IRR and Exit Math in Startup Investing and Equity Crowdfunding

When screening for startup deals to invest in, regardless of whether it’s equity crowdfunding or traditional angel investing, how big of an exit should you be aiming for? For example, will a 3X return be considered a success? And how does the time to exit get factored into potential returns?

Also, is there a difference between aiming for a 3X return on each investment vs. a 3X return on your overall startup investing portfolio?

The objective of today’s post is to answer all these questions and to remove some confusion around exit math and terminology. Today’s post will:

- Clarify the Internal Rate of Return (IRR) vs. Exit Multiples — what they are, how they differ, how to calculate them, and when to use each

- Discuss the differences between overall portfolio target returns and individual investment target returns, and how to estimate the latter for your screening process

- Share our free web app calculators to help investors with both #1 and #2

Use our IRR to Exit Multiple Calculator here

Use the Target Investment Return Calculator here

1 — IRR and Exit Multiple Overview

Two of the most popular ways in which investors will hear venture asset returns being discussed are via the Internal Rate of Return (IRR) and exit multiple (sometimes referred to as “MOIC” – Multiple of Invested Capital).

To explore the difference between IRRs and exit multiples/MOIC and when to use each, let’s use an example.

Imagine making a $100 investment in a tech startup. Five years later, that investment returns $500 in total.

The exit multiple is the amount of capital returned divided by the total capital invested. For this example, $500 / $100 = 5X.

While exit multiples are easy to understand, they lack one critical piece of information. This is the time it takes to provide that return.

IRR vs. Exit Multiple — Time is the key difference

Imagine if that same $100 initial investment returned the same $500, but instead of taking five years it only took one year. You would now have $500 of capital that could be re-deployed into new investments, but you are only one year into your investing timeline, meaning you could end up with much more than $500 by year five.

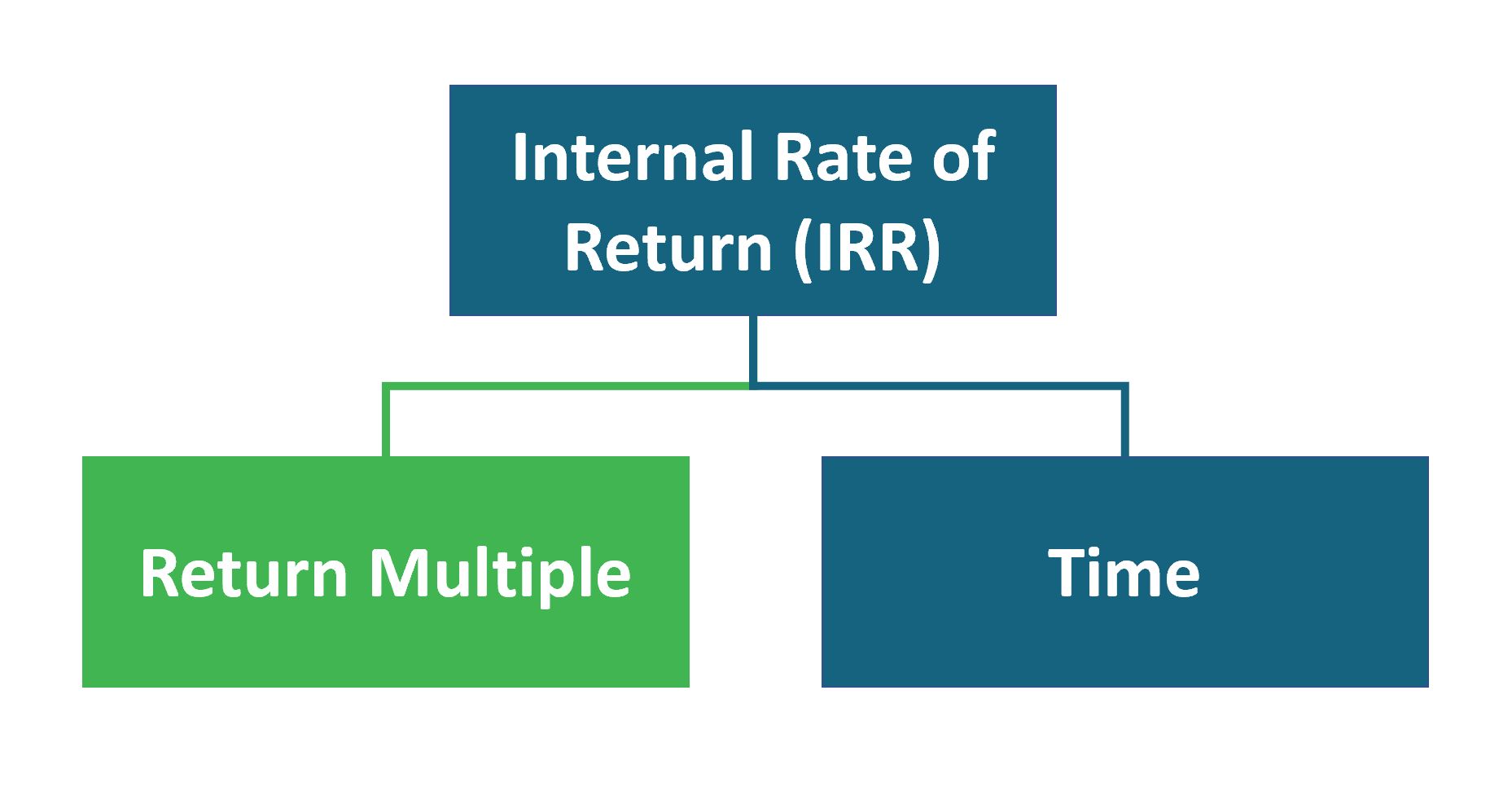

This is where the concept of the Internal Rate of Return (IRR) comes in. Instead of simply looking at a return multiple (5X), it also factors in how much time is required to result in that return multiple.

Comparing the two examples above of $500 in year 1 vs. $500 in year 5, that results in a 400% IRR vs. a 38.0% IRR, respectively.

All else being equal, a higher IRR for an investment opportunity reflects a better use of investment capital.

When to Use IRR versus Exit Multiples

While there are no hard-and-fast rules and each investor is different, we find that exit multiples are best used when assessing individual deal outcomes, while IRR is the appropriate measure to use when looking at your overall portfolio returns. The IRR makes it easier to make comparisons between alternative investment options (e.g. equity crowdfunding, stocks, bonds, or real estate).

The simplicity of exit multiples is one of their advantages. For example, if you were looking at a company and trying to determine whether it could provide either a 20% annualized return or a 5X exit multiple by a certain year, which is easier to envision and calculate? The exit multiple is definitely easier to understand here.

When performing your due diligence on a company and estimating what the business is worth now and what the business could potentially be worth in the future, the exit multiple is a convenient way of making quick, back-of-the-envelope calculations.

However, keep in mind that IRR factors in time, which can be important when weighing different investment decisions. You should tie each investment’s potential exit multiple back to your portfolio’s target IRR to ensure your investments are aligned with your overall strategy.

Assume you have the choice between two different investments — the first would potentially be acquired for 2X the current value in the next five years, while the second has a bigger potential exit of 3X within eight years. Which is the better use of your capital?

Using IRR, the two outcomes would result in 14.9% and 14.7%, respectively. Here, they have similar outcomes, but the first option does have a slight advantage due to the earlier return on capital, even though it has a lower exit multiple.

Key Lesson: It’s not always the case that a bigger exit multiple is the best investment option. Use the IRR to weigh different investment options and to factor in time.

What is the Internal Rate of Return (IRR)?

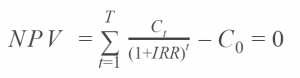

Stated in mathematical terms, the IRR is the annualized interest rate that sets the net present value (NPV) of all future cash flows of an investment equal to zero. The cash flows can be both positive (investment returns) and negative (additional capital investments or losses).

The mathematical formula for the Internal Rate of Return is:

Where:

- t = number of time periods (in this example, years)

- Ct = cash flow at a given time

- C0 = initial investment at time t=0

- IRR = annualized (i.e. compounded yearly) internal rate of return

For comparing simple investments where there are only two cash flows — an investment on day zero and a return in a future year “t” — the IRR equation simplifies to:

Solving for IRR, the simplified equation becomes:

Where:

- Ci = initial investment

- Ct = investment return in the final year “t”

- (Ct/Ci) = exit multiple

- t = number of years to provide the specified returns

For the simplest example, imagine a company that you invest $100 in on day one, and it returns $120 at the end of year one.

Because t=1 (year) in this example, the equation is simply IRR=($120/$100)^(1/1) – 1 = 20%. Obviously, a 20% gain in one year is simply a 20% IRR. But what about more complex returns after several years?

A $120 return on a $100 investment after 3 years would result in IRR=($120/$100)^(1/3) – 1 = 6.27%. Note that this is not the same as the average annual return, which would be 20% / 3 years = 6.67%.

By substituting in any initial investment amount, expected return, and number of years, you can calculate the IRR for each of your potential investments.

The real power of IRRs comes in when you start looking at multiple investments and withdrawals over time, such that you can calculate your portfolio’s overall returns for a series of cash-flows, or compare complex investment opportunities that differ in time and are harder to compare only based on the magnitude of the return.

Our IRR Calculator

We have created a simple and free web calculator for IRRs and exit multiples. It can either take the time (years) and exit multiple as inputs and return the IRR, or it can take the desired IRR and time as inputs and return the exit multiple.

The calculator is also available as a Google Sheet here.

Built-in IRR Spreadsheet Functions — “=XIRR(Date_range,CashFlow_range)”

For those of us that want to calculate our own custom IRRs using formulas and spreadsheets, both Excel and Google Sheets have built-in IRR calculators. There is an “=IRR” and an “=XIRR” function that will automatically do the calculations for you for a series of cash flows.

The difference is that the =IRR function requires the cash flows to be at regular intervals, while the =XIRR function can handle cash flows on any random dates. Since most investments will not pay off at regular intervals, be sure to use the XIRR function.

2 — Portfolio vs. Individual Investment Returns

Now that you have a solid understanding of the differences between IRR and exit multiples, it is important to discuss the differences between your targeted portfolio returns and your targeted investment returns for individual deals.

Let’s assume you are building an equity crowdfunding investment portfolio comprised of 50 companies. Assume that you want to target a 20% annualized portfolio return over the next 7 years. Using our IRR calculator, that is equivalent to a 3.6X return on your initial portfolio investment capital.

A common misunderstanding could lead new investors to start looking for companies that could provide this same 3.6X return, since that is what you are targeting in your portfolio.

However, a 3.6X (or any other) return on your overall portfolio is much lower than the returns that you must be targeting for each individual investment you make in early-stage companies.

A 3.6X portfolio return over 7 years is more likely to require a minimum 10X return for each successful investment. Why?

The reason is that the number of failures in early-stage investments is high.

This means that your investments that do not fail must provide a much higher return to compensate for the failures and still meet your overall portfolio’s targeted returns.

Misunderstanding this crucial fact about venture asset class returns could lead unaware investors to be screening for deals that are not a good fit for their portfolio. Ultimately, this will lead to disappointing investment results.

So, what is the correct exit multiple you should be screening for in each deal, based on your overall portfolio strategy?

How to calculate targeted investment returns based on targeted portfolio returns

For an investor to determine whether each individual investment will need a 5X, 10X, 100X, or another return multiple, they will need to know (or assume) three pieces of information:

- Portfolio target IRR (e.g. 20%)

- Investment time-frame (e.g. over 7 years)

- Estimated failure rate (e.g. I expect that 50% of all my investments will fail)

Use our target investment return calculator here to see how the failure rate impacts the types of returns you need to target in each investment.

References for Calculator Assumptions

The FAQ section on the above calculator app has some good starting points for each of the fields that you need to input.

Some factors that will influence your portfolio’s target IRR and investment time-frame may include:

- Reason(s) why you are investing in equity crowdfunding. Are you looking for maximum capital appreciation, or are you looking to invest in and support companies that you believe in?

- The stage of the businesses you are investing in. Are you planning to invest in primarily early-stage or later-stage businesses, or a combination? The stage of a business will determine the typical failure rate, which will then factor in to the type of returns you must achieve to hit your portfolio’s returns.

Our analysis of various angel investor studies indicated that 52-56% of angel investments will fail to return the invested capital, while 7-9% will return >10X. An analysis of failure rates by funding stage based on Crunchbase data from 1990-2010 can also be found here.

Quick Example — Reg CF Investment Returns vs Portfolio Returns

Assuming a rate of return between the public market equivalent stock returns and traditional angel and VC returns, we will use an estimated portfolio return of 20% annualized over 7 years to illustrate the process of determining investment targets from overall portfolio targets.

For simplicity and quick math, let’s assume a 50% failure rate for our hypothetical portfolio. Note that many sources suggest a 65% or higher failure rate for early-stage investments.

So our hypothetical equity crowdfunding portfolio may look like:

- Total # of Investments: 50 (not required for the calculation)

- Target Portfolio IRR: 20% annualized

- Holding Period: 7 years

- Estimated Failure Rate: 50%

If 50% of our 50 investments fail, that means the remaining 25 investments wouldn’t just have to generate 3.6X return each; they would now have to make up for the failures and generate twice as much, or 7.2X on average.

25*0X + 25*7.2X = 180 / 50 = 3.6X overall portfolio returns (20% annualized for 7 years)

And while the 7.2X average return is starting to get closer to the types of early-stage companies we should consider, the reality is that the businesses we invest in should likely have an even higher potential exit than that average multiple.

This is due to the power-law nature of early-stage investments.

Remembering the Power Law of Venture Investments

Power law returns state that a small number of the deals will generate most of the fund’s returns.

Again using our angel data, we saw that from 4000+ angel deals from the Wiltbank studies, 7-9% of them returned >10X. Of those, the likelihood is that very few of those returned almost all of the >10X returns.

So while our “average” winner in our hypothetical equity crowdfunding portfolio must have a 7.2X exit multiple after 7 years, the reality is that many of our winners will result in smaller exit multiples, while very few winners will result in much larger return multiples.

What is the return I should target for each individual investment?

With all the above information for our hypothetical portfolio, what should the investor ultimately be targeting?

Because the 7.2X average multiple for winners is the absolute minimum, investors should likely be targeting more on the order of 10X-20X potential exits in their investments.

Although looking for 3.6X companies vs. 10X companies may not seem like a big difference, the implications of this erroneous screening process could be huge for equity crowdfunding investors.

This is why it is crucial to start with your overall portfolio return goals, and then derive individual investment goals based on your assumptions.

Otherwise, you may be setting up your investment screening process for failure before you have even started investing.

Summary and Takeaways for Equity Crowdfunding Investors

As discussed, exit multiples are typically easier to deal with and talk about when looking at individual investment outcomes. It is crucial to tie these exit multiples back to your portfolio’s target return rate.

Our calculators help any new equity crowdfunding investor use personal assumptions for the rate of return, the time-frame, and the failure rates, to estimate what the average return multiple should be.

So what does all this mean for crowdfunding investors?

First, you should start by looking at your investment goals and strategy and determining what you are targeting for IRR and time-frame in your portfolio.

Once you have a starting point for your portfolio’s targets, you should make some assumptions based on the types of deals you will be investing in and derive your individual investment exit multiple targets.

Once you have the individual investment targets, you have a better idea of whether you should be looking at companies that may only return 3-5X, or if you should only be considering companies that have the potential to return 10X+.

As always, remember there is no single, correct answer. Each investor will have different targets based on their investment goals. But understanding what your overall and individual goals are from the start will ensure that your screening strategy isn’t flawed and that you are setting up your portfolio for the best chances of success.

[…] First, we will look at some private market studies on Angel Investors and Early-Stage VCs that suggest early-stage investments have historically obtained an average ~26% Internal Rate of Return (IRR). […]