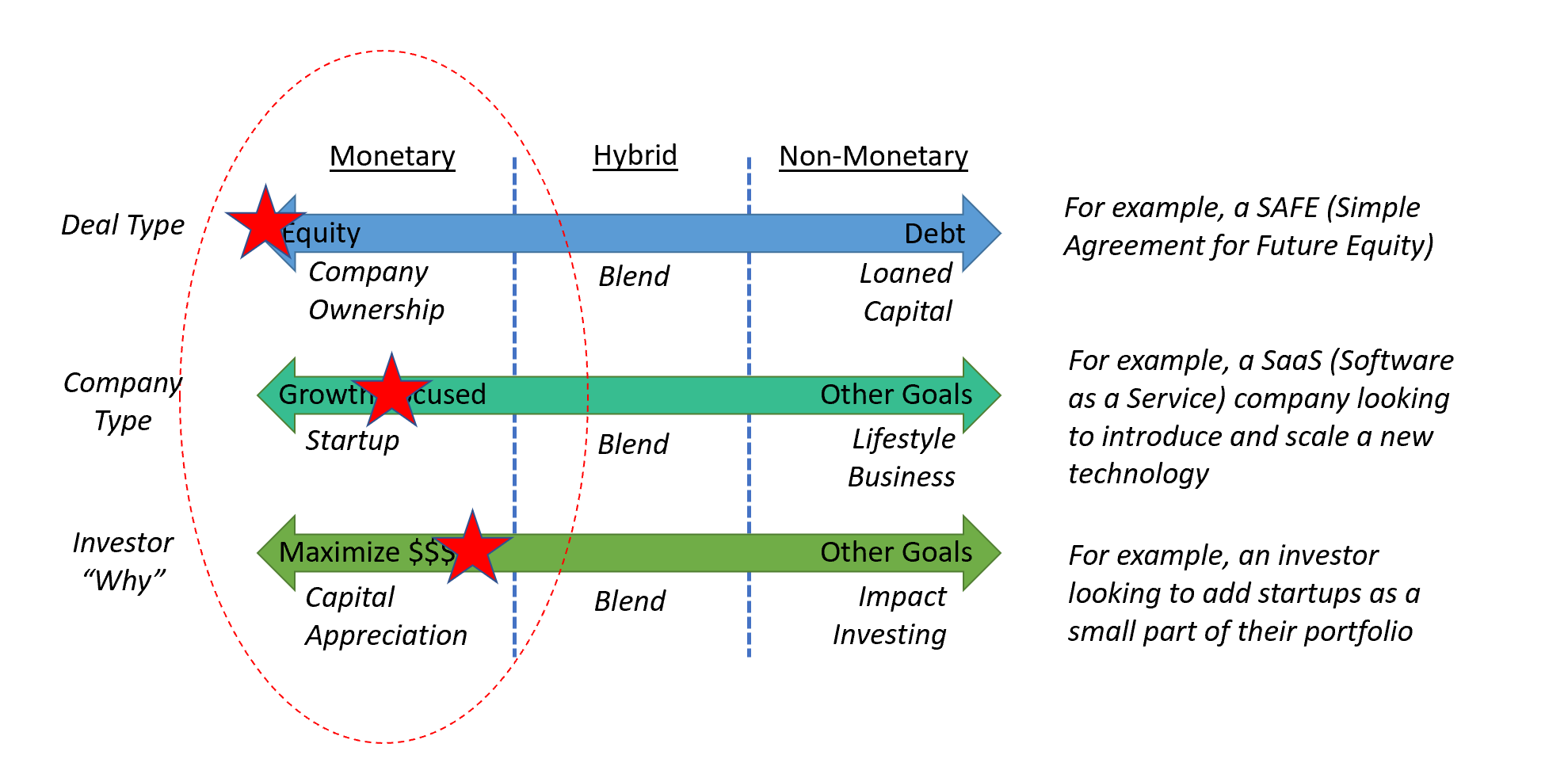

Maximum Alignment

First, maximum alignment will have check marks all within the same third of the spectrum on each of the three levels. This indicates that founder/investor/offering alignment is present, and you can confidently move on to due diligence to determine whether this is a good investment or not.

Note: it does not matter which of the three focus segments (monetary, hybrid, or non-monetary) the evaluations fall under, as long as they are all within the same third.

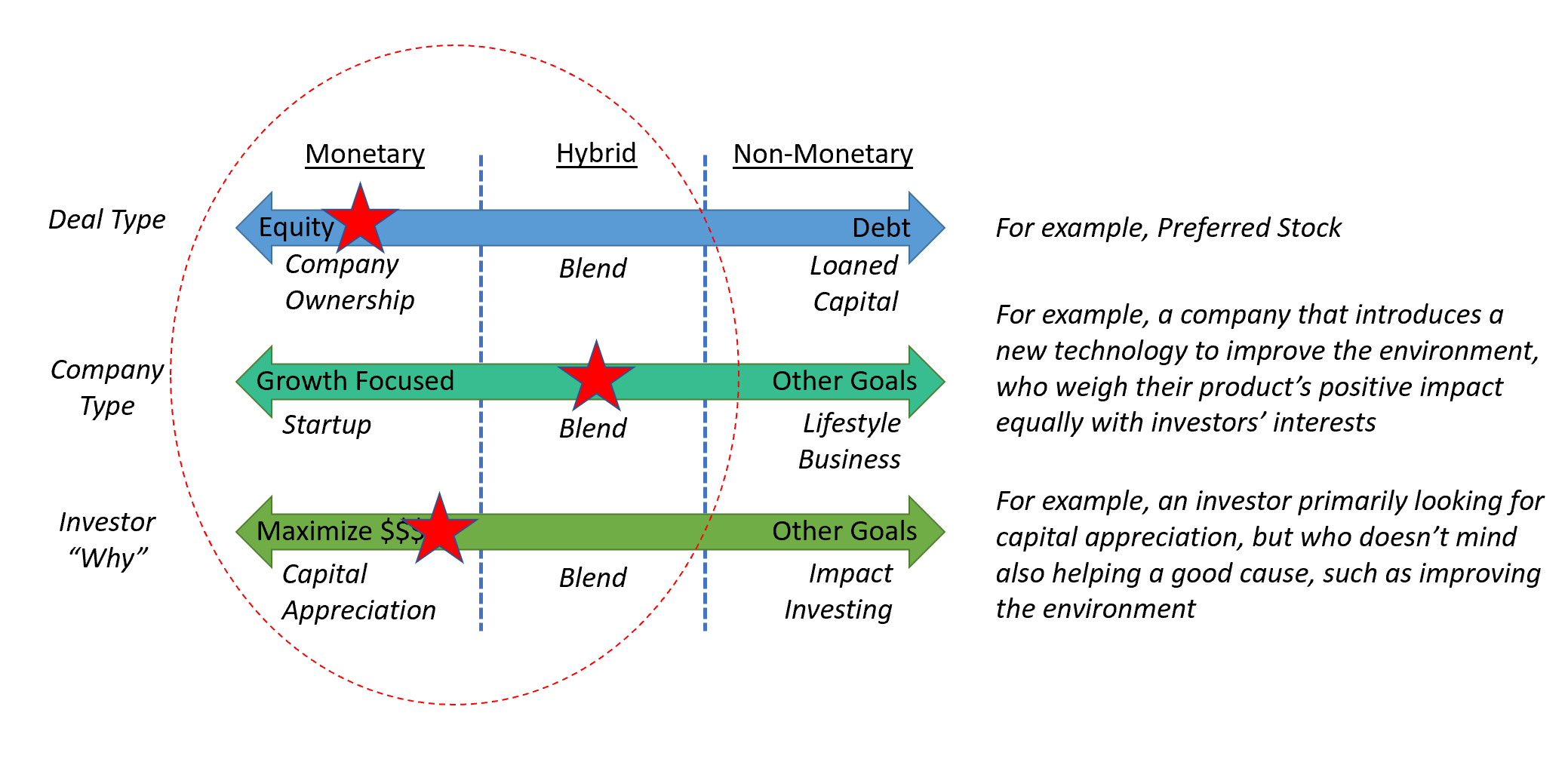

Moderate Alignment

Second, moderate alignment will have check marks between two adjacent thirds of the spectrum. This indicates there is relatively good alignment, but you should keep this in mind as you move on to detailed screening and due diligence. You may uncover more evidence as you do a deeper dive that convinces you that there is good alignment (or not) with the founders and deal structure.

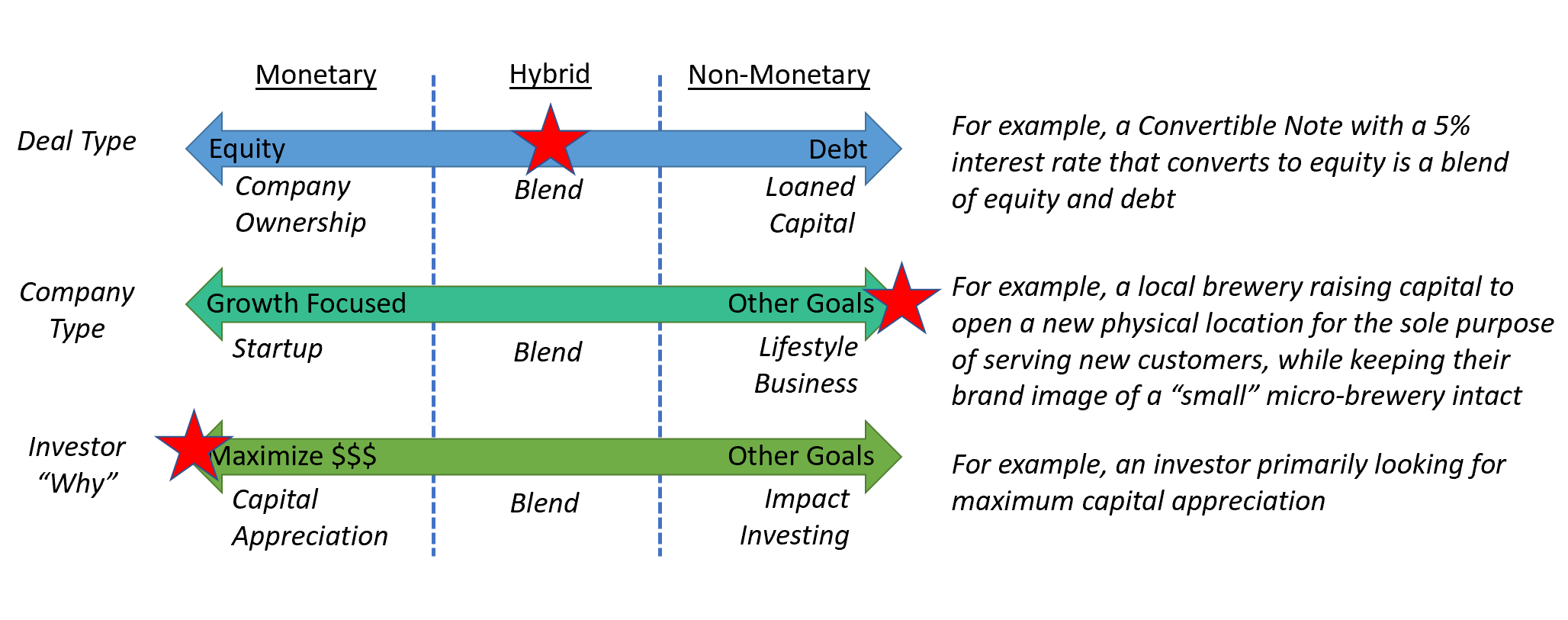

Poor Alignment

Lastly, misalignment is indicated when there are check marks on any level that are on opposite extremes of the spectrum. This indicates you should likely stop right here in your research of this investment opportunity, since the company or deal type is not aligned with your personal investment motives.

How and When to use the Early-Stage Alignment Check

When starting out investing in equity crowdfunding, we recommend doing the alignment check for each of your potential investments. As you repeat the process and begin to recognize the types of companies and deals that align with your personal investment motives, you will then begin to make quicker assessments up front whether a particular deal is aligned with your interests.

We recommend doing the alignment check first thing when looking at a new potential investment. If you discover the type of company and/or the deal are not aligned with your investment goals, you can prevent yourself from wasting any more time researching the company and move on to the next potential investment.

How: the Step-by-Step Process for Checking Alignment

The steps of the early-stage investment alignment check are:

- Identify a potential early-stage investment that you are interested in.

- On Level 1 of the diagram, indicate where on the spectrum – from monetary, hybrid, to non-monetary – your primary reason(s) for investing lie.

- On Level 2, indicate where on the spectrum – from startup (growth), hybrid, to lifestyle business – you believe the founders’ visions for the company lie.

- Assuming that Level 2 and Level 1 do not lie on opposite ends of the spectrum, continue on to Level 3. If Level 1 and 2 lie on opposite ends, this deal is likely not a good fit for you.

- On Level 3, indicate where on the spectrum the type of offering lies, from equity, hybrid, to debt.

- Compare the spectrum on all three levels to determine whether you have maximum, moderate, or no alignment between the investor, founder, and offering.

- If there is alignment, proceed with doing a deep dive and due diligence on whether the opportunity actually is a good investment or not. Remember that all you have determined so far is whether or not there is alignment of objectives, not whether this is a good investment to make.

Identifying Investment Opportunities and Deal Due Diligence

You now have a method for determining whether founder/investor alignment is present.

However, what about finding deals in the first place? Or once you have determined there is alignment, how do you perform due diligence to assess whether the opportunity is actually a good investment?

We’ll be covering both of these topics in future week’s blog posts.

Do you prefer a more structured learning style? Perhaps you like online courses more than reading blog posts?

If you’d like to get access to the free investor courses we are putting together on CrowdWise Academy, sign up at the link below or use the “Sign Up” link in the navigation menu.

Learn more about free investing courses

Also, follow our blog by signing up in the footer below to get the latest blog posts on equity crowdfund investing delivered right to your email inbox as soon as they are published.

Responses