2019 US Equity Crowdfunding Stats – Year in Review

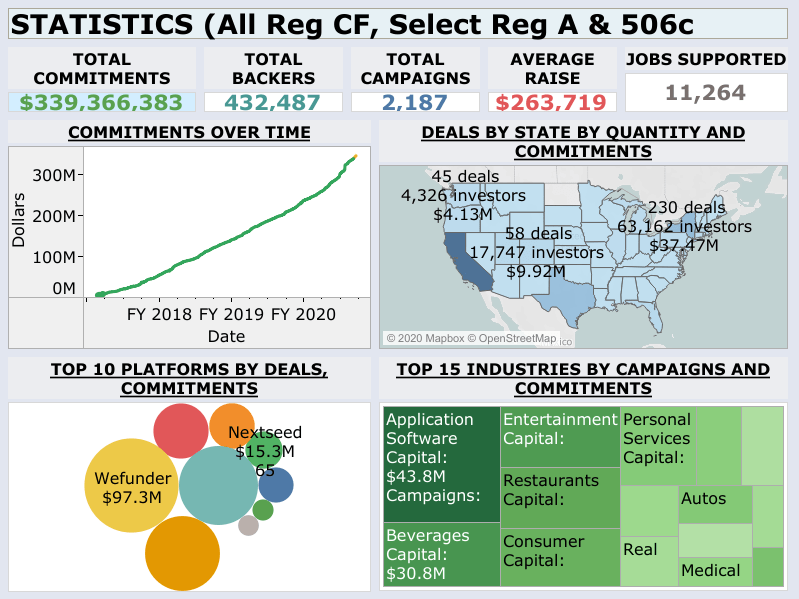

In terms of milestones and stats, the year 2019 was an exciting one for the online startup investing industry (aka equity crowdfunding) in the US. [2020 Update: interested in what the top Reg CF sites are in 2020? Check out the top ten equity crowdfunding sites as of 2020].

- The two top funding portals, WeFunder and StartEngine, both surpassed $100M in total capital raised for startups

- Regulation Crowdfunding (Reg CF) surpassed $300M total raised since launching in 2016 ($337M as of Dec 31 2019 according to Crowdfund Capital Advisors data)

- 2019 Reg CF capital raised grew ~59% year over year since 2018 (~$86M in 2018, ~$137M in 2019)

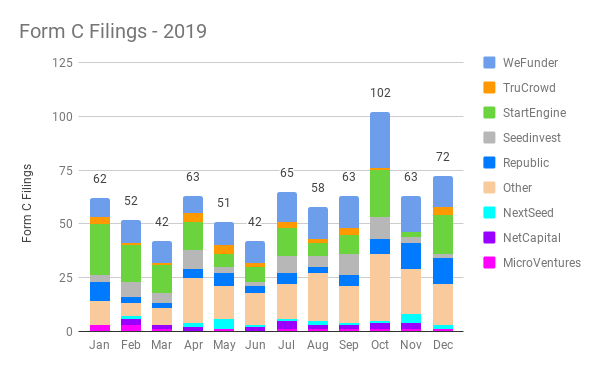

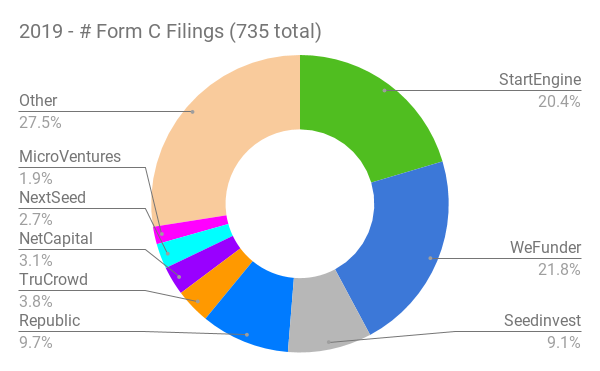

- 735 total Reg CF crowdfunding campaigns in 2019 (source: SEC’s EDGAR Form C Filings) – 4% decline from 2018 (763)

- Top funding portals added hundreds of thousands of investors each, reaching nearly 2X year-over-year investor growth from 2018

- At least one Reg CF business, CNS Pharma (Ticker: CNSP) from Republic, held their Initial Public Offering (IPO) on the NASDAQ exchange

- Secondary Markets for crowdfunding shares were announced (StartEngine Secondary) and secondary transfer platforms used in practice (Netcapital Secondary)

- Republic announced the Note Token and their plans to link it to future returns of portfolio companies (simulating an index fund of Republic startups)

- Claim your free bonus Notes here

Source: Crowdfund Capital Advisers (CCA), CCLEAR Dashboard

2019 Equity Crowdfunding Stats and Data

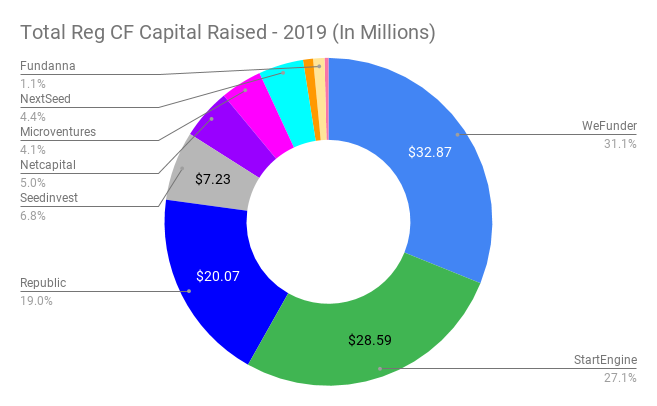

2019 Capital Raised by Funding Portal (Regulation Crowdfunding)

Source: Kingscrowd monthly funding reports

2019 Crowdfunding Campaigns (Reg CF) by Month and Portal

Source: SEC’s EDGAR Form C Filings

2019 Crowdfunding Campaigns by Portal (Reg CF)

Source: SEC’s EDGAR Form C Filings

Get all the latest equity crowdfunding data for the top eight funding portals by visiting our funding portal comparison page.

Startup Investor Communities – 2019 Stats

- WeFunder closes 2019 with over 400,000 investors

- Republic boasts a community of over 400,000 (not solely investors)

- Kingscrowd acquires Newchip’s aggregator tool and grows user base by 100,000+ startup investors

- Neil Patel’s Angels and Entrepreneurs Network grows to over 70,000 members in 6 months from launch

The Future of Equity Crowdfunding

Despite these advancements in 2019, there is still a lot of room for improvement and growth in the equity crowdfunding market.

Consider a few of these facts:

- In 2018, companies raised more than $1.7 Trillion (that’s with a T!) in capital under Regulation D

- The entirety of Reg CF capital raised to date ($337M+) is not even a fraction of a rounding error compared to Reg D (0.0000198%)

- Despite being a smaller overall private capital market compared to the US, one of the UK platforms, Seedrs, raised £283M ($366M USD) in 2019 alone

- The 2019 UK crowdinvesting market was estimated at $719M USD according to Statista

It’s obvious that the potential upside for equity crowdfunding is huge.

Looking Ahead – 2020 Predictions for Equity Crowdfunding

Given all the progress and momentum that the equity crowdfunding industry saw in 2019, what can we expect in 2020?

Our predictions are:

- Over $500M in total Reg CF capital raised by 2021

- More, higher-quality deal flow for Reg CF deals (especially with the passage of the Crowdfunding Amendments Act)

- Continued innovation in the industry – the announcement of passive index funds of startups (similar to this one in the UK), Secondary Markets, other innovations

- A re-thinking of how Reg CF and Reg D operate together with the amendment of the accredited investor definition later in 2020

First, there are a few big things to keep on the radars of startup investors.

Right now, the SEC is open to comment against their proposed changes to the accredited investor definition. If some of the proposed changes are adopted by the SEC, this would allow more non-accredited investors to be able to qualify as accredited investors by either passing an exam, holding certain professional credentials, or having other finance related experience. This would give many more sophisticated (as qualified via a test or actual experience, vs. just the wealth levels that are used today) investors to invest in Reg D offerings.

Second, in March 2019, the SEC released proposed changes to Reg CF and the exempt offering framework, which would finally make key updates to the regulations, such as:

- Increasing the Reg CF limit from $1.07 million to $5 million

- Updating 12-month investment limits (and removing the limit on accredited investors)

- Allowing the use of certain special purpose vehicles (SPVs), called “crowdfunding vehicles)

- Limiting the types of securities that can be sold and offered to be consistent with Reg A+ (e.g. disallowing SAFEs)

- Updating the “test the waters” and “demo day” communication restrictions for Reg CF companies

Many of these updates were recommended by WeFunder, the Association of Online Investment Platforms (AOIP), and many other individuals and organizations since the launch of Reg CF in 2016. Removing these obstacles from Reg CF should attract more issuers to platforms and incentivize more businesses to choose Reg CF as a viable way to raise capital, meaning higher quality and quantity of options for investors.

If growth continues at the current rate and some of the JOBS Act 3.0 changes are implemented, it isn’t unreasonable to predict that we may end the 2020 year having surpassed $500M in total Reg CF capital raised, and over $150-200M in capital in 2020 alone.

Overall, this bodes well for increased access to capital in startups, and thus for attracting more quality issuers and giving investors even better investment opportunities.

[…] to crowdfunding for investment. Since its beginnings in 2016, Regulation Crowdfunding had raised more than $300M through 2019 and grew by nearly 59 percent in the last year […]

[…] […]

[…] some of the traffic to the campaign. Reg CF has raised over $300M since inception in 2016, with the top four portals raising almost $90M in 2019 alone. The choice of portal is an important platform to help guide the campaign to success. For […]

[…] those startups that are successful at raising capital through equity crowdfunding, the average raise was approximately […]

[…] there’s tons of platforms for crowdfunding for startups and it’s been getting more popular each year. It’s becoming more common for young companies to look towards the crowd to […]

[…] total Reg CF investments rose to $137 million from $86 million in 2018. That’s an impressive 59% year-over-year […]

[…] total Reg CF investments rose to $137 million from $86 million in 2018. That’s an impressive 59% year-over-year […]

[…] at the top six websites to start with, which currently have the majority of all the offerings. 80% of all Schedule C deal offerings are currently on the six sites listed below, as of October 2018. From there, I’d suggest you […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new policies went into result in 2016, fairness regulation crowdfunding has totaled additional than $300 million, according to Crowdfund Capital Advisors, with an normal elevate of $263,719 per company, according […]

[…] the fact that the new policies went into impact in 2016, equity regulation crowdfunding has totaled a lot more than $300 million, according to Crowdfund Funds Advisors, with an typical increase of $263,719 for every business, in […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the reason that new guidelines went into impact in 2016, fairness regulation crowdfunding has totaled more than $300 million, in keeping with Crowdfund Capital Advisors, with a mean increase of $263,719 per firm, in keeping […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] that the new regulations went into influence in 2016, fairness regulation crowdfunding has totaled far more than $300 million, according to Crowdfund Money Advisors, with an average elevate of $263,719 for every corporation, […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the new rules went into effect in 2016, equity regulation crowdfunding has totaled more than $300 million, according to Crowdfund Capital Advisors, with an average raise of $263,719 per company, according […]

[…] the reason that new guidelines went into impact in 2016, fairness regulation crowdfunding has totaled greater than $300 million, in accordance with Crowdfund Capital Advisors, with a mean increase of $263,719 per firm, in […]

[…] The proof of these changes lies, as they say, in the pudding, Since the new rules went into effect in 2016, more than $300 […]

[…] (1) 2019 US Equity Crowdfunding Stats – Year in Review – Crowdwise […]