Risks of Equity Crowdfund Investing – Part 2

This is Part 2 of the Equity Crowdfund Investing Risk Series, discussing the seven specific risks to investors in equity crowdfunding deals. Part 1 covers risk-reward tradeoffs, asset allocation, and investor psychology.

————————————-

When investing in early-stage companies, I like to imagine that I’m building a bridge.

Only with this bridge, I’m not entirely sure where it starts or where it ends. The cost of the bridge, how long it will be, how much material will be needed, and whether or not it will be an eventual success are all unknowns.

As you can imagine, many of those bridges will end up in shambles on the valley floor below.

Similarly, when investing in early-stage companies, figuring out where a company is at, where it is going, and what it will take to get there is often considered more of an art than a science because there are so many unknowns.

In project management, one way of planning for and dealing with the unknown is by understanding and managing risk. Similar to the risks that arise during the construction of a bridge, investments in equity crowdfunding businesses comes with their own associated risks.

While you can’t remove the risks entirely, by understanding them before starting, you can better manage and mitigate any negative impacts when and if they do occur.

We will first discuss a hierarchy for grouping and managing risk in any financial investment. We will then dive into detail on the seven risks specific to the Regulation Crowdfunding asset class.

Understanding the Different Levels of Financial Market Risk

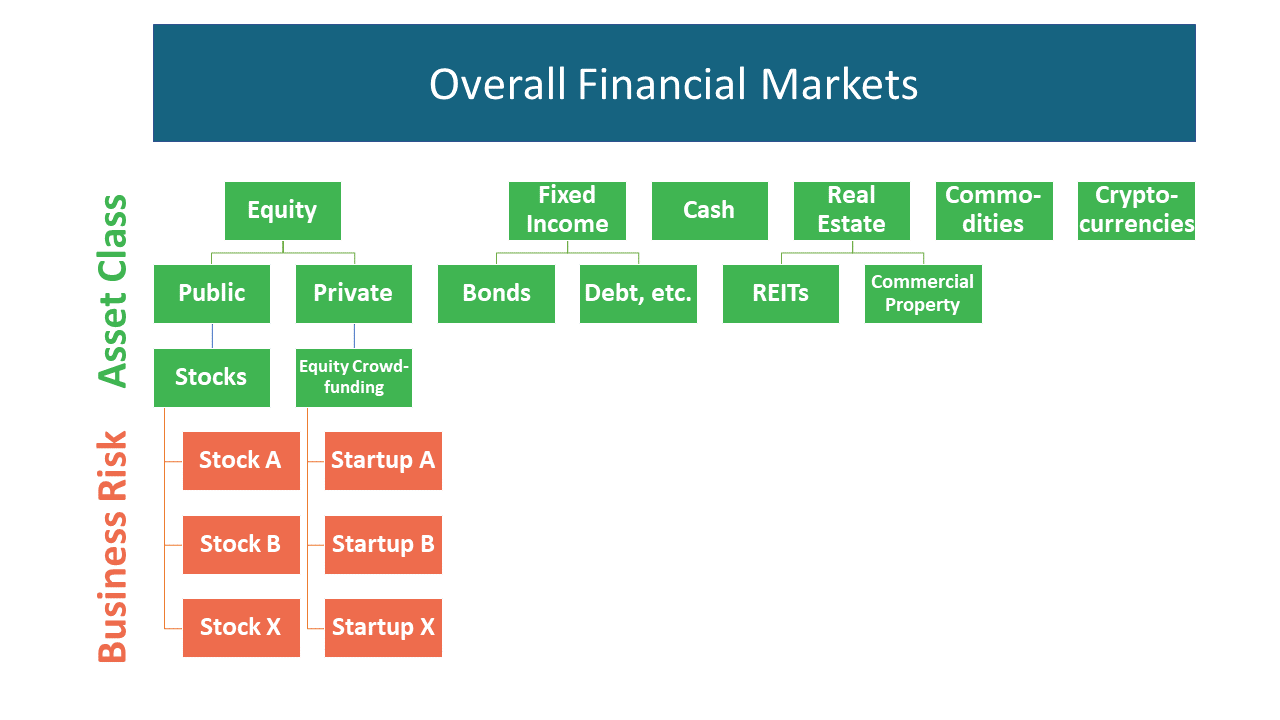

When making any investment, it is imperative to understand the types of risks that apply at each level, from the overall financial markets all the way down to the specific company you are investing in.

We will be grouping investment risks into three categories and discussing the asset-class risk for equity crowdfunding in detail below.

- Systemic risk (or market risk) – due to factors impacting the overall financial markets

- Asset-class risk – applicable to groups of investments that behave similarly, such as public stocks, bonds, real estate, and equity crowdfunding

- Business risk – company-specific risk, which varies by each startup and each deal

Systemic risk, or market risk – the overall risk to the broader financial markets due to macroeconomic conditions and other factors (e.g. recessions, inflation, wars, and other such events).

Systemic risk, or market risk – the overall risk to the broader financial markets due to macroeconomic conditions and other factors (e.g. recessions, inflation, wars, and other such events).

Asset-class risks – risks that are applicable to groups of assets that behave in a similar manner. Below, we cover the seven types of asset-class risk that are applicable to equity crowdfunding investments.

Business risk – i.e. company-specific risks, such as legal, tax, future funding, team, industry, regulatory, competition, etc. – must be assessed on a case-by-case basis. This is typically done while performing due diligence.

This list of risks is by no means all inclusive; political risk, currency risk, and many other risks may come into play, but in general can be included in one of the categories above.

Asset-Class Risks for Equity Crowdfund Investing

Since the equity crowdfunding market is still in its infancy and continues to evolve at a fast pace, this list may continue to evolve in the coming years. You should never assume you have all the information in startup investing and always question assumptions or common beliefs.

The seven primary asset-class risks of equity crowdfund investing are:

- Illiquidity

- High Failure Rates

- Dilution

- Lack of Control

- Limited Information

- Speculative Valuation

- Deal Terms (unique to Regulation Crowdfunding, Reg CF deals)

Risk 1 – Illiquidity

If you have a liquid investment, this means it is relatively easy to buy and sell at any time. An illiquid asset is much harder to buy and sell whenever you want.

One example is that your house is likely an illiquid investment. It would take significant time, effort, and money to sell, versus something like a public stock – a liquid investment – which can be bought and sold with ease.

Equity crowdfunding and the private markets are considered highly illiquid investments. This is because once you invest your money, it will be locked up for many years. You cannot simply choose to sell if you change your mind or need your money back, and you have almost no control over when you will get your money out, if ever.

Equity crowdfunding will become more liquid as secondary markets are established. Secondary markets are the exchanges where you will be able to buy and sell your shares of private companies to other investors, prior to that company having an exit or a liquidity event.

However, those markets are still under development. Even then, there will not be a large number of buyers and sellers to start, so you may have to pay a premium to buy or sell on the secondary markets, further eroding your returns.

Risk 2 – High Failure Rates

Angel Investment studies of over 4,000 investments in the US and UK indicate that 52-56% of all investments will completely fail. Investors in the public stock markets would almost never expect to see an investment go all the way to zero. But in the private, early-stage markets, failure is the norm rather than the exception.

For startup investment failures, investors in equity crowdfunding should be aware that we aren’t just talking about companies that go bankrupt and close-up shop.

For example, a company could continue operating – rather successfully – for decades, but never provide the growth necessary to provide an exit, and never return a single penny to investors. This is referred to as a zombie in the early-stage investment world.

A failed investment should thus be defined as any investment that returns less than the invested capital.

And the ways that a business can fail to return capital to its investors are plentiful in the startup world. Some examples are:

- The company fails for a huge number of reasons, and you lose all your money (most obvious)

- The company does not shut down, but never raises additional funds, go public, be acquired, or have any other “exit”, and thus you never get your money back (i.e. a zombie startup)

- The company continues to raise additional funds without significant forward progress, continually diluting your initial shares and diminishing returns on your initial investment

While the above bullets cover some of the most common failure-related risks, there are many uncertain and unfavorable possibilities due to the highly unpredictable nature of startups. You should always be sure to understand the terms of the specific deal you are investing in.

Risk 3 – Dilution

Dilution is when additional capital is raised during future funding rounds, resulting in your initial ownership becoming a smaller piece of a (hopefully) bigger pie.

Although investors in equity crowdfunding today may not consider this, dilution is a huge potential risk that can seriously erode investor returns. Thus, it is crucial to consider whether the company you are investing in is capital-efficient, if they are nearing profitability, and other factors that may influence how often and how much additional capital they will need to raise before a potential exit.

Let’s run through a quick dilution example with some simple math.

Let’s assume you invest $1000 in a startup. The business raises $50k, with a post-money valuation of $1M. You would own 0.1% of the company ($1,000 / $1M = .001).

After a few months, the company makes excellent progress, but needs to raise additional capital by issuing more shares. If they decide to raise another $100k at a $2M post-money valuation for 5% of the company. Would you still own 0.1% of the company, making your initial investment now .1%*$2M = $2000?

Not exactly, due to dilution. Because 5% of the company is being offered for $100k, that is like pouring more water into a cup with a concentrated syrup – the syrup would become less intense, or diluted.

You would now have 95% of the equity you previously held (100%-5%). However, because the valuation is higher, your investment is now worth 0.95*0.001*$2M = $1900.

So as additional funds are raised, you will own a smaller and smaller piece of the company – but hopefully at higher and higher valuations.

For capital-intensive businesses and those that are not generating revenues yet to cover operating costs, the risk for needing to raise additional capital often is much higher, potentially increasing your dilution risk in future funding rounds.

Imagine instead that it took the founders multiple rounds of 10% equity offerings and they only get up to a $1.5M valuation after four more rounds – not a good scenario. Now your $1000 would be worth: .9*.9*.9*.9*.001*$1.5M = $984. Thus, even though the company is technically worth 1.5X the initial valuation when you invested, you have actually lost money due to dilution.

Note: dilution typically will not impact SAFEs and Convertible Notes until after they have converted to equity shares.

Risk 4 – Lack of Control

Unless you are investing amount of capital closer to traditional Angels (e.g. $25,000+ per deal), don’t expect to get pro-rata rights. Similarly, if you are investing $100 in a startup, you shouldn’t expect to get face time with the founder and team.

The smaller investment amounts of Reg CF (e.g. $100s per deal) means you will sacrifice other forms of control, such as voting rights and board seats. Typically, your crowdfund investment contract will delegate those rights to a single individual, such as the CEO.

This makes the logistics for having a crowd of investors more manageable for the startup. However, it does mean that you will have less control over the future direction of your investment than a traditional Angel Investor.

Risk 5 – Limited Information

Similar to Risk 4, if you are investing hundreds per deal instead of thousands, it is not reasonable to expect that the founder will be sending you a weekly (or even monthly) update on the detailed progress they have made.

The great founders and teams will still provide periodic updates to their investors regardless of investment amount. But understand that their sharing of proprietary and sensitive topics to hundreds (or more) of investors puts them at greater risk of that information leaking out to competitors.

Thus, many startups choose to err on the side of caution when providing sensitive financial and business updates to Reg CF investors, meaning the potential of limited information rights for minor crowdfund investors.

Risk 6 – Speculative Valuation

One of the primary aims of the Title III Reg CF legislation was to reduce the associated legal costs and financial burdens on businesses trying to raise smaller amounts of capital.

While there are still strict requirements that companies must follow for Reg CF, many of the more burdensome requirements were removed, such as those that are more applicable to large companies doing an IPO.

The removal of these often excessive burdens on early-stage businesses is beneficial to the startups, but will result in less information being made available to the public and to investors. Thus, there will be more uncertainties and the future potential of a business will be more speculative, compared to a more mature business being offered on public markets and being scrutinized by many professional and other investors.

Also, be aware that certain funding instruments, such as SAFEs and Convertible Notes, are not formal priced rounds and aren’t considered ownership until they convert to equity.

While this further lowers the administrative, legal, and financial burdens on the business – allowing them to focus more on their product and getting to profitability – it does come with the increased risk of less transparency and less information.

Risk 7 – Deal Terms Risk (Title III – Reg CF)

Of all the risks, I believe this is the most overlooked and unknown today among Reg CF investors.

Deal terms are never identical, and sometimes the legal terms must be adjusted to make the possibility of Reg CF offerings possible and attractive in today’s market.

One example of this risk is how SAFE terms are very different across different funding portals or even on the same funding portal. Note: SAFEs offered for Reg CF deals are not the same as the Y-Combinator boilerplate SAFE (which was recently updated in Fall 2018 to be post-money instead of pre-money), but that is not the major concern here.

SAFEs work best when you only have a handful of investors on your cap table. Issuing SAFEs to hundreds of potential investors introduces complications. Some of these complications include: information/voting rights concerns (if any), “messy” cap tables, and securities laws that limit the number of unaccredited investors to 500.

Founders have concerns that a messy cap table from a Reg CF raise will potentially make them not as attractive for future professional money from VCs.

To combat this, funding portals like WeFunder and Republic have introduced their own custom SAFEs. Crowdfund investors must realize that even these two SAFEs can be different.

For the Republic CrowdSAFE, the primary difference from the traditional YC SAFE is that companies can choose not to convert SAFEs in the first equity financing round. This is essentially kicking the can down the road for conversion, to whenever the founders decide it is the right time (which can actually be beneficial in terms of anti-dilution to the investor). Even Republic CrowdSAFEs can have repurchase rights, though.

For many WeFunder Crowdfunding SAFEs, if the startup determines that having a messy cap table is a deterrent to future potential investors, instead of deferring that conversion, like in the Republic CrowdSAFE, they typically have repurchase rights for minor shareholders. This means the company can buy out all SAFE holders prior to a conversion at either the greater of the original purchase price or the Fair Market Value (FMV) of shares. This is potentially a very bad thing if the company you invested in continues to massive success.

Imagine having been one of the first investors in Facebook, Uber, or Airbnb, but then being offered your initial money back with meager returns on their next funding round.

If a company in your portfolio, like Zenefits, had been bought out prior to conversion at the first priced round, you may have made a little money, but you would then have missed out on most of the 200X+ returns. These are the types of returns that will make or break any early-stage investment portfolio’s success due to power law returns.

In the end, investors must look at the specific deal terms for each investment they make, so that none of these deal term risks come back to haunt them in later years. And having the JOBS Act 3.0 pass the Senate (passed the House in mid-2018) will go a long way towards fixing some current Reg CF shortcomings like those listed above.

Hidden Benefits of Crowdinvesting Risks

While there are many risks to the equity crowdfunding asset-class, some of the biggest risks can actually be blessings in disguise.

Benefits of Illiquidity: let’s look at the first risk of illiquidity. If an investor isn’t aware of illiquidity when starting out and then needs the money they invested shortly after, they will be completely out of luck.

However, for the investor that acknowledges this risk and only invests money they can afford to lose, not having the ability to buy or sell on a whim can actually protect the investor from their own human flaws.

It is human nature to experience emotions, and short of only having robots do our investing and throwing away the key, it is nearly impossible to remove all emotion from our investment decisions. Thus, whether the market is booming or crashing, it could actually be seen by long-term investors as a benefit that they cannot buy or sell on a whim.

Benefits of Limited Information: personally, I try not to pay much attention to the news. Why? Most stories that are deemed newsworthy these days are bad events happening in the world. The types of events that make the news – shootings, home invasions, natural disasters, wars, and the list goes on and on – would make you think we’re living in a world spiraling out of control, when actually the complete opposite is true.

However, it is the rare nature of these events that makes them popular, and so they continue to get disproportionate coverage.

Don’t get me wrong, information about your investments, especially before investing, is important.

But too much information and not being able to filter the signal from all the noise can lead to disconnects between reality and your view of the world. And those types of disconnects are what can lead to bad decisions.

So when many things will be outside of your control (see Risk #4), why bother worrying about such events and adding more stressors to your life?

Again, if you are writing checks more like traditional Angels, paying attention to your startups and what you can do to help with every problem may be much more important.

But for those of us who are investing smaller amounts across many deals and do something else for a living, it just isn’t practical to try and stay in the loop on every single company’s problems.

Benefits of Speculative Valuation: Marc Andreessen believes you can draw a 2×2 matrix for Venture Capital that describes how money is made. With “Success/Failure” on one axis, and “Consensus/Non-Consensus” on the other access, a deal must be in the “Success” and “Non-Consensus” quadrant in order to make money.

For example, if everyone knows that a deal will be successful (i.e. consensus), it will likely be priced into the investment already, and so you won’t get as big of a return. But knowing is much easier said then done – just look for the countless stories of respected investors that turned down Airbnb, passed on Twitter (Jason Calacanis called it “inane and pointless”), and scoffed at many other Unicorns in their early days.

That is why companies must be non-consensus successes in order to make money. It’s hard and speculative.

What does this mean for early-stage investors? Sometimes your best investments will look stupid or crazy. According to Andreessen’s non-consensus matrix, that’s even a requirement for getting outsized returns.

The trick is to learn to recognize the difference between “crazy with huge potential” and simply “crazy”.

Summary – Crowdfund Investing Risks

As mentioned in Part 1 of the article about risk vs. reward tradeoffs, deciding whether Reg CF investments as an asset class belong in your portfolio is up to each individual investor. Can you tolerate higher risk and volatility for the potential for higher returns?

While historical Angel Investment returns from studies indicate average annual returns of 26%, the returns of equity crowdfunding are still to be seen in the coming years.

These are the primary risks specific to the Reg CF asset class, but by understanding the risks before investing, you are already far ahead of many of the other Reg CF investors today.

Are there other risks that you feel are vital to be aware of? Feel free to share them and discuss in the comments section below, so that future readers can benefit from your knowledge.

[…] of the unique risks of the Republic Note token, you should remember to treat this as any other startup investment and only invest money that you can afford to lose. Even if Republic doesn’t fail, if Reg CF […]