Four Lessons Investors can Learn from Turkeys

While many people around the US are giving thanks today and celebrating with friends and family, one guest at each Thanksgiving feast are completely and utterly surprised in a bad way. Those individuals are the turkeys.

Today, Thanksgiving Day, we’ll see what lessons we can learn from the turkey problem, and how to apply those lessons to investing to ensure we don’t become a turkey in equity crowdfunding.

The Turkey Problem

In his book Antifragile: Things That Gain from Disorder (Amazon Associates link), Nassim Nicholas Taleb introduces the concept of the turkey problem.

Turkeys spend their entire lives being fed, pampered, and led to believe in every way that butchers love them. Each day that the turkey is alive and being fed only strengthens the turkey’s confidence in this model and belief. However, come Thanksgiving each year, they are in for a big shock.

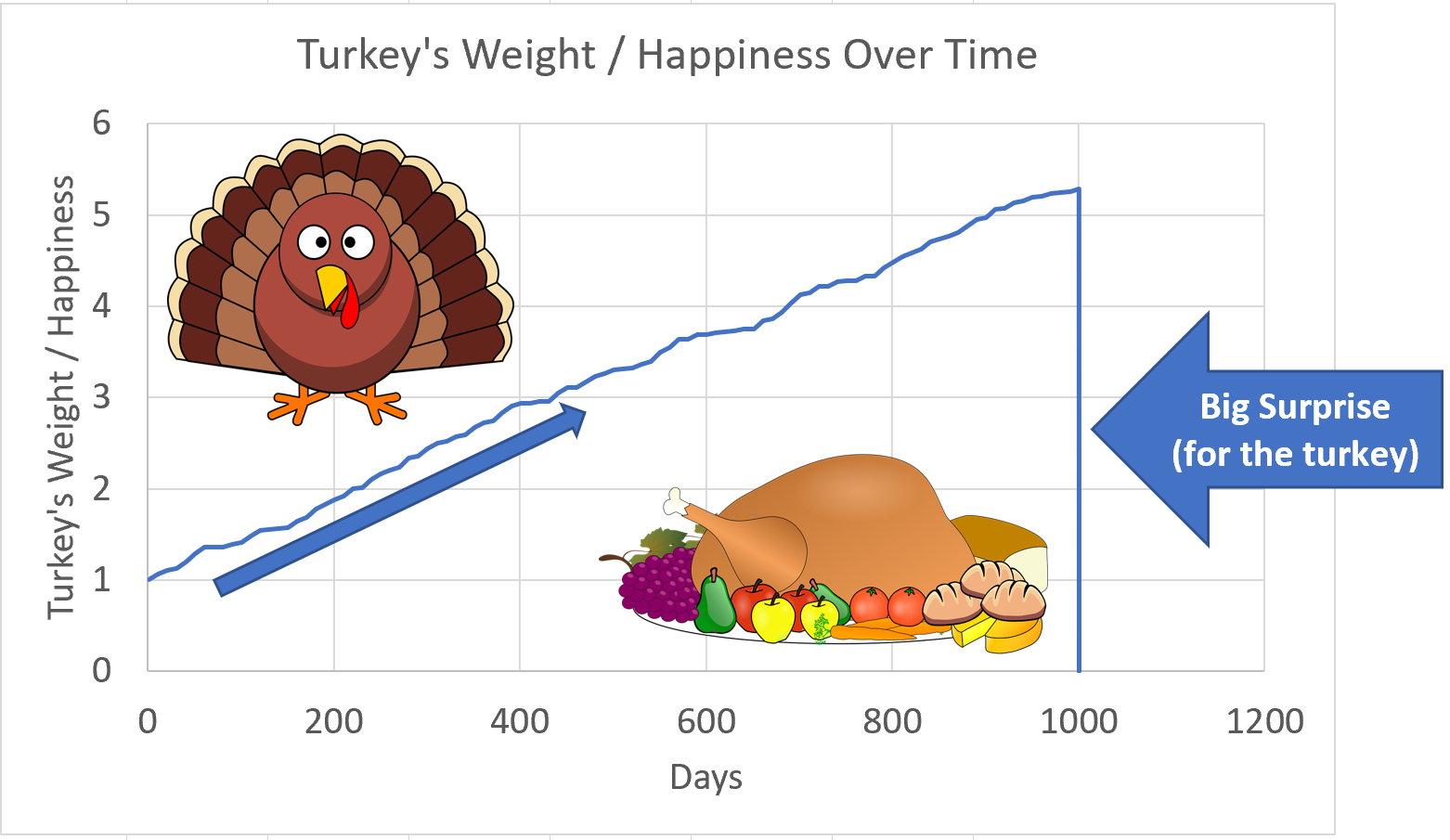

Here is a visual representation of the turkey problem:

As Taleb pointed out, “Consider that the [turkey’s] feeling of safety reached its maximum when the risk was at the highest!”

However, this is not at all a surprise to the butcher, who had known about the plan all along.

If this sounds familiar to any financial crashes or mispredictions in the past decade or two, it’s because investors can fall into the same trap as the turkey. Here, the market (or economy) is like the butcher, and you (the investor) are the turkey.

Let’s see how we can learn from the turkey’s example to apply some of these principles and make ourselves better investors.

Lessons from the Turkey Problem Applied to Investing

Reflecting on the above chart, it may not look that different from an investment portfolio that is built over time. We often rely on historical data and trends to make future predictions and guide our investments, and seeing those predictions come true only reinforces our confidence in those models.

So how do we apply the lessons from the turkey problem to investing? Let’s look at four of the failures in the turkey’s logic that can be applied to your investments. They are:

- Mistaking absence of evidence and evidence of absence

- Overconfidence in using the past to predict the future

- Not using the barbell strategy or diversifying among potential outcomes

- Not understanding the Maximum Downside Exposure (MDE) and mitigating risk

Lesson 1 – Mistaking absence of evidence for evidence of absence

The first lesson is mistaking the absence of evidence for evidence of absence. This is also referred to as the problem of induction in philosophy.

For the turkey, until Thanksgiving Day, there is no evidence that the butcher actually has the turkey’s best interests at heart. This absence of evidence, however, should not be mistaken for evidence that the butcher actually does have the turkey’s best interests at heart.

Using Taleb’s example from The Black Swan (Amazon Associates link), if every swan you have ever seen was white, you may infer that “all swans are white”. However, seeing a single black swan would disprove that inference. In this case, not seeing a black swan is an absence of evidence. It is easy to prove that not all swans are white by finding a single black swan, but impossible to prove that all swans are white just because you haven’t seen any other colored swans (yet).

What this means for crowdfund investing: let’s say you are looking at a list of potential startups to invest in. You notice that no sewing company in history has ever had a $1 billion exit before. Does that mean no sewing company could ever have a $1B exit?

While this is an absence of evidence, it obviously does not imply that no sewing company could ever have a $1B exit. Furthermore, think about what new trends in the world could potentially change that moving forward. Thus, pay attention to your implicit assumptions when looking at deals and make sure that you aren’t falling for the problem of induction.

Lesson 2 – Don’t become overconfident when using the past to predict the future

Whether it’s investing in public or private markets, both individuals and professional investors often rely on data sets and models to guide their investment decisions.

Whether it’s investing in public or private markets, both individuals and professional investors often rely on data sets and models to guide their investment decisions.

While there can be many advantages, and thus profits, to be gained from accurate models, it is crucial to not become over-reliant on these tools or fall victim to the belief that you have a crystal ball that predicts the future. After all, these are often models built solely on what we know from the past, and that can lead to a “turkey surprise” when something completely new or unexpected comes along.

Take the example of designing cities and buildings for worst-case floods. Often, an engineer could use the 100 or 200-year flood levels when designing buildings and barriers. Statistically, that will suffice most of the time (200-year flood implies a 1 in 200 chance in any given year, or 0.2%). But what happens when a 500- or 1000-year flood, although extremely rare, comes along?

Similarly, what happens if climate change or other factors have modified the equation so much that the 500-year flood happens three times in three years? Note: this should be a (1/500)^3 = 0.0000008% chance, but it actually happened recently.

The answer is that bad and unexpected things do happen, because people often miscalculate the odds based on what they have seen in the past. The Fukushima meltdown is an example of this when under-designing against the worst-case earthquakes.

What this means for crowdfund investing: don’t be over-reliant on or over-confident in your models. Don’t be fooled into thinking that they actually predict the real future. They are simply tools to aid you in decision making, but you should always question their validity. Always remain flexible and ask “what if” type questions, since the only thing constant in the world is change.

So, how do you invest knowing that even the greatest models can sometimes be incorrect?

Lesson 3 – Use the barbell strategy to invest

In Antifragile, Taleb discusses something called the barbell portfolio strategy (not to be confused with a barbell strategy that invests in bonds of varying maturity dates). Like a barbell shape, where the two plates on the ends are connected by a bar, he suggests that investing in hyper-conservative and hyper-risky assets, with nothing invested in moderate-risk investments in the middle, is the best way to mitigate unknown risk and still have exposure to maximum upside with a limited downside.

Taleb believes that risk is often misunderstood and/or miscalculated for moderate risk investments, and so people are often blindsided by these investments due to underestimating the risk. No one can know with absolute certainty what the market will do. Thus, by having a small portion of investments in hyper-aggressive assets (e.g. startups, individual stocks, cryptocurrencies, etc.), you have diversified exposure to an unlimited (unknown) upside with a limited downside.

This portfolio has the added benefit of that – when large crashes and market corrections do take place – the large portion of your portfolio that was in hyper-conservative assets is still safe and can now be deployed to take advantage of depressed prices.

What this means for crowdfund investing: early-stage companies can be good examples of hyper-aggressive investments in the barbell strategy. While the majority of those private companies will fail, the few companies that succeed can pay huge rewards for early investors.

Note that diversification is still a crucial element, even with your hyper-aggressive and hyper-conservative investments. Thus, it is important to spread your investments not only among many startups (since the majority will fail), but also across multiple industries and products.

Remember, instead of trying to predict the future, your goal is to create a portfolio that will benefit regardless of what surprises the future brings.

Lesson 4 – Know your Maximum Downside Exposure (MDE)

It’s a fact of life that catastrophes will happen. When they do occur, a concept that can help you be more prepared than others is knowing your portfolio’s Maximum Downside Exposure (MDE).

It’s a fact of life that catastrophes will happen. When they do occur, a concept that can help you be more prepared than others is knowing your portfolio’s Maximum Downside Exposure (MDE).

In the case of the turkey problem, the turkey was all-in. So when Thanksgiving came around, the turkey lost everything in one fell swoop due to their misjudgment of the situation.

In addition to using diversification to ensure that industry-specific catastrophes (e.g. the real estate bubble, the dot-com bubble, the cryptocurrency bubble) don’t impact your entire portfolio, investors can also use a strategy called hedging.

What is hedging?

Do you own car insurance? Do you ever plan to actually use it?

Since you hope you’ll never have to use it, why do we bother to buy insurance? Essentially, you are paying a small monthly or annual premium to reduce the negative impact in the event that a catastrophic event – however unlikely – does occur.

Hedging investments is similar, and there are many ways to hedge that are outside the scope of this article. Understand that you’re paying a premium to reduce volatility and risk. Thus, you will have lower overall returns, but you will also have a lower risk of losing it all (like investing everything in a single stock vs. diversifying in an index).

What this means for crowdfund investing: while the secondary markets to buy and sell (and perhaps someday, to short) private equity investments are still being developed for equity crowdfunding, you can impact your long-term investment returns by being aware of your MDE.

Do you have 50% in inflation-protected cash and 50% in stocks? If stocks crash, your MDE is 50%. Or if you have 100% in stocks, bonds, and startups, your MDE could be 100% if the economy goes up in flames.

Summarizing the Turkey Problem in Investing

To recap, the four principles of the turkey problem that can be applied to investing are:

- Understand the difference between absence of evidence and evidence of absence

- Don’t be fooled that models built on historical data can accurately predict the future

- Use the barbell strategy (splitting hyper-conservative and hyper-aggressive exposure)

- Understand your investments’ Maximum Downside Exposure (MDE)

Taleb’s book Antifragile has many other lessons and thought experiments that can be applied in many areas of life, not only in investing.

If you enjoy this brief takeaway and summary from Antifragile, be sure to head on over to the CrowdWise books page to check out numerous books that have valuable lessons to apply to your investing strategy.

To get an investment book summary delivered right to your inbox each time we finish and summarize a book, enter your name and email below to join the CrowdWise investing book club.

Make sure you aren’t investing like a turkey. Happy Thanksgiving.

[…] of these events are better represented by power laws. Similar to the turkey problem in investing, they are completely unexpected or statistically improbable before they occur, but […]