Top Equity Crowdfunding Sites 2019 – Deal Flow and Capital Raised

As of late 2019, the number of FINRA-registered funding portals – that is, websites where crowdfunding investors can invest in startups – had reached a total of 50.

With so many different options and platforms to invest on, how should crowdfunding investors choose which funding portal to use when investing in startups?

Last week, we discussed the important characteristics of a crowdfunding intermediary that investors should look for. We captured these criteria in our 10-point checklist to help investors decide which website(s) to invest on.

This week, we will break down the top 2019 Regulation Crowdfunding (Reg CF) websites in terms of two of those criteria – deal flow (i.e. number of deals) and total capital raised (i.e. dollar value of successful offerings).

Since capital-seeking startups tend to “follow the money,” these funding portal rankings may be a good indication of where investors should start for some of the best crowdfunding offerings in 2019.

As a reminder, to get our free chart comparing the top eight Reg CF funding portals in 2019 in terms of investor fees, deal flow, due diligence standards, and much more, check out the link below.

Get your Free 2019 Reg CF Funding Portal Comparison Chart here.

Top 2019 Reg CF Funding Portals

There are several metrics that we can use when considering what the top Reg CF funding portals are.

Today, we will look at equity crowdfunding sites based on:

- Deal-flow (i.e. the number of deals available) – from the SEC EDGAR database Form C filings

- Total capital raised (i.e. the dollar volume of successful offerings) – from Crowdfund Capital Advisors 2016-2018 data and Crowditz 2019 monthly reports

Deal-flow gives an indication of the number of potential deals available to investors. Total capital raised gives an idea of the success of startups in attracting investors, which in turn may attract more startups to a given portal.

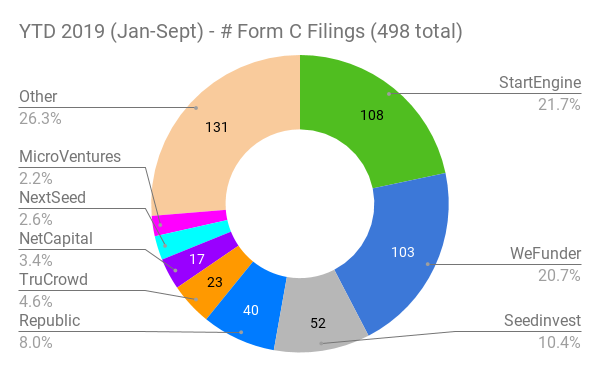

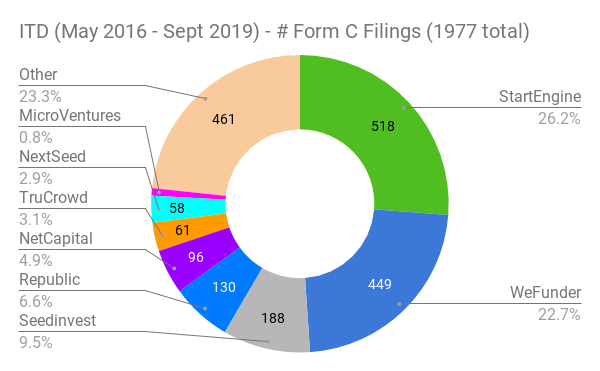

1 – Top Equity Crowdfunding Sites by Deal Flow (i.e. number of offerings)

Deal flow for a funding portal can be seen by looking at Form C filings on the SEC’s EDGAR database, which tallies the number of deals on each funding portal.

Here are the statistics for Reg CF campaigns for each funding portal. We analyzed the data from inception (i.e. May 2016, Inception-to-Date) as well as from the beginning of 2019 (Year-to-Date).

The top four funding portals ranked by the number of Form C filings (both ITD and 2019 YTD) are:

- StartEngine

- WeFunder

- Seedinvest

- Republic

As expected from power law distributions, the top two portals, WeFunder and StartEngine, accounted for more than half of the entire Form C filings since 2016. The top four portals accounted for nearly two-thirds of overall Reg CF offerings, both in 2019 and since Reg CF went live in May 2016.

StartEngine also publishes a monthly Reg CF industry update called the StartEngine Index; just keep in mind who the publisher is (StartEngine) as there could be some subtle biases in the data to show the most rosy picture for StartEngine’s platform.

Takeaway for investors: if you want to be as efficient as possible (i.e. create the fewest accounts with access to the most deals), you can stick to the top 2-4 funding portals (StartEngine, WeFunder, Seedinvest, and Republic) and gain access to the majority of Reg CF offerings.

Remember that early-stage investing is a numbers game, so at the very least you should be looking at deals across the top two funding portals.

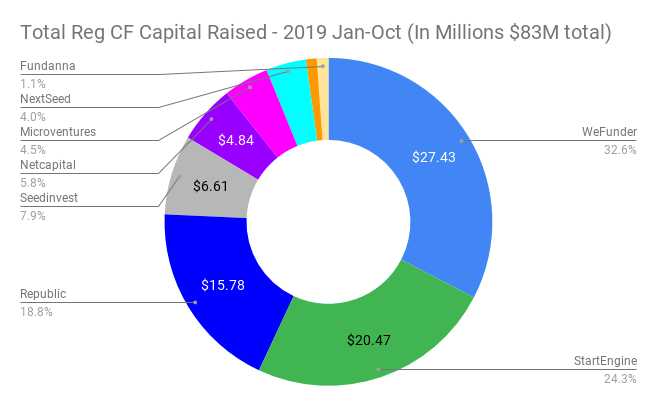

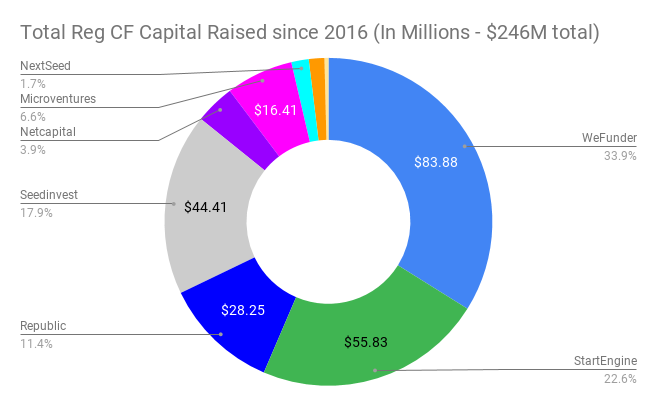

2 – Top Equity Crowdfunding Sites by Total Capital Raised (i.e. dollar value of successful offerings)

The second measure of activity would be the investment volume by platform. That is, the amount of capital successfully raised by startups.

Three years of Reg CF data shows that WeFunder is #1 in this category, with StartEngine ranked #2.

It’s interesting to note that even though StartEngine has had a higher quantity of Reg CF offerings in 2019 thus far, WeFunder investors have committed more total capital compared to StartEngine.

It’s no surprise that the top three crowdfunding sites continue to dominate. Those three funding portals (WeFunder, StartEngine, Republic) account for ~75% of Reg CF capital raised in 2019 through the end of October.

While Seedinvest raised more total capital than Republic since 2016, Republic has taken the third spot for total capital raised in 2019, raising almost 3X the amount of Seedinvest.

The total capital raised by each platform since 2016:

Again, the top four funding portals – WeFunder, StartEngine, SeedInvest, and Republic – account for ~85% of the total Reg CF funds raised since 2016.

Obviously, some of these websites have been around longer than others, which may skew the data a little. But as the 2019 chart shows, the break-down this year is still similar to the inception-to-date results.

Takeaway for investors: if you were a startup raising capital, which website(s) do you think you would be most inclined to approach? Since the majority of the capital from investors is on roughly four of the platforms, it’s safe to assume that many of the best startups looking to raise capital today will start on one of these top portals.

That is why it is important for investors to know where the most active funding portals are. Startups will “follow the capital”, and so all else being equal, you may get access to both a higher quantity and also a higher quality of startups on those top portals. Just keep in mind how due diligence standards vary from website to website, since that can also influence the potential quality of offerings.

What about the other 46+ funding portals?

While some other funding portals are close to the top (Netcapital, Microventures, and Nextseed), many of the other 41 funding portals that make up the “Other” category – coming in at only ~6% of the total Reg CF capital raised in 2019 – may seem to be in the noise.

Why would investors consider these other portals?

Two primary reasons may be:

- Investors who are looking for niche offerings (e.g. cannabis, green energy, real estate, etc.)

- Investors who are seeking overlooked and/or potentially undervalued deals

Many of these smaller funding portals focus on niche offerings. For example, the funding portal Fundanna, owned by Trucrowd, focuses on cannabis startups. They have successfully raised $660k in 2019.

Second, while the largest funding portals today may be great for a high number of deals, that can also mean there is more competition for investors. In early 2019, more and more Reg CF businesses have been raising the $1.07 million maximum amount (some in less than 24 hours!), meaning that investors who don’t take action early enough may not be able to invest at all.

Thus, it is possible that there is less investor competition on these smaller funding portals. However, most of the deals today still don’t reach their maximum limit, so investors should consider other reasons when choosing whether to invest on the smaller websites.

In the end, competition is a good thing (both among funding portals and among investors), and so I do encourage everyone to take a look at the funding portal list and choose a few that resonate the most with your personal investment style and objectives.

Secondary Markets and Liquidity in 2019

While the number of offerings and successful investment amounts are both important, investors should keep in mind that there are many other factors to consider, such as investor fees, due diligence standards, and liquidity options.

In terms of liquidity, most equity crowdfunding portals are in a similar boat today. That is, they are all extremely illiquid, meaning that once you invest, your money is locked up.

Early-stage businesses are very illiquid for investors, where positive exits are likely to take 5–8 years on average. This will depend more on the businesses you invest in, not the platforms you invest on (except where they differ in the types and stages of companies that they allow on their platform).

While some portals – such as StartEngine and Seedinvest – have filed Form ATS with the SEC to create an Alternative Trading System (ATS) to be able to buy and sell equity crowdfunding shares in a secondary market, the only Reg CF funding portal that has active trading today is Netcapital.

Funding Portal Reviews

After grabbing a copy of our free funding portal comparison guide, one of the best resources for crowdfunding investors who are trying to decide which website to invest on is Yieldtalk.

While YieldTalk won’t have every single funding portal, they do have reviews for most of the top funding portals. They also review alternative investment websites in the real estate and peer-to-peer lending space, so this may be a helpful resource for your other types of investments.

CrowdWise Academy Lesson 2-2-3 – Crowdfunding Intermediaries (Funding Portals and Broker-Dealers)

For a more detailed overview of the two types of crowdfunding intermediaries and some of the key concepts for crowdfunding investors, check out our free CrowdWise Academy video lesson 2-2-3 – Where to Invest: Crowdfunding Intermediaries (Funding Portals and Broker-Dealers).

This is part of our Level 2 Intermediate investor course series. The content is absolutely free – it just requires that you create a free account.

[…] 4. Top Equity Crowdfunding Sites 2019 – Deal Flow and Capital … […]

[…] 9. Top Equity Crowdfunding Sites 2019 – Deal Flow and Capital … […]

[…] 7. Top Equity Crowdfunding Sites 2019 – Deal Flow and Capital … […]

[…] As we head into 2020, StartEngine is ranked #2 (behind WeFunder, which we reviewed in the prior post) in terms of capital raised. It is considered by both investors and founders to be one of the top crowdfunding sites. […]

[…] we head into 2020, WeFunder is one of the top crowdfunding sites for capital raised and deal […]

[…] weeks back, we looked at the Top 8 Regulation Crowdfunding (Reg CF) intermediaries ranked by total capital raised and deal flow. We also shared our free funding portal comparison […]