Due Diligence 101 (Part 1) – Overview for Crowdfunding Investors

In Part 1 of our due diligence series for early-stage investors, we cover:

- What is due diligence,

- Why it’s important,

- How much time to spend on due diligence,

- Whether it is better to use your gut (intuition) or analysis (checklists),

- Resources for equity crowdfunding investors, and

- How to download your free crowdfunding investor due diligence checklist.

In Part 2, we will talk about the CrowdWise 5 T’s framework for conducting due diligence (Team, Tech, Traction, TAM, and Terms), and discuss how to use our free checklist for crowdfunding investors.

These two blog posts cover much of what we cover in our due diligence CrowdWise Academy courses. Here is Lesson 3-1-2, Due Diligence 101 in our Level 3 Advanced Investor course series:

What is due diligence in early-stage investing?

Have you ever bought a used car? Or perhaps a new house?

Chances are that you didn’t simply show up, hand over the cash, and be on your way with your new car or house.

Before making any substantial investment, buyers want to “kick the tires,” look under the hood, tour the house, have a home inspection performed, and other such actions to reduce the risk of buying something that has undisclosed issues.

In a similar fashion, due diligence in early-stage investing involves doing research, talking to customers and founders, and understanding the business to de-risk your investment and ensure that you are getting what you paid for (or hopefully more than what you paid).

The Angel Capital Education Foundation’s (ACEF) best practices guide on due diligence says: “…the primary objective of due diligence is to mitigate investment risk by gaining an understanding of a company and its business as well as determining the suitability of the investment for the portfolio.”

Due diligence is a crucial step for any investor, whether that is an angel investor, venture capitalist, private equity, or even a public market investor. However, the amount of due diligence performed will widely vary, depending on the amount of the investment and the type of the investment (e.g. early- vs. later-stage).

Why is due diligence important?

Coming from an engineering background, I like to use analogous examples that are intuitive and easy to explain, and apply similar lessons to my investing in equity crowdfunding.

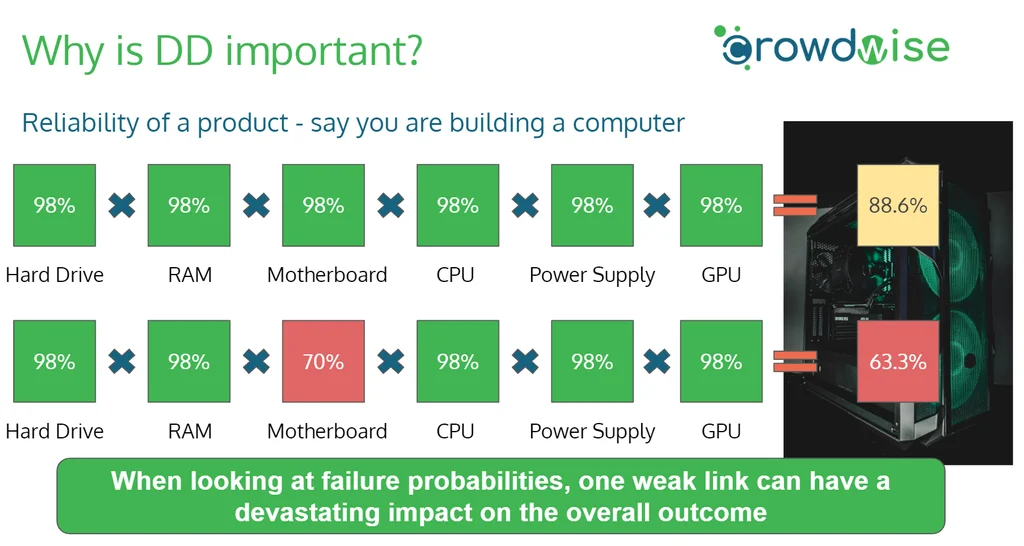

For anyone that is familiar with product reliability, you know that the reliability of a product that has independent failure mechanisms, is essentially the reliability of each component in the chain multiplied by all the others.

Let’s take the example of building a computer. A computer is made up of various components, such as the hard drive, memory (RAM), motherboard, video card (GPU), processor (CPU), and a few other components.

For simplicty, let’s assume all these components have an independent reliability of 98%. What would be the overall reliability of the end-product, the computer that you are building?

It would be the product of each of these (0.98*0.98*0.98*0.98*0.98*0.98*0.98, or 0.98^7) = 88.6%.

Now, assume that just one of those components is defective or faulty in some way. Assume that the motherboard has a reliability of 70% instead of 98%. How do you think this will impact the final computer’s reliability?

It turns out that individual reliability can have a big impact on the outcome. In this case, just reducing the reliability of one of the seven components to 70% makes the final reliability now drop to 63.3%!

These same principles can be applied when considering potential investments. Think about de-risking your investments in a myriad of areas that all have to go right (e.g. solid founder and team, better than the competition, satisfying real market needs, avoiding litigation or liability issues, etc.). Even if the majority of the areas are solid, having one weak area can add a lot of risk to your overall investment.

How does due diligence time impact investment returns?

While equity crowdfunding is still relatively new in the US, data on how due diligence impacts investor returns is hard to come by. This is because many VC firms may withhold this information from being released to the public as it could give them a competitive advantage. Also, data on angel investors is often hard to collect and/or track.

One study that did look at the impact of due diligence hours vs. investment outcomes was a study done in 2007 by Wiltbank and Boeker called Returns to Angel Investors in Groups. The study looked at data from over 538 angels in 3,000 investments.

The takeaway was no surprise:

“Due diligence time: More hours of due diligence positively relates to greater returns.”

The study showed that the overall return multiples for angel investors were:

- 1.1X for less than 20 hours of due diligence

- 5.9X for greater than 20 hours of due diligence

The amount of actual due diligence varied widely, though. While the median amount of time spent on due diligence was 20 hours, 26% of the investors spent more than 40 hours, and a good number did upwards of 60+ hours of due diligence.

On the other end of the spectrum, while half of the angels did fewer than 20 hours of due diligence (and resulted in much higher rates of failure), many angels made a decision to invest after just a few hours, or even a single meeting with the founder.

However, as crowdfunding investors will likely be investing much smaller sums of money compared to angels (more in the $100-$1,000 per deal range), it doesn’t make financial sense to be spending upwards of 20+ hours screening each deal.

One key question for crowdfunding investors then becomes: if 20 hours is the threshold for positive financial returns for angel investors, is it reasonable to expect that returns for crowdfunding investors won’t be able to match those of angels who spent significant time on due diligence?

Decision-Making – Gut (intuition) vs. Checklists (analysis)

One area that many angel investors and VCs feel passionate about (while having strong opinions in two camps) is: is it better to invest based on your gut or by using objective criteria, such as a checklist?

While the detailed explanation and examples are provided in the video lesson for due diligence 101, suffice it to say that we strongly believe that checklists improve outcomes, even for experts.

This has been widely discussed and debated in various venture investing blogs and books, but for a great resource that argues for the importance of checklists – such as those used by airline pilots and surgeons – check out the book Checklist Manifesto by Atul Gawande.

Furthermore, it is commonly believed that investing in a strong founder and team is one of, if not the, most important aspects of an early-stage investment. In his PhD dissertation, Geoffrey Smart looked at The Art and Science of Human Capital Valuation. That is to say, evaluating the founders and/or management teams of venture-backed startups.

His conclusion? The airline captain approach (i.e. using objective criteria and checklists) far outperformed all the other methods that VC firms use when evaluating the team.

Due Diligence Resources for Crowdfunding Investors

Here are some great tools and resources at the disposal of any equity crowdfunding investor to get started with due diligence:

- Funding Portals

- Campaign page – these websites, such as WeFunder, StartEngine, Seedinvest, Republic, and others, are where the Regulation Crowdfunding deals are posted. The campaign pages have many of the relevant details that investors need and are the best place to start.

- Q&A on the campaign page – in my opinion, one of the best resources that crowdfunding investors have is looking at the founder Q&A section on the campaign page. Here, any potential investor with an account can ask due diligence questions of the founder and team. Think of it as a multiplier of your own due diligence process, since these questions come from potential investors of all different backgrounds and walks of life. It also gives crucial insight into how the founder/CEO responds to questions and communicates.

- Ratings services

- Kingscrowd – we’ve talked about Kingscrowd in the past. They give investors insight and access to founders through webinars and investor Q&A that you otherwise wouldn’t have. In addition, they provide deal recommendations and additional due diligence that investors can use to supplement their own due diligence process. [Disclaimer: I am an investor in and paying customer of Kingscrowd. This is because I truly believe in the value of the product, and wouldn’t be mentioning it here otherwise.]

- Download and/or use the app, service or product

- Is the product, service, or app launched and live today? Many products today come with free trials, so it is worth your time to download the app, check out the product, and see whether the value proposition is easy to understand from the customer’s perspective. Would you be drawn to purchase or use this product yourself?

- Media – TV shows, podcasts, etc.

- You’d be surprised at how many startups that raise use equity crowdfunding sites have also been featured on TV shows such as Shark Tank and podcasts like The Pitch. It never hurts to hear what professional VCs and angels think of the same startup and product.

- Various funding portals are also launching their own media shows, such as Republic’s Meet the Drapers and Venture Unplugged, as well as WeFunder’s Adventure Capital.

- Also, watching either live or recorded “demo days” or pitch events on the funding portal can give you more insight into how the founder communicates and allow investors to ask more questions.

- Online resources

- Last but definitely not least, there are a plethora of online tools that make investing in startups online possible today. Some of the ones I use include:

- Crunchbase (business research and prior funding round history)

- Statista (Market / Industry forecasts)

- Google (look for press releases, general news, etc. on both the founders and the business)

- LinkedIn (great for getting a read on the prior experience of founders)

- Website and Social Media Accounts

- Last but definitely not least, there are a plethora of online tools that make investing in startups online possible today. Some of the ones I use include:

Get Your Free Due Diligence Checklist for Crowdfunding Investors

While there are many similarities between angel investing and crowdfunding investing due diligence, there are also some important differences.

To help you get started, I have documented my own due diligence process and questions and made it available for free to all CrowdWise Academy members.

To get your free due diligence checklist, create a free account and then log in to the Members-Only Resources page of CrowdWise Academy (important note: ensure you are logged in first to your account, otherwise you will get a “404” error if logged out).

Part 2 – Due Diligence 102: The 5 T’s Framework and Due Diligence Checklist Overview

In Part 2, we discuss the CrowdWise 5 T’s Framework for due diligence. This is very similar to many of the early-stage investing frameworks out there, with just a few minor tweaks to make it relevant to crowdfunding investing.

We will also go over the due diligence checklist in detail, talking about important questions to ask in each of the 5T areas: Team, Tech, Traction, TAM, and Terms.

As a reminder, for the best learning experience and to get all these lessons and more completely free, sign up for a free CrowdWise Academy account.

[…] recent posts, we have been discussing the importance of performing due diligence and estimating valuations of early-stage, pre-revenue (or early revenue) startups. One of the most […]

[…] diligence saw 5.9X returns. Those who invested less than 20 hours only achieved 1.1X returns [38]. Key due diligence steps […]