Part 3 – What Type of Company Should You Invest In?

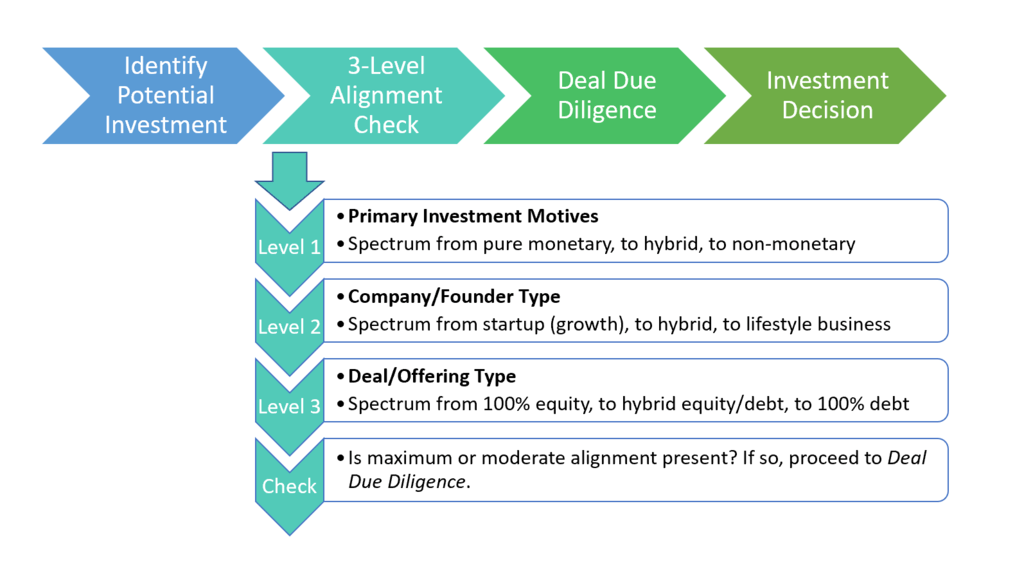

Until you have significant experience investing in equity crowdfunding, the first step in evaluating a deal should never be to try to calculate the proper valuation, estimating potential return on investment, assessing the product and market, weighing risks, or anything else as part of due diligence. The first step of any investment decision should be determining whether the company and the offering align with your personal investment goals.

Today, we will discuss the second level of a three-level early-stage investment alignment check: the types of companies and founders, and which ones you should (or shouldn’t) be investing in.

In the previous post of this series, you learned how to evaluate your personal motivations for investing (Level #1 in the above diagram). Let’s now look at the various types of businesses (Level #2) and their key differences. Next week, we will look at the third and final level, the types of offerings (Level #3) that you will see on equity crowdfunding platforms.

Startup vs. Lifestyle Businesses

As an early-stage investor, you will come across two types of companies in the private market for equity crowdfunding. They are classified as either high-growth startups or lifestyle businesses.

While I personally made this mistake when starting, it is important to remember that not every newly-formed company is necessarily a “startup”.

Startups Focus Primarily on Growth

Startups are those businesses that are focused on growing and scaling as fast as possible, with the hopes of becoming large enough to either hold an Initial Public Offering (IPO) or to be acquired by another company. Some popular examples of successful startups over the past decade include Uber, Twitter, Facebook, WhatsApp, Dropbox, and Airbnb, but there are thousands more that you have never heard of.

Startups are those businesses that are focused on growing and scaling as fast as possible, with the hopes of becoming large enough to either hold an Initial Public Offering (IPO) or to be acquired by another company. Some popular examples of successful startups over the past decade include Uber, Twitter, Facebook, WhatsApp, Dropbox, and Airbnb, but there are thousands more that you have never heard of.

In order to achieve maximum growth, startups often take on capital from outside sources, such as Angel Investors, Venture Capital firms, and now equity crowdfunding.

When faced with tough business decisions, startups will typically make the decision that best serves their investors for maximum growth. In some extreme examples, this decision could even mean abandoning the original product to pivot to another product or service seen as offering more growth potential.

As Paul Graham, co-founder of the popular accelerator and investment firm Y-Combinator, said in his article Startup = Growth, “The only essential thing [of startups] is growth. Everything else we associate with startups follows from growth.”

Lifestyle Businesses Focus on Areas Other Than Maximum Growth

Lifestyle businesses, in contrast to startups, typically aim to provide their founders with a job that allows them to live a more balanced lifestyle. These businesses can still be very successful and profitable for investors, but may not aim to maximize investor returns at every opportunity.

Lifestyle businesses, in contrast to startups, typically aim to provide their founders with a job that allows them to live a more balanced lifestyle. These businesses can still be very successful and profitable for investors, but may not aim to maximize investor returns at every opportunity.

Founders of lifestyle businesses must still consider their investors when making business decisions; however, they may make decisions that best serve their founders, their existing customers, or even the world at large, which sometimes means turning down opportunities that could lead to maximum growth.

An extreme example of this would be a business so dedicated to improving the world via the product and mission that they originally set out to achieve, that they consciously chose to not pivot to a more lucrative product that they stumble upon.

Lifestyle businesses can stay in business for decades, but never have an exit, such as an acquisition or IPO. This is generally bad for equity investors, since exits are the necessary liquidity events where investors are rewarded and paid for their early investments.

Lifestyle Businesses Can be Extremely Successful

Alternatively, lifestyle businesses can still be wildly successful. Just because a business founder chooses to pursue something other than maximum growth does not mean that explosive growth cannot still occur.

One popular example of this is MailChimp. Although they could technically be classified as a lifestyle business based on the fact that they are wholly owned by the two co-founders without ever taking on any outside funding, they still have experienced explosive growth in recent years. In 2017, MailChimp reported $525 million in annual revenue, up from $400 million in 2016 – a feat that many startups would be ecstatic to achieve.

One popular example of this is MailChimp. Although they could technically be classified as a lifestyle business based on the fact that they are wholly owned by the two co-founders without ever taking on any outside funding, they still have experienced explosive growth in recent years. In 2017, MailChimp reported $525 million in annual revenue, up from $400 million in 2016 – a feat that many startups would be ecstatic to achieve.

However, that didn’t happen overnight. MailChimp’s success has been nearly two decades in the making, since they were founded in 2001.

Thus, while determining the type of company – and thus, the type of decisions the founders will make at critical junctures – is important, it does not mean that lifestyle businesses cannot still be lucrative investments for their backers.

However, as a general investment strategy, which would you prefer when trying to maximize gains – a company always looking to maximize growth, or a company that may pass on growth opportunities in lieu of other social or product objectives? Different investors will have different answers to this question, which is why it is crucial to understand your own personal motivations for investing in early-stage companies.

The Startup-Lifestyle Spectrum

Most companies that you come across will likely not be 100% growth focused or 100% lifestyle, but a blend somewhere in between the two extremes.

You can think of each early-stage company as lying along a startup-lifestyle business spectrum. Some companies may be focused 100% on growth (pure startup), while others may be dedicated to providing a balanced life for the founders (lifestyle business), while others may lie somewhere in the middle.

Ask yourself: where do I believe the founder’s vision for the company is along the startup-lifestyle spectrum?

Do you think the founder is looking to build the next Facebook or Google (i.e. startup)? Or are they more family-oriented, customer oriented, even employee oriented, and looking for a more steady and balanced growth (lifestyle business)?

Other Company Considerations

In addition to determining whether the company is a high-growth startup or a lifestyle business, there are a few other questions to ask when looking at a potential investment to better understand how it fits (or doesn’t fit) into your portfolio.

Question 1: is this a capital efficient or capital intensive business?

While companies will vary in terms of their business models and goals, early-stage investors will sometimes further categorize companies into two sub-groups based on capital efficiency. That is, whether the founders are running a capital efficient or capital intensive business.

A capital-efficient business requires relatively less capital up-front to initially build and scale a business.

For example, SaaS (Software as a Service) companies are common examples of being capital efficient. This is because they can prototype and iterate software code relatively quickly. It is generally much easier to write and test code than it is to get a physical product manufactured, assembled, and tested. The cost of modifications and re-design are also typically much lower.

The cost and speed of scaling is also more favorable for a capital efficient business.

Once a software company finds product-market fit, the incremental cost and logistics to scale from 1,000 users to 1,000,000 users is much, much less than scaling in a similar way for a hardware company.

For example, scaling from 1,000 widgets to 1,000,000 widgets means the additional cost of goods that go into those widgets, not to mention logistical and supply chain challenges, the time and costs associated with manufacturing the additional widgets, etc.

A capital-intensive business requires relatively more up-front capital to initially build and scale a business.

This could be a business requiring significant research and development, such as a pharmaceutical or food company developing a new drug or supplement and requiring FDA approval. Another example is a business that has high higher costs for prototyping and building a physical good, such as designing an expensive satellite system. Besides all the certifications and the cost of the physical hardware, the potential cost of failure is much higher since you only have one chance to have a successful launch. Thus, more is invested up-front to mitigate these risks.

Capital-intensive businesses can still be hugely profitable for investors when all goes well, but may require more up-front capital to help scale or achieve that initial success. This could mean more potential dilution for early investors compared to capital efficient businesses, due to all the additional capital being required during additional funding rounds.

Both capital efficient and capital intensive businesses can be good investments. It is important to understand the differences so that you can properly evaluate the offering and decide whether it is an investment that meets your portfolio requirements.

Question 2: is this a B2B or B2C business?

Another important consideration that will help you in understanding the potential market for a business is whether they are B2B (business to business) or B2C (business to consumer) focused.

B2B companies market and sell their products to other companies, while B2C companies will market and sell to consumers.

Again, neither of these is necessarily better than the other – although some studies indicate that the top 100 B2B investments outperformed the top 100 B2C investments – but they both require different skills to succeed, different approaches, and have different pros and cons.

Thus, as an investor you should understand who their target customers are so you can understand the market potential for the product, as well as assessing whether the team has past B2B or B2C experience.

Case Studies – the Lifestyle Business and the Startup

Lifestyle Business – An Investment for Shapers and Believers, not for Maximizing Financial Returns

Let’s assume a local restaurant is raising funds. It’s been a family-run business for 60 years, and the founders are looking to raise funds to renovate the restaurant and open several new locations over the next 5 years.

Let’s assume a local restaurant is raising funds. It’s been a family-run business for 60 years, and the founders are looking to raise funds to renovate the restaurant and open several new locations over the next 5 years.

They are raising on an equity crowdfunding platform and their pitch deck has shown some great traction and interest in the new locations. After your due diligence, it seems all the financials line up and indicates a good probability of success for opening the new locations.

Should you invest?

The answer is that it depends on your motivation for investing. Are you investing purely for capital appreciation? Or are you investing because you believe in the company, the founders, the restaurant, and want to support them regardless of financial returns?

Ask yourself the founder question: what do I believe the founder’s vision for the company is?

If you look at their vision of opening a few new locations over the next five years, it is highly unlikely that just opening those new locations in that time frame would make them large enough for a lucrative acquisition or an IPO.

Does the fact that they only want to open a few locations in the next few years mean they don’t care about being profitable?

Not at all! Of course they want to be profitable (who doesn’t!?). They can successfully return money to investors via revenue-sharing, debt, or some other types of deals.

However, from an equity investor’s perspective, they are more likely to grow at a slower and more manageable rate. This means if this company was offering an equity-based deal, you should seriously consider the possible ways, if any, that they would become an acquisition target or hold an IPO.

Now, if they pitch they are opening five new locations in the next 9 months to test out their franchising model, with a plan to open several hundred stores in the next five years, that may indicate more of a desire to focus on growth, leading to something that could be a lucrative exit for equity-based investors.

This is one reason why it is crucial to ensure your investment goals are aligned with the visions of the founders. As we’ll discuss next week, the type of offering (e.g. equity vs. debt) must align with the type of company.

Startup – The Investment of Choice for Maximum Capital Appreciation

High-growth startups seek capital to help them find product-market fit and then scale as quickly as possible to reach profitability. Often, these early-stage startups are not yet profitable, and may not have revenue or current customers.

Let’s say that a company is developing a new iPhone App to help sell last-minute airplane seats. It’s essentially a platform that puts buyers of last-minute plane tickets in contact with people who can’t make their flights last minute, in a similar fashion to Airbnb.

Their initial software prototype has shown good interest among customers and the airlines. The founders want this to be available on every airline and airport across the world, and they are willing to pivot to different ideas to find success. For example, perhaps airline regulations and last-minute changes for seats due to security proved too tough a challenge, so they pivot and offer their apps for buying and selling last-minute train or bus tickets.

This would be a good example of a capital-efficient startup. To pivot and change their app code from applying to airlines to instead buses or trains would not be the end of the world. And the founders are focused primarily on growth, since they are willing to pivot and abandon their original idea for something that offers more potential.

The question is, could startups like Facebook, Google, Uber, and others have gotten to where they are today without raising capital? Perhaps, but definitely not within the same amount of time! The cases where businesses grow and scale rapidly without raising capital – like MailChimp – are exceptions and not the norm.

While anything is possible in the world of startups, everything moves quickly. The saying “time is money” couldn’t be more applicable to early-stage companies, especially those that aren’t yet profitable. More importantly, time is a crucial factor for maximizing investor returns.

Why Faster Growth Means Higher Financial Returns

From an investment perspective, time has everything to do with your potential Internal Rate of Return (IRR). That is why startups, which focus on maximum growth, provide the best potential returns to investors.

Let’s say there are two identical companies, except that one is a startup and returns 10X your investment in 5 years, while the other business had more steady growth and returns 10X your investment in 10 years. (Side Note: 10 years could still be considered typical, even for a startup!)

The startup that gave you a 10X return in 5 years works out to a 58.5% IRR. This is a much higher return than a company that gets you the same 10X your money but in 10 years (25.9% IRR).

Achieving the same multiple returns in half the time doesn’t mean you would have just doubled your investment with the startup. If you extrapolated that 58.5% growth rate over the same 10 years it took the lifestyle business to reach 10X, you would have made 100X total – 10X more than the lifestyle business!

Thus, for investors looking to generate maximum returns on their early-stage investments, startups are the types of businesses you should primarily invest in.

This does not mean that lifestyle businesses will not be profitable or turn into larger companies. But remember, time is everything in your rate of return calculation. From an investor’s perspective for maximizing returns, the goals of the founders are better aligned for startups compared to lifestyle businesses.

Summary of Equity Crowdfunding Business Types

We covered the differences between the types of companies – high-growth startups vs. lifestyle businesses – as well as some other considerations when looking at different companies.

We learned that no two companies are alike. Each founder has a unique vision for their business, and this lies along a spectrum from 100% growth-focused to having many other types of goals.

Also, one type of business is not necessarily superior to another. Each offers the investor something different, so you should ensure the companies you are investing in align with your investment goals.

Lastly, it is worth mentioning that the business entity you invest in – whether it’s structured as a Limited Liability Company (LLC) or a C Corporation – can impact your annual taxes. So always do your research before investing in a deal, even if it’s only for $10.

No Two Deals are Created Alike

In Part 4 of this series, we will discover that no two deals are created alike, either. Assuming there are two companies who are exactly identical in their business models, we will learn that there are still numerous different options for how they raise funds on equity crowdfunding sites.

As an investor, this is critical to understand since it means you not only need to assess the type of business, but also the type of deal before investing.

Interested in Learning More?

Assuming you find a business and a deal that aligns with your investment goals, are you wondering what the steps are to screen a potential investment? Or how to determine how much you should invest in each deal? Or perhaps how to use each funding portal to find and invest in startups?

To help address many of these critical questions, we have put together a completely free mini-series of courses to dive into some of the most commonly asked questions and topics to take the next step in investing.

If you’d like to get access to the free investor courses at CrowdWise Academy, enroll here or click the “Sign Up” link in the navigation menu.

——————–

This is Part 3 of a five-part series to provide a brief introduction to equity crowdfunding.

Responses