Top Equity Crowdfunding Sites – Comparison for Startup Founders (Q4-2019)

2020 Update: check out the top ten equity crowdfunding sites of 2020 in our latest post here.

————-

As the founder of a startup, you already have enough things to worry about. The seemingly simple task of selecting which equity crowdfunding website (i.e. intermediary) to use for your campaign can quickly become overwhelming. That’s why we have assembled the information below to help you select the best crowdfunding portal for your Reg CF campaign.

Several weeks back, we looked at the Top 8 Regulation Crowdfunding (Reg CF) intermediaries ranked by total capital raised and deal flow. We also shared our free funding portal comparison matrix for investors. Today, we will look at these same eight Reg CF intermediaries (i.e. the websites), but from the perspective of an issuer (i.e. a startup) that is looking to raise capital.

Investors should also pay attention; the Reg CF intermediaries that offer the best combinations of the below factors will likely attract the best startups. This means that the best startups and deal flow will likely be located on the most attractive and successful portals below.

Startup founders can download our free 2019 Reg CF intermediary comparison matrix below to compare the top eight portals based on fees, investors, due diligence, and more.

Get your free Reg CF comparison matrix

What should founders look for in a Reg CF intermediary?

Some of the most important factors that startups looking to raise capital should assess before choosing a funding portal or broker-dealer are:

- Investors on the platform (number of active investors, average check size)

- Platform fees

- Discounts on fees

- Due Diligence process

- Securities offered (e.g. SAFE, Equity, etc.)

- Valuation range

- Overall fit

Investors on the platform

How many active investors are there? What is the average check size and number of backers for each equity crowdfunding campaign?

This can be one of the most important factors in determining how successful a campaign is, since the size and engagement of the investor base on a platform can lead to more campaign investors.

Platform fees

Fees vary widely from platform to platform. Some portals, such as SeedInvest, include most of their fees in their overall percentage that they take upon successful completion of the campaign. Others, such as StartEngine, have many smaller fees that depend on the type(s) of payments you accept, whether you have international investors, and more.

While a few percentage points of difference might sound small, think of how the fees will impact your campaign in terms of your maximum target. For example, if you raise $1 million, every 1% of fees is $10,000. Remember to balance this with what the platform offers in terms of investors, though. A portal with zero fees but very few investors won’t help you raise any capital!

Discounts on fees

Several platforms offer referral bonuses for startups and those who refer them to the platform. These bonuses typically result in $500-$1000 in savings for issuers (i.e. startups). However, these fees are typically for new applications only, so be sure to reach out to us in advance if you are looking to apply to a Reg CF funding portal that offers a referral discount.

Due diligence and deal curation process

Intermediaries that have extra due diligence or deal curation (above and beyond the required Reg CF checks) are:

- Republic

- SeedInvest

- Netcapital (“100-point check”)

- MicroVentures

- NextSeed

The intermediaries in the Top 8 that do not perform additional due diligence or deal curation are:

- WeFunder

- StartEngine

- truCrowd

Issuers should reflect on whether their business will pass additional due diligence in advance. If you believe your startup may be viewed as a non-traditional type of startup, you may be better off going with the portals that don’t require due diligence.

By looking at the types of deals currently offered on these platforms, founders can quickly assess whether their business would be a good fit for a given portal.

Securities offered

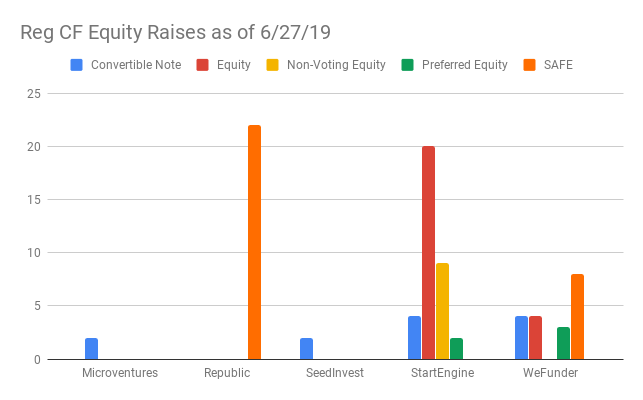

While several intermediaries have a diverse set of securities that are offered (e.g. StartEngine), others may choose to focus on a certain type of security, such as Republic and their single Crowd SAFE offering.

Thus, if you have a certain type of security in mind that you would like to offer, check the live offerings on the platform to ensure that your desired security type aligns with others that the platform offers to investors.

For example, some of the top funding portals offered the following securities in mid-2019:

Valuation range

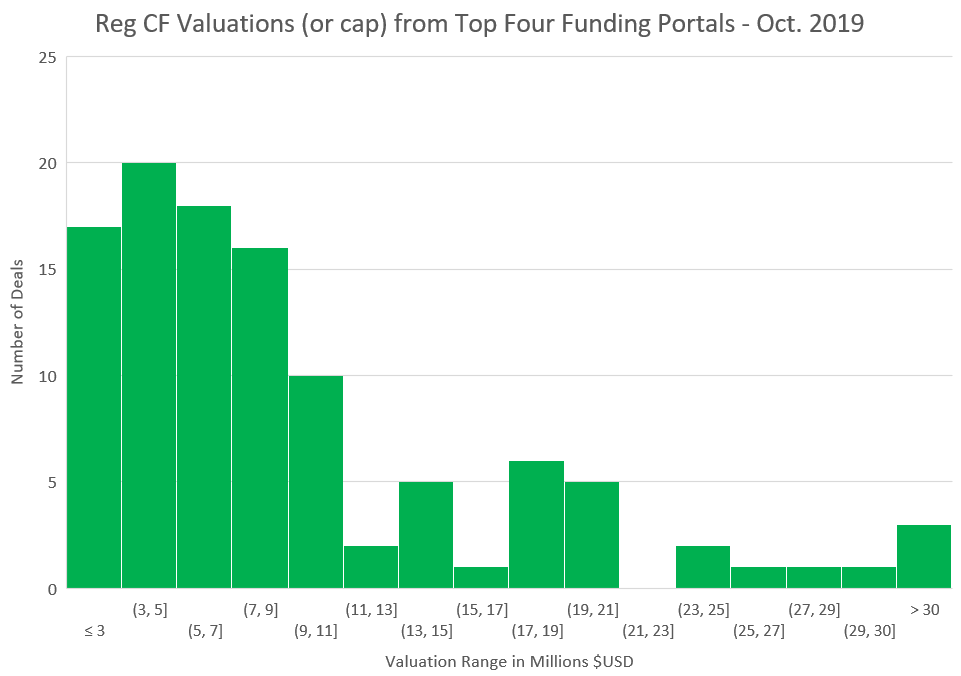

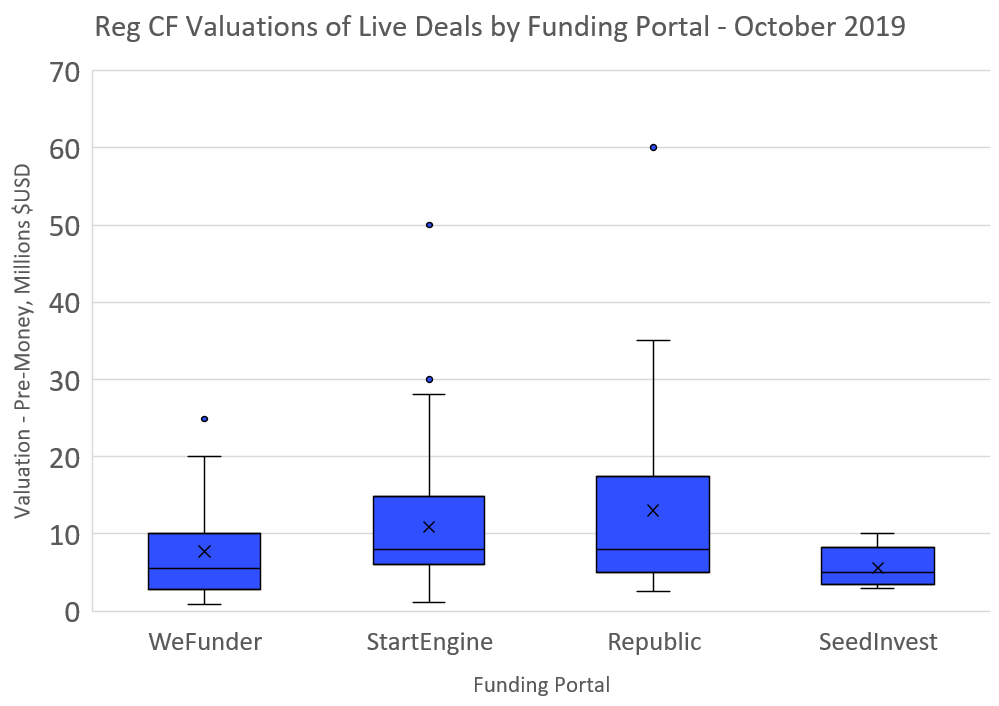

As discussed in our 2019 valuation summary article, the bulk of Reg CF offerings range from $2M-$11M pre-money. However, there are still a decent number of offerings up to $20M in pre-money valuations, and even some that go as high as $60M that are currently live.

Choose a Reg CF portal that is most in line with your anticipated valuation, as this will both maximize your odds of being accepted by the portal, as well as being a good fit for the investors on that platform.

Overall fit

In the end, you as the founder will have to weigh these factors (and many others) and decide which funding portal gives your startup the best odds of successfully raising capital.

And while our Reg CF comparison matrix for founders compares these statistics (and more) for the top eight funding portals, there are over 50 funding portals registered today. Look at the list on FINRA’s website and browse some of the active offerings on each platform to see if it might be a good fit for your business.

Many of the smaller funding portals are much more focused on certain niches, such as cannabis, green energy, local or main street businesses, and more. Thus, if you’re looking to connect with a specific crowd, these focused funding portals may offer you a smaller but more relevant base of investors.

Top Equity Crowdfunding Site Comparison (Reg CF)

Here is a brief overview of the top eight funding portals and how they compare on the various characteristics.

The top eight Reg CF platforms by dollars raised in 2019 (through September) are:

- WeFunder – $25.95M

- StartEngine – $15.73M

- Republic – $12.70M

- SeedInvest – $6.29M

- Netcapital – $4.78M

- MicroVentures – $3.34M

- NextSeed – $3.03M

- truCrowd – $0.81M

WeFunder (review and overview)

- Startup capital raised (2019 YTD): $25.95M

- Platform Fees: 7.5% of amount raised (best price match offer)

- Other Fees: none (credit card fees of 3.5% paid by investors)

- Referral Discounts on Fees: Yes – up to $1,000

- Extra Due Diligence / Deal Curation: No

- Primary Securities: SAFE, Equity

- Registered Broker-Dealer: No

StartEngine (review and overview)

- Startup capital raised (2019 YTD): $15.73M

- Platform Fees: 7-12% of amount raised; $10k service fee

- Other Fees: 0.5% escrow fee

- Referral Discounts on Fees: Yes – up to $1,000

- Extra Due Diligence / Deal Curation: No

- Primary Securities: SAFE, Equity, Convertible Notes, Revenue Share

- Registered Broker-Dealer: Yes, as of 2019

Republic (review and overview)

- Startup capital raised (2019 YTD): $12.70M

- Platform Fees: 6% of amount raised, 2% of securities sold

- Other Fees: $1,500 for Form C, ~$1,500 for escrow, 3.5% for credit card transactions

- Referral Discounts on Fees: Yes – up to $1,000

- Extra Due Diligence / Deal Curation: Yes

- Primary Securities: SAFE

- Registered Broker-Dealer: No

SeedInvest

- Startup capital raised (2019 YTD): $6.29M

- Platform Fees: 7.5% of amount raised, 5% of securities sold

- Other Fees: SI covers escrow, legal, due diligence, and filing fees up-front, reimbursed as flat $10k upon successful campaign closing

- Referral Discounts on Fees: None

- Extra Due Diligence / Deal Curation: Yes

- Primary Securities: Convertible Note, Equity

- Registered Broker-Dealer: Yes

Netcapital

- Startup capital raised (2019 YTD): $4.78M

- Platform Fees: 4.9% of amount raised + engagement fee

- Other Fees: escrow included in Netcapital performance fee

- Referral Discounts on Fees: None

- Extra Due Diligence / Deal Curation: Limited (100 point inspection)

- Primary Securities: Equity

- Registered Broker-Dealer: No

MicroVentures

- Startup capital raised (2019 YTD): $3.34M

- Platform Fees: No fees in 2019; now charge 5% commission + 2% securities as of August 2020

- Other Fees: $1,000 min. or .35% escrow fee; $1,500 Form C software; $1,000 Form C legal review

- Referral Discounts on Fees: None

- Extra Due Diligence / Deal Curation: Yes

- Primary Securities: Convertible Note, Revenue Share

- Registered Broker-Dealer: Yes

NextSeed

- Startup capital raised (2019 YTD): $3.03M

- Platform Fees: 7-10% of amount raised (only 5% for investors brought in through unique referral link)

- Other Fees: escrow fee of $500; investors charged 1% on each payment

- Referral Discounts on Fees: Yes – $500

- Extra Due Diligence / Deal Curation: Yes

- Primary Securities: Debt and Equity

- Registered Broker-Dealer: Yes

truCrowd

- Startup capital raised (2019 YTD): $0.81M

- Platform Fees: $3,500 listing fee, up to 12% of amount raised

- Other Fees: escrow fee $5,000

- Referral Discounts on Fees: No

- Extra Due Diligence / Deal Curation: No

- Primary Securities: Various

- Registered Broker-Dealer: No

Download our Free Reg CF Intermediary Comparison Matrix (for Startup Founders)

To get all this information in spreadsheet format, along with more details not given above, download our 2019 Reg CF intermediary comparison matrix for founders.

[…] #3 Reg CF funding portal by Capital Raised (2019; #4 since 2016) […]

[…] #2 Reg CF funding portal by Capital Raised (2019 and since 2016) […]