Testing the Waters – What Reg CF Investors Should Know

With the new crowdfunding regulations that went into effect on March 15, 2021, the U.S. SEC introduced something called “testing the waters” (TTW) for Regulation Crowdfunding (Reg CF).

While testing the waters previously existed under Regulation A+ (Rule 255), the updated regulations now permit issuers to test the waters under Reg CF (Rule 206). We’re going to cover what testing the waters is, why investors should care whether an issuer is testing the waters, and how to tell the difference between a testing-the-waters vs. live offering.

What is Testing the Waters (TTW)?

Testing the waters (TTW) is a set of rules that allows issuers (i.e. startups who are raising money) to gauge potential investor interest prior to filing their Form C for Reg CF. This allows the company to assess the amount of potential investor interest before incurring the major expenses associated with an exempt Reg CF offering (e.g. legal fees, audit fees, etc.).

Testing the waters can be done orally or in writing and does not have to be done on a crowdfunding intermediary platform. Because of this, investors may see TTW offerings being made through email, on social media, and on other non-regulated platforms, in addition to being made on regulated funding portals and broker-dealers.

Testing the Waters Rule Differences – Reg CF vs. Reg A+

Depending on which exemption an issuer is going to use to raise capital, there are different rules governing testing-the-waters communications, disclaimers, and requirements.

Securities Act Rule 206 (Reg CF TTW) – a new rule as of March 2021, this is the most common form of testing-the-waters communication that crowdfunding investors will come across. This allows testing-the-waters communications after an issuer has decided that they will be doing a Reg CF offering but before they have filed the Form C. Testing-the-waters communications must cease after the Form C has been filed and all testing-the-waters materials must be filed along with the Form C.

Securities Act Rule 241 (generic TTW) – another new rule as of March 2021, this is a new form of generic testing-the-waters communication where the issuer has not yet decided which exemption they plan to use (e.g. Reg D vs. Reg CF vs. Reg A+). One big limitation of testing the waters under Rule 241 is that state “blue sky” laws are not preempted, meaning that an issuer may have to comply with each individual state’s laws.

Securities Act Rule 255 (Reg A+ TTW) – this is the existing testing-the-waters rule associated with Reg A+ Tier 2 offerings (up to $75 million). Testing-the-waters communications under this rule for Reg A+ can be made both before and after the filing of the offering statement with the SEC.

Why Investors Should Identify Testing the Waters Campaigns

It’s important to recognize whether a company’s offering is simply testing the waters or whether a formal offering statement (such as a Form C) has been filed with the SEC.

If you come across a company that is testing the waters and that you are interested in, you can only “express interest” or “reserve shares”. This usually means providing your email address and basic contact information, but not yet connecting a bank or initiating a payment. Because of this, investors will have to return to a crowdfunding intermediary (i.e. a funding portal or broker-dealer) to complete the investment process when (and if) the company files their Form C.

A Word of Caution for Investors Looking at Testing the Waters Offerings

A company that is testing the waters doesn’t have to make the same types of disclosures to investors that the SEC requires in a Reg CF Form C filing. Because of this, there are several areas that investors need to beware of when looking at TTW offerings.

Deal Terms – because you are only expressing interest in a deal, it is possible that the issuer who is testing the waters might not have all (or any!) of the deal terms finalized. Thus, it is possible that any advertised TTW deal terms may change when the company finally files the Form C.

Valuation – similar to deal terms, a company’s valuation isn’t always available when testing the waters. Investors should keep this in mind, as valuation is obviously a critical piece of information needed to make any investment decision. When confirming an investment made through any test-the-waters campaign, investors should always double-check the final valuation of the submitted Form C and ensure that the valuation is still fair for the investment opportunity.

Financials – another area that is typically lacking on testing-the-waters pages is the company’s financial information. Financial statements are often one of the most expensive and time-consuming parts of preparing a crowdfunding campaign and are rarely available while testing the waters. If financials are available, those financials are likely preliminary, so investors should always verify and review financials before officially investing in a campaign.

The SEC requires that all offerings using Rule 206 for Reg CF must file their testing-the-waters materials along with their Form C. In doing this, the SEC’s intent was that this requirement would drive accountability on the part of the issuer by making all TTW materials publicly available. Hopefully, this lowers the chances that an issuer would be dishonest in trying to attract interest in a testing-the-waters campaign by offering terms that are purposefully different (i.e. more attractive) than what they plan to offer in the actual campaign.

Reserving TTW Interest Without Having All the Information

Personally, I don’t see how a serious investor can make an informed investment decision without having all the information (especially deal terms, valuation, and financials). Thus, I don’t usually spend a lot of time looking at testing-the-waters offerings. That being said, it can be a good way to find up-and-coming deals, and sometimes popular deals will sell out fast, so it might be advantageous to reserve shares early and then come back to make the final investment decision later on.

Investors should always use caution when going back and officially completing an investment. Check that the deal terms, valuation, and financials are all provided and haven’t changed significantly from the testing-the-waters materials. If anything has changed, ensure the overall investment opportunity is still acceptable.

And recognize that you may have imparted some psychological biases — such as the endowment effect and loss aversion — to your investment process by merely “reserving” shares without thinking about it.

How to Identify if a Startup is “Testing the Waters”

According to the SEC’s new rules, any Reg CF testing-the-waters communication must have a legend attached that says:

- No money or other consideration is being solicited, and if sent, will not be accepted;

- No offer to buy the securities can be accepted and no part of the purchase price can be received until the offering statement is filed and only through an intermediary’s platform; and

- A prospective purchaser’s indication of interest is non-binding.

Because money cannot be collected until the Form C is filed, investors who express interest during testing the waters will receive an email with instructions on how to confirm and officially invest. Not all companies that test the waters will go on to file a Form C and launch a campaign, especially if they discover that there is not enough investor interest.

Recognizing TTW Offerings on Funding Portals

It’s important for investors to note that testing-the-waters campaigns are presented differently on each funding portal. We will cover how testing-the-waters campaigns appear on the top three U.S. equity crowdfunding sites: Wefunder, Republic, and StartEngine.

Testing the Waters on Wefunder

Testing-the-waters offerings on Wefunder are the hardest to tell from live offerings. In many ways, the campaign page of a TTW campaign on Wefunder looks nearly identical to live campaigns that have filed a Form C. The button at the top of the campaign page even says “Invest”, despite the fact that you cannot actually invest until a Form C has been filed.

How to tell if a Wefunder campaign is testing the waters:

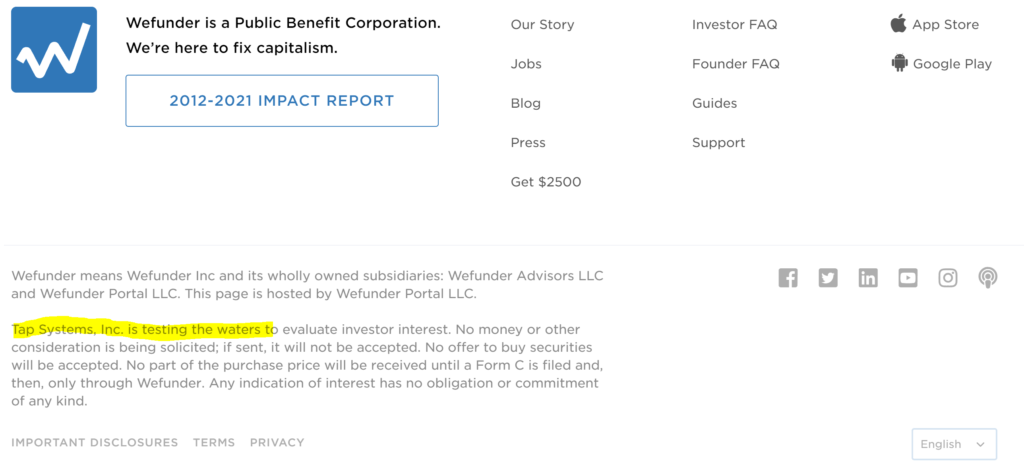

- On the bottom of the page in the footer, the required legend will say if the issuer is testing the waters:

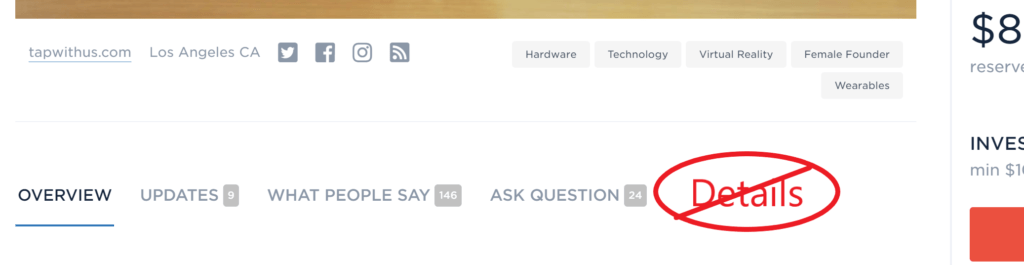

Wefunder Footer Testing the Waters Example - At the top of the campaign page, the “Details” tab (which typically has info like Financials) will not be present. This only happens on campaigns that are testing the waters.

- Lastly, when you enter an amount and click the “Invest” button on any TTW campaign, you will get a confirmation screen saying that your investment amount has been reserved.

Testing the Waters on Republic.co

Campaigns on Republic are much more obvious in terms of which ones are testing the waters.

How to tell if a Republic campaign is testing the waters:

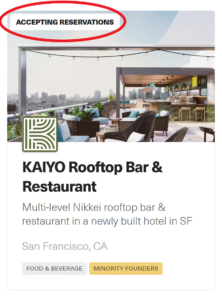

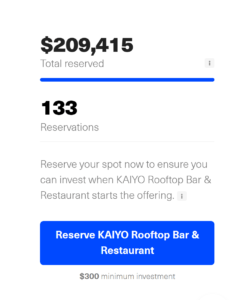

- The company card will say “Accepting Reservations”

- On the company’s campaign page, all the wording will indicate that interest is being “Reserved” rather than “Invested”.

- Lastly, Rule 206 reservations will be noted in the footer of the campaign page.

Testing the Waters on StartEngine

As of the time of this blog post, there were no campaigns currently testing the waters on StartEngine. However, in the past, there have been a number of Reg A+ campaigns that tested the waters on StartEngine, which used similar wording in terms of “Reservation” of interest.

When in doubt, you can hit CTRL+F (CMD+F on Mac) to search for “waters”, “testing the waters”, or “reserve” to see if those terms appear anywhere on an offering page and thus are an indication that the company is still in testing-the-waters mode.

Closing Remarks

Overall, testing the waters was introduced to Reg CF to make the capital raising process a little more flexible for issuers. Testing-the-waters communications allow issuers to test various assumptions and gauge investor interest before they have committed all the time and money required to launch a full-blown equity crowdfunding campaign. This reduces the issuer’s risk of investing up-front costs into a crowdfunding campaign and then launching and failing to raise enough capital.

Along with other regulation updates, such as increasing the Reg CF limit to $5 million, testing the waters does appear to be working so far, as the number of crowdfunded companies and the total crowdfunding capital raised has been on an upward trend since 2020.

Furthermore, the SEC introduced testing the waters in Reg CF in the hopes of benefitting investors. The hope was that investors would not only be able to see more of these opportunities ahead of time, but to potentially help influence the structure of the deal (e.g. deal terms and valuation) and to give feedback to the issuer about various aspects of the deal.

While we haven’t yet seen any examples of an issuer who used testing the waters to define the deal structure with investors, we are still in the nascent stages of testing the waters. I expect we will continue to see rapid innovation around the ways that issuers are testing the waters and how crowdfunding platforms will use TTW campaigns as part of their onboarding process.

Interesting deep dive on this (likely) under-appreciated aspect of the regs. Extra important for investors to recognize the way different platforms handle it differently. Thanks, Brian!

Agreed – I feel that especially on Wefunder (because it looks like an actual investment page), most investors don’t even realize when they are investing in a TTW campaign vs. an actual campaign.