Top 7 Methods for Valuing Startups – Valuation (Part 2)

Valuation often feels like a tug of war. On one end, there are founders who want the highest valuation based on optimistic future revenues. On the other end, there are investors who want the lowest valuation based on current revenues and metrics. Since the final valuation typically lies somewhere between the two extremes, how do founders and investors agree on valuation?

There are many methods for valuing early-stage companies. Today, we will look at the top seven pre-revenue and post-revenue startup valuation methods. We will also consider how valuation works on websites that offer equity crowdfunding deals.

Despite the guidance that these methods provide to investors, there is no substitute or shortcut for practical, real-world experience. These methods are tools for early-stage investors to use. There is no silver bullet that will give you an exact valuation every time.

The more startups that you analyze and perform due diligence on, the more you will hone your sense of what the market value of a given startup is. Nearly all of these methods still depend on finding what the average pre-money valuation is for similar startups. So your selection of the benchmark startups and the assessments of each area are just as important as the methods themselves.

In Valuation Part 1, we looked at what valuation is, why it is important for startup investors, and covered some basic terminology. Now let’s roll up our sleeves and learn how investors and founders go about valuing a pre-revenue (or very early revenue) startup.

Early-Stage Valuation Methods

There are as many ways to value a company as there are flavors of ice cream. Thus, we have selected the top seven methods in terms of their applicability to early-stage startups and their popularity among angels and venture capitalists.

Ranked in order of increasing complexity, the top methods for early-stage startup valuation are:

Pre-Revenue Methods

Post-Revenue Methods

The more complex methods, such as DCF, Comps and First Chicago Method, tend to be more popular with and useful for VC firms. This is because they are investing at later stages (when the business is generating revenues) and investing much larger sums of money in each startup. Thus, they can afford to spend a lot more time performing due diligence and estimating valuations.

1 – The Berkus Method

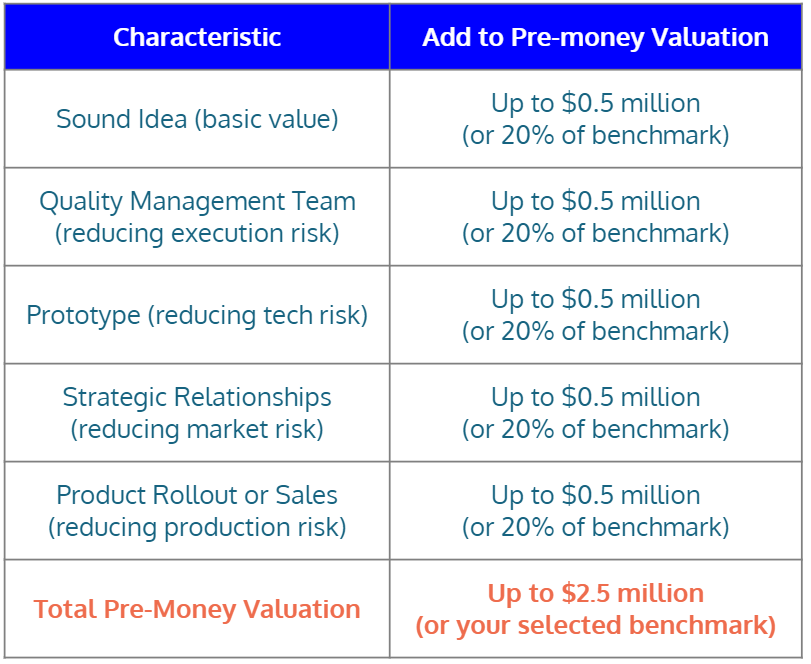

The Berkus Method was first devised in the mid-1990s by David Berkus, and last updated in 2016. An angel and VC investor himself, David says “…[the Berkus Method] was created specifically for the earliest stage investments as a way to find a starting point without relying upon the founder’s financial forecasts.”

The Berkus Method looks at five key areas of a startup and assigns a value ranging from zero to $500,000 for each area. These areas are:

- Sound Idea

- Quality Management Team

- Prototype

- Strategic Relationships

- Product Rollout or Sales

The sum of all the assigned values results in the pre-money valuation for the startup.

Since the original Berkus Method had five areas with a maximum of $500k, that leads to a theoretical maximum pre-money valuation of $2.5 million.

Thus, an important modification to the Berkus Method (and David Berkus himself suggests that it must be flexible, both in terms of the areas and the amounts) is to adjust the theoretical maximum depending on geography, sector, and other factors.

For example, if the average valuation for a given startup in Silicon Valley is $6 million, then each of the five areas would get up to 20% of $6M, or $1.2 million each instead of $500k each.

The traditional Berkus Method is:

Pros and Cons of the Berkus Method

- Pros: quick, high-level, and doesn’t rely on forecasts.

- Cons: weighs all five areas the same in terms of importance, requires skill to know how much to credit each area, ignores some areas that the more detailed methods cover, and is dependent on choosing an appropriate benchmark startup valuation to set the maximum value (e.g., $2.5M max vs. $5M max).

2 – The Scorecard Method

Famed angel investors Bill Payne and David S. Rose (author of the book Angel Investing) both believe that the Scorecard Method is the most useful of all the early-stage valuation methods. Bill supports this method so much that it is sometimes referred to as the “Bill Payne” valuation method.

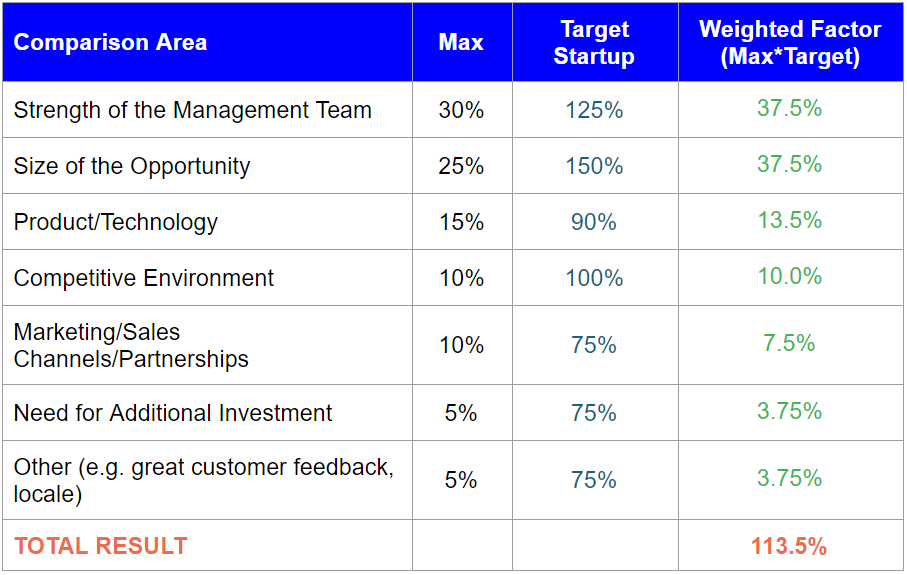

The Scorecard method starts by finding a representative group of startups and their range of valuations. Then, you assess the target startup in seven areas, and compare how your target startup stacks up against the representative startups in your sample.

If the startup in question is superior to the comparison group, then you assign relative values, such as 125% or 150%. If the startup is lacking in comparison, then approximate the degree to which it falls short of the benchmark (e.g. 50%, 75%, 90%).

Next, multiply each of your assessments by the maximum factor of each category (as shown in the table below), and then sum up all the weighted results to get the final adjustment multiple.

Finally, multiply that multiple by the average valuation from the startup group (or, if you wish, you can multiply it by the min/max to get a range), and you end up with the final estimated valuation for the startup in question.

The seven areas of the Scorecard method and their corresponding maximum values are:

- Strength of the Management Team (30%)

- Size of the Opportunity (25%)

- Product/Technology (15%)

- Competitive Environment (10%)

- Marketing/Sales, Channels/Partnerships (10%)

- Need for Additional Investment (5%)

- Other (e.g., great customer feedback) (5%)

An example of applying the Scorecard valuation method to a startup that has a strong management team, exceptional potential market opportunity, less-than-average product offering, average competition, and less-than-average marketing/sales and other areas would result in:

Assume that the comparison group of startups in the above example had an average valuation of $4 million. Thus, multiplying $4M*(1.135) would result in a $4.54M estimated valuation for the startup in question.

Pros and Cons of the Scorecard Method

- Pros: covers more areas than the Berkus method, but is still relatively straightforward and easy to apply; doesn’t weigh all areas the same as the Berkus method does; is the method of choice by Bill Payne and David S. Rose and many other angels.

- Cons: requires skill to know how much to credit each area, ignores some areas that the more detailed methods cover, and is dependent on choosing an appropriate benchmark startup valuation to set the maximum value (e.g., $2.5M max vs. $5M max).

3 – Risk Factor Summation Method

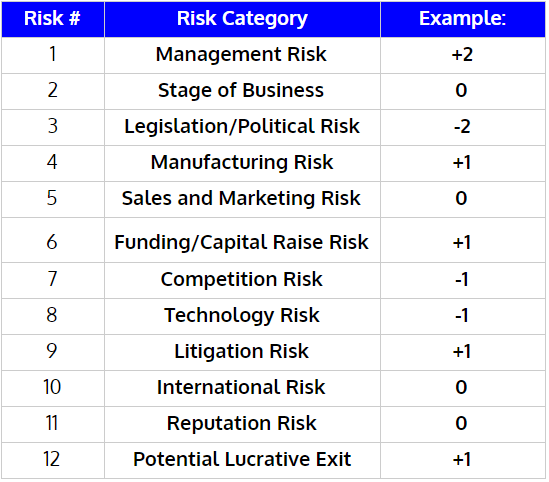

This method looks at a list of 12 risk areas and then assigns a value ranging from -2 to +2, depending on how the target startup compares to the selected group of benchmark startups.

In a similar fashion to the last two methods, you must start with the pre-money valuations for other pre-revenue companies in the region. Then, for each +/-1 increment in the risk assessment, you adjust the startup’s value by $250k. For example, a -2 rating corresponds to -$500k, a -1 to -$250k, a +1 to $250k, and a +2 to +$500k.

The Risk Factor Summation Method risk areas are:

- Management Risk

- Stage of Business

- Legislation/Political Risk

- Manufacturing Risk

- Sales and Marketing Risk

- Funding/Capital Raise Risk

- Competition Risk

- Technology Risk

- Litigation Risk

- International Risk

- Reputation Risk

- Potential Lucrative Exit Risk

An example of applying the Risk Factor Summation Method would be:

In the above example, since the sum of the third column results in a net result of +2, you would add 2*($250k) = $500k to the average valuation that you started with. So if the average valuation of startups in the region is determined to be $3M, this startup may be valued closer to $3M+$0.5M = $3.5M.

Pros and Cons of Risk Factor Summation Method

- Pros: considers areas that the Berkus and Scorecard methods overlook, and is relatively straightforward to apply when comparing other startups.

- Cons: this is a glass-half-empty way of assessing a startup – i.e. it looks at all the things that could go wrong, but doesn’t consider what could go right. It also assumes everything is equally weighted (e.g. a strong management team only gets the same weighting as a good litigation risk, whereas a team is generally much more important than other areas). Lastly, it still relies on the initial group of startups that you select as the representative benchmark for comparison.

4 – The Venture Capital Method

The Venture Capital method works by starting with the end in mind. It requires estimating the terminal value (in a harvest year, when it is sold or acquired), your desired ROI, and then backing out the post-money and pre-money valuations from there.

Because of this, it can be a useful indicator in terms of the valuation that would be required for you to invest in order to get a given return, assuming all goes to plan. However, one shortcoming is that unless you use the company’s anticipated growth rate for the ROI number (which can be nearly impossible to estimate for pre-revenue startups), it’s only telling you what valuation you need to invest at, not what the valuation of the startup is worth based on the team, product, or anything else.

The steps to the VC Method of valuation are:

- Estimate the terminal value (i.e. valuation during a future exit year) of the startup.

- Use any suitable method for estimating this – e.g. looking at similar startup exits in the industry, etc.

- Estimate your required (or expected) rate of return as an exit multiple.

- Use our portfolio return calculator, or use any other estimates (e.g. 20X return). Just keep in mind that a 25% portfolio IRR is very different from the individual startup IRR that will be required, since more than 50% of your investments will likely fail. More on that in our blog post here.

- Calculate post-money valuation: discount the terminal value by your required (or expected) rate of return (i.e. exit multiple).

- Post-Money Valuation = Terminal Value / Exit Multiple

- Calculate pre-money valuation: subtract the total new investor capital in the current round from the post-money valuation obtained in Step 2 to get the pre-money valuation

- Pre-Money Valuation = Post-Money Valuation – (Current Round Size)

- Account for dilution to obtain the final pre-money valuation estimate

- Pre-Money Valuation * (expected dilution) = Final Pre-Money Valuation

Venture Capital Valuation Method Example

- Assume you find similar startups to the one you are looking at have exited for $50M

- You determine that your required return on each successful investment is a 20X multiple

- Post-Money Valuation is $50M / 20x = $2.5M

- If the startup is raising $500k in the current round, it would have a $2M pre-money valuation

- Assuming 50% dilution, $2M * 50% = $1M pre-money valuation

Note: the resulting $1M pre-money valuation is what is required for you to meet your investment goals. This is not an estimate of what the company is actually worth today, since it doesn’t look at any of the factors of the team, product, traction, risks, etc.

Pros and Cons of the VC Valuation Method

- Pros: useful for calculating required or expected valuations for pre-revenue businesses.

- Cons: doesn’t look at aspects of the business (i.e. team, product, traction, risks, etc.) in determining a valuation – it only depends on your required rate of return. It still requires a selection of representative startups to estimate future potential terminal values.

Post-Revenue Valuation Methods

Next, we will look at three of the most common post-revenue valuation methods. These will be less practical and useful to the micro-angel and crowdfunding investor, but it is worth covering to see some other ways that valuations are estimated.

1 – Discounted Cash Flow (DCF) Method

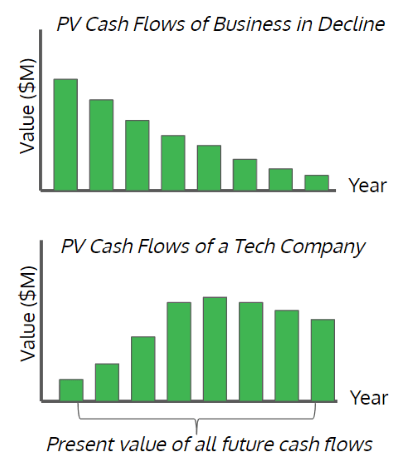

As the name implies, this method involves projecting future cash flows of a business. Then, those cash flows are discounted to the present value, and the sum of all those cash flows is the present-day valuation.

In Peter Thiel’s book Zero to One, he illustrates the difference in cash flows between a company that is in decline and a tech startup:

“Most of the value of low-growth businesses is in the near term. Technology companies follow the opposite trajectory. They often lose money for the first few years: it takes time to build valuable things, and that means delayed revenue. Most of a tech company’s value will come at least 10 to 15 years in the future.” -Peter Thiel, Zero to One

Thus, the DCF method attempts to estimate all these future cash flows and then calculate the present value of those cash flows.

Because the DCF method relies on accurately projecting future revenues, it is more suitable for mature companies with predictable growth rates and existing revenues. This is because if you try to predict what the future cash-flows of a pre- or early-revenue startup will look like, your best-guess is at best an approximation. What’s more likely, though, is that your projections are way off in either one direction or the other. No one can predict the future.

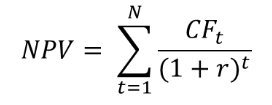

The equation to calculate the net present value (NPV) of future cash flows is:

where:

- CFt = cash flow for each period

- r = discount (interest) rate

- t = year

- N = total number of years

Pros and Cons of DCF Method

- Pros: can provide an intrinsic value of a business based on estimated future cash flows.

- Cons: “Garbage in, Garbage out”: it’s only as accurate as the cash flows that you predict. It’s highly speculative beyond a few years out, especially for startups where that is where the majority of startup value comes from (i.e. 5-15+ years out). Most appropriate for more mature businesses with predictable growth.

2 – Comparables Method (i.e. Market “Comps”)

The Comparables or “comps” method involves looking at similar businesses in an industry and what valuations they have raised money at, and then adjusting your valuation for a target startup based on comparing key metrics (e.g., revenue, Monthly Active Users (MAU), etc.).

While it’s common to use revenue or earnings as a metric (think of price/earnings ratios in the public markets), it can be applied to other metrics such as active users. Thus, it can also be applied to pre-revenue, earlier-stage startups.

The process to use the Comps method for valuation is:

- Select businesses from the same niche or industry that are representative of the target startup

- Identify Key Performance Indicators (KPIs), such as MAUs, revenue, or other relevant metrics

- Valuation: Look at recent M&A data (e.g. from Crunchbase) to get the latest valuation for each startup

- KPI: approximate what the value of the KPI was at the time of the valuation

- Comp ratio: divide the valuation by the KPI to get the comp ratio.

- Average the comp ratios for the selected comparison startups (or use min/max to get a range)

- Multiply your startup’s KPI by the comp ratio to arrive at a valuation

| Startup Name | Last Valuation | KPI | Comp Ratio Valuation / KPI |

| Startup A | $x million | y | x / y |

| Startup B | $x million | y | x / y |

| Startup … | … | … | … |

For example, let’s assume you are looking at a new startup that is creating a new type of niche dating app.

After looking at several other recent niche dating app startups, you decide that DAU (daily active users) is one of the most important metrics pre-revenue. Thus, you collect the DAU metrics for each of these other dating app startups, as well as what valuations they raised at.

Assume that your comparison companies looked like this:

| Niche Dating Startup Name | Last Valuation | KPI – DAU at time of Valuation | Valuation / DAU |

| DracuDate – Dating for Vampires | $25 million | 4.17 million users | 6 |

| SwipeStripes – Tinder for Zebras | $50 million | 12.5 million users | 4 |

After gathering a few more examples, you see that the average for Valuation/DAU tends to be around $5.0 / DAU. Interesting side note: Facebook had ~1.6B DAU as of June 2019 and around a $512B market cap, meaning the current DAU market rate for Facebook is $320/DAU in comparison.

Thus, if the startup you were valuing currently has 750k DAU, then $5*750k = $3.75M valuation using the comps method.

One of the most common metrics is valuing a startup based on a multiple of its revenue – once it is generating some. For example, if the going market rate for a class of startups was 5X revenues, and your startup was generating $500k annual recurring revenue (ARR), the approximate value would be 5X*$500k = $2.5M.

Typical Revenue Multiples

What are some example ranges of revenue multiples? It varies widely by stage, profitability, and other factors, but here is some guidance on revenue multiples:

- Public company examples (Enterprise Value / Sales, as of 9/30/19)

- Amazon – 3.5X revenues (~25% gross margin)

- Apple – 4.0X revenues (~40% gross margin)

- Facebook – 7.5X revenues

- Uber – 5.1X revenues

- Typical startups raise at 4X-10X annual revenues*

- SaaS or trending startups may be higher, e.g., 10X-20X*

- “Hot” startups may be 50X+ (MSFT invested in FB at 100X)

- *Reference

Pros and Cons of Comps Method

- Pros: based on the market value of similar startups; doesn’t rely on founder projections; can give a very quick approximation of value if you are familiar with the KPI multiple (e.g. revenue multiple) for a certain group of startups (one reason why some investors prefer to specialize in certain types of startup, e.g., enterprise SaaS).

- Cons: it assumes that your target startup will have a similar outcome to other startups. Knowing which metric/KPI to use when using Comps can be critical. It ignores the talent of the actual team or product in this instance, as well as unique risks.

3 – First Chicago Method

Last on our list is the First Chicago Method. I like to think of it as a combination of the DCF and Comps methods, while also taking best and worst case scenarios into account.

Because of this, it is also the most complicated and time-consuming method on this list. Thus, it may be more suitable for higher-dollar angel investors and VC firms rather than the crowdfunding investor or micro-angel.

The first element of the First Chicago Method is that you must construct your valuation estimation for three scenarios, and assign a probability to each scenario:

- Best Case

- Average

- Worst Case

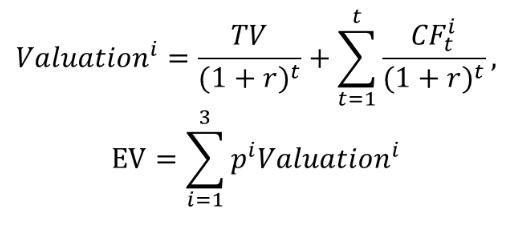

To estimate the valuation in each case, this method uses both the terminal value (e.g. valuation based on comps) as well as future cash flows.

After discounting both the terminal value and cash flows to their present value, the overall valuation is then simply the product of this valuation times the probability you assigned to each of the three outcomes (best case, average, and worst case).

In terms of the formula, the First Chicago Method is:

Where:

- i = 1,2,3 for the best case, average, and worst case situation

- TV = terminal value

- CF = cash flow

- r = interest rate for present value discounting

- t = the year of the TV or cash flow

- p = probability of each of the three outcomes (best/average/worst)

- EV = enterprise value (overall valuation)

For example, assume you determine the final valuation for each of the three outcomes as follows:

- Best case = $7M (30% chance)

- Average = $5M (60% chance)

- Worst Case = $3M (10% chance)

Then, you essentially calculate the expected value of outcomes to get the overall weighted valuation: $7M*.3 + $5M*.6 + $3M*.1 = $5.4M.

This method can be modified to be as complex as you would like it to be. For example, if you determined there were more than three possible outcomes, it easily allows you to model four, five, or any number of outcomes and probabilities. This can allow you to account for “black swans” – those extremely improbable but very-high-impact types of exits.

Pros and Cons of First Chicago Method

- Pros: very detailed and thorough; based on concrete estimates of future value exits and cash flows; provides a range of potential outcomes; accounts for unlikely but high-impact outcomes.

- Cons: very complex and time-consuming; requires a lot of knowledge of the business and future estimates to produce accurate results. Not useful for pre-revenue startups.

Which Valuation Method is Best for Crowdfunding and Angel Investors?

While Venture Capital firms more often employ the First Chicago Method and Discounted Cash Flow methods (especially because they typically invest later in a startup’s lifecycle), these valuation methods are often overkill for smaller angels or crowdfunding investors.

There are many other methods – such as the asset-based or book value method and others – that we didn’t even touch upon here because they aren’t as relevant to early-stage startups.

So what is the best valuation method for angels and crowdfunding investors?

The general consensus is that it’s a combination of several simple methods.

David S. Rose, author of Angel Investing, suggests starting with the Scorecard Method and including one or two other methods (e.g. Berkus, Risk Factor Summation, or VC). He suggests using a few of the methods side-by-side to see if they are in the same range.

Personally, I started out using a combination of the first three methods (Berkus, Scorecard, and Risk Factor). Honestly though, after screening hundreds of deals, I don’t spend as much time on the valuation anymore for crowdfunding offerings. This is because:

- Valuations are pre-determined by the funding portal (for those that negotiate), and so negotiation isn’t as important as it is for angels and VCs, and

- I am much more familiar with valuations in different areas and have a sense of what feels right when screening a deal because of the number of deals I have screened

That being said, if a valuation feels off to me, or I look at a startup in a new sector that I am not experienced with, I will use a combination of those three methods to see if it is in the ballpark.

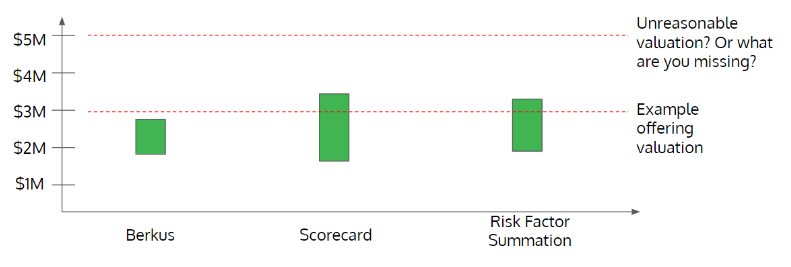

Since using multiple valuation methods can be important to check your results, there is an important way to compare them that I like to use called the football-field approach.

The Football-Field Approach for Visualizing Valuations

One of the best ways to assess where your valuations overlap is by using the football-field approach.

Plot your range of valuations that you obtain via the different methods, as shown in the following figure:

Assume that you performed different valuation methods and got ranges as shown. If the startup was offering securities at a $3M pre-money valuation, you could rationalize that it is reasonable, since it agrees with 2 of the 3 of your methods, and is still close to the third.

But what if that same startup was offering financial securities at a $5M valuation? Depending on how big the disconnect is, there are only two possible explanations:

- The founder is wrong. They have a disconnect with reality in terms of what the market value of their startup is or have received bad advice.

- You are wrong. Look again to see if you are missing a key piece of information and update your models as necessary.

Investors must be humble when investing in startups, since it is not possible to be correct 100% of the time.

You will only improve your valuation skills over time if you practice and make use of feedback when it is offered to you.

Valuation in Equity Crowdfunding Deals

My number one suggestion for crowdfunding investors (based on my own approach) is to try to estimate valuations while doing your research before you look at the valuation being offered.

This is unique to crowdfunding offerings, since individual angels do not have the luxury of looking at what valuation is being offered (except for angel groups, syndicates, or unless there is a lead investor already). Thus, angels typically spend a LOT more energy on negotiating valuations.

In crowdfunding deals, depending on the funding portal, valuations will either be negotiated by the funding portal in advance, or the founder will choose the valuation (or valuation cap for convertible notes and SAFEs), and then leave it up to the crowd as to whether to invest. If the founder chooses to offer too high a valuation, then their campaign may fail to reach its minimum, so the founder is incentivized to select a valuation that they believe is fair in the eyes of investors.

The upside to investing on crowdfunding portals is that you leave the valuation up to an experienced team (i.e. the funding portal) who see hundreds of startups a year.

The downside to investing on crowdfunding portals is that there is no negotiating. So if you don’t agree with the value being offered, you either have to pay more than you would like to pay, or you don’t invest at all.

Summary of Startup Valuation Methods

To sum up today’s lengthy topic of valuation methods, I suggest that angel investors and crowdfunding investors practice the following when valuing companies:

- Practice makes perfect. There is no substitute for experience. There is no magic formula that will give you exact valuations. The more you practice valuing companies, the better you will become.

- Keep it simple, especially when starting out. We suggest starting simple and using the Berkus, Scorecard, and Risk Factor methods. As you become comfortable, adjust and try some of the more advanced methods. It’s a matter of investor preference, but also impacted by how much you are investing in a deal.

- Use multiple methods. Use the football-field approach to visualize ranges and check how the outcomes of different methods compare with one another.

[…] people prefer investing in equity crowdfunding because it is a way to get involved with a startup exactly like those you want to. These […]