Zero to One by Peter Thiel – Book Summary

When embarking on any new endeavor, the best way to avoid mistakes and achieve success is to learn from those that have gone before you. And whether you want to be successful as a startup founder or an investor, it’s hard to find a better example of either than Peter Thiel.

In his book, Zero to One – Notes on Startups, or How to Build the Future, Thiel shares valuable insights and lessons from his own experiences as both a founder and an investor.

When first drafting this book summary, I tried grouping the lessons from his book into two lists: one for startup investors, and one for startup founders. But I quickly realized that the real value of Peter’s knowledge is that it speaks from his experience on both sides of the table.

His questions, thoughts, and perspectives take both the founder’s and the investor’s challenges and goals into account.

Just as we offer advice for both startup founders and investors, whether you are a founder or an investor you will learn a lot from the knowledge that he shares in this book.

Peter Thiel – from PayPal Mafia to Zuck’s Earliest Investor

Peter Thiel is well-known among the startup community, and he has good reason to be. As a startup founder, he co-founded PayPal in 1999 (worth ~$120B today) and Palantir Technologies in 2004 (targeted a private market value of $26B in September 2019).

As an investor, he organized the Silicon Valley VC firm Founder’s Fund in 2005, with famous portfolio investments such as Facebook, SpaceX, Spotify, Palantir Technologies, Airbnb, Lyft, Stripe, and Flexport. As an angel investor, he invested $500k of his own money as the first outside investor in Facebook at a $5M valuation.

Peter Thiel is lesser-known for his teaching. In 2012, he taught an entrepreneurship class at Stanford. One of his students, Blake Masters, took notes on that class and shared it with a broader audience.

That is how the book Zero to One was born.

What does Zero to One mean?

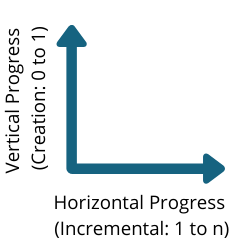

Peter Thiel describes human and technological progress along two different axes.

First, he outlines the X-Axis, which he calls horizontal progress. This is taking something from 1 to n; essentially, copying something that already exists, and scaling it.

Horizontal progress is characterized by incremental change.

For example, if you have one car, it would be analogous to copying that one design and manufacturing 1,000 more. Horizontal progress could also be implementing minor updates that would result in the next year’s model.

In contrast to this is the Y-Axis, which he calls vertical progress.

This is taking something from zero to one; that is, creating something entirely new out of nothing. As you can imagine, creating something from nothing is much harder than creating incremental change.

Going back to the car example, when Henry Ford introduced the motorized vehicle in the time of horse and buggies, that was something that was completely new and unexpected.

In Henry Ford’s often-quoted example, he claims that if he had asked his customers what they wanted, they would have said “faster horses” (incremental change). Instead, he gave them cars (technology).

Vertical progress is much harder to imagine and impossible to predict beforehand. But it is the foundation upon which all future innovations and technological revolutions are born.

Key Takeaways and Book Summary

While every startup founder and investor should read this book from cover to cover, here are some of the most thought-provoking and insightful takeaways that resonated with me.

Counter-Intuitive Startup Principles for Success

- It is better to risk boldness than triviality

- A bad plan is better than no plan

- Competitive markets destroy profits

- Sales matters just as much as product

Four Ways to Create a Monopoly (which is a good thing)

- Proprietary Technology – makes your business hard or impossible to replicate.

- Network effects – your product becomes more useful the more people that use it.

- Economies of scale – fixed costs can be spread over a larger base of sales as the business grows.

- Branding – think of Apple. But it must start with substance, not branding – i.e. monopolies can’t be built on brand alone. What would Apple be without the beautifully designed iPod, iPad, and Macbook?

Fierce Competition isn’t always (or even typically) a good thing

“Just as war cost the Montagues and Capulets their children, it cost Microsoft and Google their dominance: Apple came along and overtook them all.” – Peter Thiel

Aligned with advice that we have seen in many other places, Thiel believes it is better to create a monopolistic business (think of Google and search engines) rather than one that competes in highly contested markets.

The value of tech companies comes from future cash flows

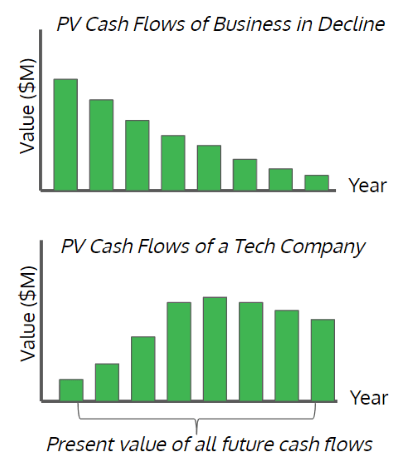

“Simply stated, the value of a business today is the sum of all the money it will make in the future… Most of the value of low-growth businesses is in the near term. Technology companies follow the opposite trajectory. They often lose money for the first few years: it takes time to build valuable things, and that means delayed revenue. Most of a tech company’s value will come at least 10 to 15 years in the future.”

“Simply stated, the value of a business today is the sum of all the money it will make in the future… Most of the value of low-growth businesses is in the near term. Technology companies follow the opposite trajectory. They often lose money for the first few years: it takes time to build valuable things, and that means delayed revenue. Most of a tech company’s value will come at least 10 to 15 years in the future.”

Obviously, this shouldn’t be taken to its extreme – i.e. startups can’t burn massive piles of cash with the hopes of making profits far into the future and expect that investors will still want to invest.

As some of the high-profile IPOs of 2019 have shown (or withdrawn IPOs, in the case of WeWork), the pendulum is always swinging back and forth between extremes, but it seems that Wall Street is again giving more attention to companies that show viable paths to profitability.

Last Mover Advantage is Crucial

Peter Thiel believes that last mover advantage is what entrepreneurs should be striving for and investors should be investing in.

“…moving first is a tactic, not a goal. What really matters is generating cash flows in the future, so being the first mover doesn’t do you any good if someone else comes along and unseats you. It’s much better to be the last mover – that is, to make the last great development in a specific market and enjoy years or even decades of monopoly profits.” – Peter Thiel

This may sound counter-intuitive to investors and founders, since there is often so much hype around having “first mover advantage.”

The history books are full of examples that validate his last mover hypothesis – think of MySpace vs. Facebook, Yahoo vs. Google, and other first movers who pale in comparison to the last movers in their industries.

The Fight-Club rule of VC Investing

There is one quote from the book that I always refer to as the Fight Club rule of VC investing.

Theil states: “First, only invest in companies that have the potential to return the value of the entire fund.” And rule two: “…because rule number one is so restrictive, there can’t be any other rules.”

By definition, Rule One eliminates most potential investment opportunities. Even those that may be “good” are likely still not “good enough” unless they have the potential to return the entire fund.

I often highlight this lesson as the difference between investing to win vs. investing not to lose.

Instead of preaching a broad “pray and spray” diversification approach, Thiel believes in identifying the highest potential founders and ideas, and then backing them with every available resource.

He gives the example of Andreessen Horowitz’s $250k investment in Instagram. After Instagram was purchased by Facebook just a few years later, Andreessen Horowitz netted a comfortable 312X return on their investment.

However, as Thiel pointed out – even that level of return is likely not enough for a large VC firm such as Andreessen Horowitz. Assuming a $1.5B fund, a fund of $250k checks would have needed at least 19 Instagrams just to break even!

That goes to show that while diversification is crucial in early-stage investing, it’s also essential that “…every single company in a good venture portfolio must have the potential to succeed at vast scale.”

That is much easier said than done. It means saying no to many companies that provide mediocre or even good returns.

Venture Investing is NOT the same as buying lottery tickets

If you read Jason Calacanis’ book Angel, you may remember one quote where he says that investing in startups is similar to playing the lottery, only his pool of lottery tickets is rigged to be in the top 1% of the winning number pool.

While this analogy may be useful for some investors, Thiel points out how the lottery ticket analogy can also lead to disastrous investment outcomes:

“Whenever you shift from the substance of a business to the financial question of whether or not it fits into a diversified hedging strategy, venture investing starts to look a lot like buying lottery tickets. And once you think that you’re playing the lottery, you’ve already psychologically prepared yourself to lose.”

This goes back to the Fight Club rule of VC investing. Thiel says that

“The biggest secret in venture capital is that the best investment in a successful fund equals or outperforms the entire rest of the fund combined.”

The key for startup investors isn’t going out and buying as many lottery tickets as you can (i.e. pray and spray). Instead, investors should find those few companies that have the biggest potential and diversify your investment capital into those.

Thoughts on Financial and Investment Bubbles

“An entrepreneur can’t benefit from macro-scale insight unless his own plans begin at the micro-scale.” – Peter Thiel

Thiel talks a lot in the later chapters about various bubbles, such as the dot-com bubble and cleantech bubble.

His point is that just because a certain technology (e.g., the internet, block chain, AI, etc.) has huge future potential, it doesn’t mean that every startup founder who creates a business can simply ride the wave of innovation to success (nor will investors succeed in getting their money back).

Instead, he gives the example of Tesla, which – while it was part of the cleantech movement in coming up with new electric vehicle (EV) designs – had a detailed roadmap and actual plans to achieve its near-term goals.

Find a Small Market That You Can Dominate and Scale

Related to the prior point, one way that investors can succeed with micro-focus while taking part in macro trends is by finding a small, niche market, and then scaling from there.

PayPal did this in 1999 when they were considering their go-to-market strategy. They identified that eBay PowerSellers would be an excellent niche market to dominate, and then allow them to further attack and expand into the market after dominating there.

Many of today’s most successful businesses also employed similar strategies (which some investors and founders refer to as their beachhead strategy). Uber didn’t start by targeting the entire cab market – they started with the Uber Black business in select cities by catering to upscale executives and clientele.

And Facebook started with a single university.

The Seven Questions that Every Business Must Answer

If you are a founder, sit down and thoughtfully answer these. If you are an investor, reflect on the answers to these questions for your investments.

- The Engineering Question – is this breakthrough technology or an incremental improvement?

- The Timing Question – is now the right time for this particular business?

- The Monopoly Question – are you starting with a big enough share of a small market?

- The People Question – is it the right team?

- The Distribution Question – do you have a way to not just create but deliver your product?

- The Durability Question – will your market position be defensible 10 and 20 years into the future?

- The Secret Question – it is a unique opportunity that others don’t see?

- Even Paul Graham said this about Airbnb – “We thought Airbnb was a bad idea. We funded it because we liked the founders.”

Thiel believes that even getting five or six of these correct can lead to success.

Summary of Zero to One

The various points that we touch on above are only the tip of the iceberg in terms of the knowledge that Thiel shares in this book.

It doesn’t matter if you are a new (or experienced) startup founder or investor – I’m confident that you will come away with at least one, if not more, nuggets that change the way you think about your business and/or investments.

And no matter which side of the table you are on, I’m confident that by gaining a broader perspective of the investor-founder relationship, you will have more success in raising capital, building businesses, or making future investments.

Responses