SEC Accredited Investor Definition Update – What Investors Need to Know

Despite all the uncertainty and change in the air due to the current economic climate, capital markets are continuing to evolve. This week, the U.S. Securities and Exchange Commission (SEC) announced that they will be adopting proposed changes to the definition of an accredited investor. While the SEC does “…not expect that the number of newly eligible individual accredited investors to be significant…”, and while the new definition still won’t allow anyone who is motivated enough to become accredited, this is still a big deal.

According to Chairman Jay Clayton:

“For the first time, individuals will be permitted to participate in our private capital markets not only based on their income or net worth, but also based on established, clear measures of financial sophistication.”

As the Chairman notes, the previous qualifications to become an accredited investor were based solely on net worth and annual income requirements. In adopting these changes, the SEC acknowledges that one’s wealth is not necessarily an accurate measure of investor sophistication and/or risk tolerance. And while this week’s announcement is only an incremental change, it signifies a willingness to change and a shift in the Commission’s mindset that sets the stage for future changes.

Investors in Regulation Crowdfunding (Reg CF) are probably wondering why they should care, since they can already invest in startups thanks to the JOBS Act. Thus, today we will be covering:

- Who qualifies as an accredited investor under the new 2020 definition

- Why crowdfunding investors should care about the changes

- What these changes might mean moving forward

Who Qualifies as an Accredited Investor Under the 2020 New Definition

While the broadened definition of an accredited investor added certain family offices, government bodies, and other entities with over $5 million in assets, we will focus on the new natural persons (i.e. individuals) who qualify.

There are currently three new ways of qualifying as an accredited investor under to the SEC’s 2020 updates. Accredited investors now include

- Series 7, Series 65, and Series 82 license holders who are in “good standing”,

- Knowledgeable employees of private funds, and

- Spousal equivalents (allows spouses to pool their finances in order to qualify).

The income and net worth requirement ($200,000 a year income for the past two years, or $300,000 joint with a spouse, or over $1 million net worth excluding one’s primary residence) remains in place and unchanged under the revised definition.

Unfortunately, this means that if you aren’t already one of the above license holders (or work for a firm that would allow that) nor part of a private fund, there is still no way for you to qualify unless you meet the minimum wealth requirements.

However, the Commission has specifically noted that they may add other qualifications “…based on certain professional certifications, designations or credentials or other credentials issued by an accredited educational institution, which the Commission may designate from time to time by order.” Thus, they have left the door open for the public and for other institutions to propose additional credential and license programs that could qualify individuals as accredited investors in the future.

Can I Become an Accredited Investor if I’m from a non-finance background or industry?

Unfortunately, the answer to this is still no, unless you meet the income or net worth requirements. Thus, even someone like me, with over 100+ early-stage investments and who owns and runs a business focused on educating investors how to invest in the private markets, can’t become accredited unless I meet the minimum wealth requirements.

Even if an individual is extremely motivated and financially sophisticated, they cannot sit for a Series 7 or 82 exam without a sponsoring firm. And while they can take and pass the Series 65 exam without a sponsoring firm, they can’t obtain an Investment Adviser Representative (IAR) license without also registering with FINRA and their state under an investment adviser company, which is completely impractical for someone who never plans to practice as an IAR and simply wants to become an accredited investor.

And it appears that it is the license, not the exam itself, that the Commission has decided to use as the means for qualifying accredited investors.

We hope that the Commission will consider additional credentials and exams in the future that will allow motivated and sophisticated non-finance professionals to demonstrate their financial sophistication and knowledge to be able to become accredited.

Why Crowdfunding Investors Should Care

Non-accredited investors can already invest in startups up to their 12-month Reg CF limit. So why should they care about the new accredited investor changes?

There are three primary reasons that equity crowdfunding investors might consider becoming accredited investors, including

- Accessing Reg D deal flow (funds and syndicates such as AngelList, as well as Reg D offerings on platforms like Wefunder and Republic)

- Removing the annual investment limits under Reg CF, assuming that the SEC’s recent proposed changes pass

- Increasing investment options due to Reg CF transfer restrictions on secondary markets

Access to Reg D Deal Flow

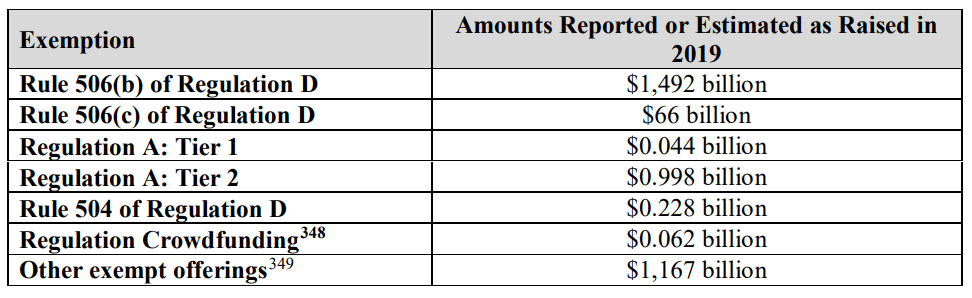

In 2019, Reg D accounted for over $1.5 trillion of private capital raised. Reg A+ was a little over $1 billion, while Reg CF came in at $62 million. That means that capital raised under Reg CF was 0.004% of Reg D (506(b) and 506(c)).

If you were a startup looking to raise capital, where do you think you would turn to first? Where 99.996% of the capital was raised in 2019, or where 0.004% of the capital was raised?

Granted, there are unique benefits to running a Reg CF campaign and the industry has been quickly accelerating so far in 2020. No one wants Reg CF to be as successful as Reg D as we do. However, non-accredited investors will never be able to say that they have access to a similar quantity and quality of deals until Reg CF becomes more of a mainstream and accepted way of raising capital.

Thus, becoming an accredited investor can open up new investment options such as participating in AngelList and other syndicates, AngelList and other accredited-only funds, and Reg D 506(b) and 506(c) offerings. For example, it is often the case that my Reg CF companies will email existing investors and open a follow-on “accredited-only” round at some point in the future. If you want to be able to participate in these types of rounds, you must be an accredited investor.

Remove the Annual Investment Limit of Reg CF

While this hasn’t yet been approved as of September 2020, the hope is that the SEC will adopt recent proposed changes to Reg CF, including the removal of investment limits for accredited investors. The current Reg CF limits are intended to protect investors from allocating too much capital into a single risky deal; however, there may be unique financial situations or circumstances where the investment limits don’t properly account for one’s financial means or risk tolerance for a particular deal.

Becoming an accredited investor will be able to remove the restriction of Reg CF limits once the proposed exempt offering framework changes are adopted.

Increased Investment Options due to Reg CF Transfer Restrictions

Lastly, becoming an accredited investor may open up more investment opportunities on secondary markets, such as Netcapital. This is because Reg CF currently prohibits the transfer or sale of Reg CF securities during the first twelve (12) months following the primary offering, unless the sale is to certain qualifying entities, one of which is an accredited investor.

Especially once more secondary platforms such as StartEngine Secondary go live, only accredited investors will be able to purchase shares of Reg CF investors who are trying to sell their shares within the first twelve months. While risk must be considered in all these situations (i.e. why do you think this investor is trying to sell their shares so soon?), it could potentially lead some accredited investors to get some good deals on shares that otherwise wouldn’t be available to non-accredited investors.

What the Changes Might Foreshadow

The SEC said it themselves that they don’t believe this new definition will bring in a significant number of newly accredited investors. Furthermore, the Commission went on to say that they expected “…the amount of capital invested by such newly eligible individual investors to have minimal effects on the private offering market generally.”

So why is everyone excited about these changes?

For one, it signifies an important shift in the mindset of the Commission. By adopting these changes, the Commission is acknowledging that there are much better ways of determining financial sophistication and the “ability to bear the risk of a loss” compared to simply using one’s income and net worth.

To paraphrase one of the popular examples given in many of the comment letters: “The government doesn’t put any restrictions on gamblers who want to walk into a casino and put their life savings down on red, and yet we tell those same individuals that they can’t invest anything in a promising founder that they met while working on an idea to change the world, unless they have a certain income or net worth.” It just doesn’t make sense.

Second, it demonstrates that the Commission is willing to adapt and change, even in uncertain and potentially risky economic environments. A good number of the comment letters were strongly opposed to the changes to the accredited investor definition, claiming that it put investor protection at risk or had the potential to erode the public markets in favor of the private (exempt) markets. It would be much easier for the SEC to leave things in the status quo. So by adopting these changes, the Commission has taken a risk that could potentially result in negative consequences but that they believe (as do we) will net more positive outcomes.

As JFK once said and we firmly believe:

“There are costs and risks to a program of action, but they are far less than the long range risks and costs of comfortable inaction.”

So what might the future hold?

First, this bodes well for the exempt offering framework changes (such as increasing the Reg CF cap to $5 million) that were proposed earlier this year. This shows that the Commission is willing to take action and make changes on issues that they believe will have a positive (although uncertain) impact.

Second, the Commission has left the door wide open for future exams and credential programs for accredited investors. We believe that the ideal accreditation method for non-finance industry professionals in the future will be an accredited investor specific exam. Thus, expect that the SEC could propose other credentials (such as CFA, CFP, and specific accredited investor exams or credentials) as a future means for qualifying individuals.

Regardless of the future, we applaud the Commission’s willingness thus far to continue to evolve and adapt to the constantly changing environment and to help bolster opportunities for both entrepreneurs and for investors.

Great read, Brian. I found the ‘Increased Investment Options due to Reg CF Transfer Restrictions’ and ‘Remove the Annual Investment Limit of Reg CF’ sub-sections really important for what I need to focus on in the near future. You continue to add value to my understanding of investing, thanks! I’m excited to learn more as the SEC chooses growth, rather than stagnate or decay.

Thanks for the kind words, Caleb! If there are any other areas that you’re interested in, please let me know and I’ll do my best to try and put some more content together to help you out.

[…] United States Securities and Alternate Fee (SEC) followed amendments to the authorized investor definition, which permit positive execs, certification holders, and others to qualify with no need to satisfy […]